Last week, the VN-Index rose by 18.14 points to reach 1,332.6 points. Trading liquidity was vibrant, with a turnover of 113,927 billion VND, a more than 24% increase compared to the previous week. The HNX index ended the week at 223.22 points, a gain of 6.9 points. The total trading value on the HNX for the week was 7,891 billion VND, an increase of over 71% compared to the previous week.

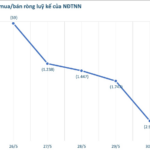

According to statistics from the HoSE, foreign investors net sold for five consecutive sessions, with a volume of 98.7 million units and a net selling value of over 2,708 billion VND. On the HNX, foreign investors also net sold for five sessions, with a volume of 5.27 million units and a net selling value of over 78 billion VND.

On the UPCoM market, foreign investors net sold for five sessions, with a volume of 7.46 million units and a net selling value of approximately 112 billion VND. Thus, during the trading week from May 26 to May 30, foreign investors net sold a total of 111.4 million units on the entire market, with a corresponding net selling value of nearly 2,900 billion VND.

VietABank aims to list on HoSE

Vietnam Investment Group Joint Stock Company (Viet Phuong) intends to sell by agreement or matching 17 million VAB shares of Vietnam Asia Commercial Joint Stock Bank (VietABank) through order matching or agreement. The expected trading time is from May 28 to June 26. The purpose is to adjust the ownership ratio according to the Law on Credit Institutions 2024, which stipulates that organizational shareholders must not own more than 10% of the bank’s charter capital.

Viet Phuong currently owns 12.21% of VietABank’s charter capital.

Previously, Viet Phuong owned nearly 66 million shares, equivalent to 12.21% of VietABank’s capital. If the transaction is successful, the number of shares owned by Viet Phuong is expected to decrease to nearly 49 million shares, equivalent to 9.06% of capital at VietABank. It is estimated that Viet Phuong will recoup about 238 billion VND if all the registered shares are sold.

According to the list of shareholders owning 1% or more of VietABank’s capital as of November 16, 2024, the bank has two major organizational shareholders: Viet Phuong, which owns 12.21% of capital, and Hoa Binh Development Investment Joint Stock Company, which holds 5.52%. Other organizational shareholders include the Ho Chi Minh City Party Committee Office, which owns 4.97%, Saigon Jewelry Company Limited (SJC), which holds 2.77%, and Cu Chi Industrial and Trade Development Investment Joint Stock Company, which owns 1.2%.

Regarding individual shareholders, Mr. Phuong Huu Viet, Chairman of Viet Phuong’s Board of Directors, owns 4.55% of VietABank’s capital, Mr. Tran Tien Dung, Member of the Board of Directors and Vice President of VietABank, holds 1.02%, and Ms. Do Thi Ngoc Ha, sister-in-law of Ms. Phuong Minh Hue, General Director of Viet Phuong, owns 0.13%.

On May 14, the Ho Chi Minh City Stock Exchange (HoSE) announced that it had received VietABank’s listing registration dossier. The number of shares registered for listing is nearly 540 million, corresponding to a charter capital of nearly 5,400 billion VND. Currently, VAB shares are traded on the UPCoM stock exchange.

Vietnam Capital Bank (BVBank, stock code BVB) announced the issuance of 20 million shares under the ESOP program, equivalent to a ratio of 3.62% of the total outstanding shares. The issuance price is 10,000 VND/share. The shares will be restricted from transfer for one year from the end of the issuance period.

BVBank stated that the ESOP issuance aims to create incentives for employees, thereby attracting and retaining talented human resources for the bank, linking the interests of employees with those of the bank. The money receipt time for buying shares is from May 30 to June 13.

In April, BVBank also announced the offering of nearly 69 million shares to existing shareholders at a ratio of 8:1, meaning that for every 8 shares owned, shareholders can buy one new share. The newly issued shares are not restricted from transfer, with an offering price of 10,000 VND/share, and a total issuance value of nearly 690 billion VND.

BVBank aims to list BVB shares on HoSE this year.

If the above two share issuance plans are completed, BVBank’s charter capital is expected to increase from over 5,518 billion VND to over 6,408 billion VND. As of the end of March 2025, BVBank had a charter capital of 5,518 billion VND, ranking 23rd in the industry in terms of charter capital scale.

At the 2025 Annual General Meeting of Shareholders, BVBank proposed to shareholders the plan to list BVB shares on HoSE this year.

Previously, in 2024, shareholders approved the contents related to the transfer of BVB shares from UPCoM to HoSE. However, BVBank stated that due to unfavorable market conditions, the bank has not yet carried out the procedures related to the exchange transfer.

The race to award ESOP

Southeast Asia Commercial Joint Stock Bank (SeABank, stock code SSB) increased its charter capital from 28,350 billion VND to 28,450 billion VND through the issuance of shares under the ESOP program.

Specifically, SeABank successfully distributed 10 million common shares with a preferential price of 10,000 VND/share to officers and employees who met the criteria for seniority, work efficiency, and functional groups.

Novaland Group (stock code NVL) approved the simultaneous implementation of the ESOP bonus share issuance plan and the ESOP offering program for employees, with a total issuance ratio of 5%.

NVL will issue more than 97.5 million shares, equivalent to 5% of the total outstanding shares.

NVL plans to issue nearly 48.8 million bonus shares from the surplus capital fund and 48.8 million ESOP shares at a price of 10,000 VND/share to 25 employees. The total volume to be issued is more than 97.5 million shares, equivalent to 5% of the total outstanding shares. The implementation time is expected in the second and third quarters of this year. The shares after issuance will be restricted from transfer for one year. Unallocated shares will be issued to other members or employees.

On June 12, Refrigeration Electrical Engineering Corporation (stock code REE) will finalize the list of shareholders to pay a 2024 dividend in shares at a ratio of 15%, meaning that for every 100 shares owned, shareholders will receive 15 new shares.

With more than 471 million listed shares, Refrigeration Electrical Engineering Corporation is expected to issue an additional 70.7 million shares for dividend payment. These shares will not be restricted from transfer.

Expert Insights: Tune in to the Market Rhythm and Seize Investment Opportunities in These Two Sectors

Stepping into June, market experts predict a period of consolidation for the first half of the month, with the index hovering around the 1,320-point mark for approximately 8-10 sessions.

The Flow of Funds: A Cautious Short-Term Approach

The VN-Index’s fourth consecutive weekly gain couldn’t mask underlying weakness as profit-taking pressures emerged last week. The gains were largely driven by the first two sessions, after which stocks turned south amid robust selling pressure, with the VN-Index failing to breach the 1,340-point peak.

A Bank Stock Unexpectedly Sells Off Hundreds of Billions in the Week’s Final Session

“The proprietary trading arms of securities companies witnessed a net sell-off of VND 831 billion on the HoSE stock exchange.”

Let me know if you would like me to elaborate on this or provide additional content related to this topic.