According to CNN, Americans have taken to social media to enthusiastically post images of canned fish with vibrant packaging. They shared creative dishes featuring canned fish, such as luxurious pasta with $4.99 canned sardines. Some even hosted canned fish parties.

Canned fish was a popular staple during the COVID-19 pandemic, and it has maintained its stronghold in Americans’ minds ever since.

However, interest in canned fish has surged in recent months, coinciding with consumers’ heightened economic concerns and declining shopping sentiments due to the trade war waged by the Trump administration.

Although most economists believe the US is not currently in a recession, consumer sentiment, as indicated by the University of Michigan’s index for May, is at a near-record low. Some experts suggest that canned fish could be a “recession indicator.”

Google searches for “canned fish” soared to their highest point in early 2024 and have continued to rise since. Over the past 90 days, searches for Nuri brand Portuguese sardines in olive oil have skyrocketed by 2750%, while Brunswick sardines in olive oil have seen a 4000% increase.

Professor Ross Steinman of Widener University suggests that consumers may be turning to more affordable options. With summer travel potentially reduced, Americans might opt for tasting imported canned fish from Spain with attractive Mediterranean-colored packaging instead of traveling to Mallorca.

Spain and Portugal are renowned for their canned fish exports, and Northern Europe has a long history in the canning industry. The canned fish industry is also robust in Japan, South Korea, and China. This global landscape presents challenges for US canned fish businesses in terms of planning against the backdrop of rising tariffs on imports, as most fish in the US are imported.

The tariffs have created a vicious cycle for businesses reliant on imports and have dampened consumer confidence.

Dan Waber, co-owner of Rainbow Tomatoes Garden, a retailer of canned fish, shared that he has not made any significant decisions regarding imported goods due to retaliatory tariffs. “All we can do is react. When prices go up, so do ours,” he said. However, the varied pricing of canned fish means consumers can opt for a $6 can of sardines instead of a $10 one.

Amelia Finaret of Allegheny College noted that it is challenging to conclude whether canned fish is a direct recession indicator.

While increased sales of inexpensive canned tuna would be a red flag, the popularity of affordable sardines might merely reflect Americans’ diversifying tastes for healthy protein sources.

Finaret emphasized that, under economic pressure, consumers typically gravitate towards two types of foods at grocery stores: long-lasting items and convenient ones. Canned fish ticks both boxes. “If people are truly after convenience, then perhaps canned fish is an indicator of growing pressure—they no longer have the time to cook fresh fish,” she said.

Title: US Hikes Import Tariffs: How Will Hoa Sen Group be Affected by the 50% Steel and Aluminum Levy?

The Hoa Sen Group asserts that the recent announcement of increased import tariffs by the US, from 25% to 50%, will have no impact on their business operations.

Which ASEAN Country Fares Best Against US Tariffs?

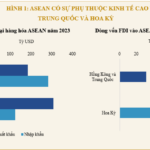

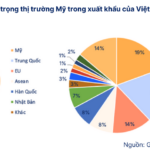

The negotiations on tariffs with the US are ongoing, and Asian countries, particularly the ASEAN region, are in a hurry to conclude them. As a highly trade-dependent region, ASEAN has much at stake when it comes to US tariff policies. However, resilience lies not in the trade deficit figures but in the intrinsic structure and strategic response capabilities of the region.

“US Tariffs Threaten FDI Appeal: Is Industrial Real Estate at Risk?”

The recent announcement of tariffs by the US, imposing up to 46% on exports from Vietnam, presents a significant challenge for various economic sectors, particularly industrial real estate. This industry has traditionally thrived on foreign direct investment and the demand for expanded production capabilities.