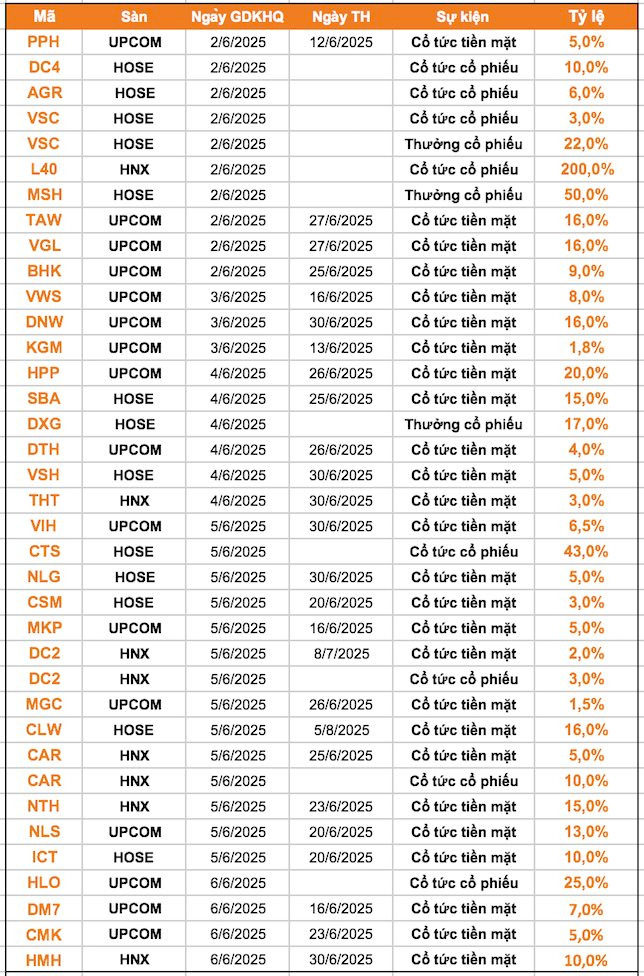

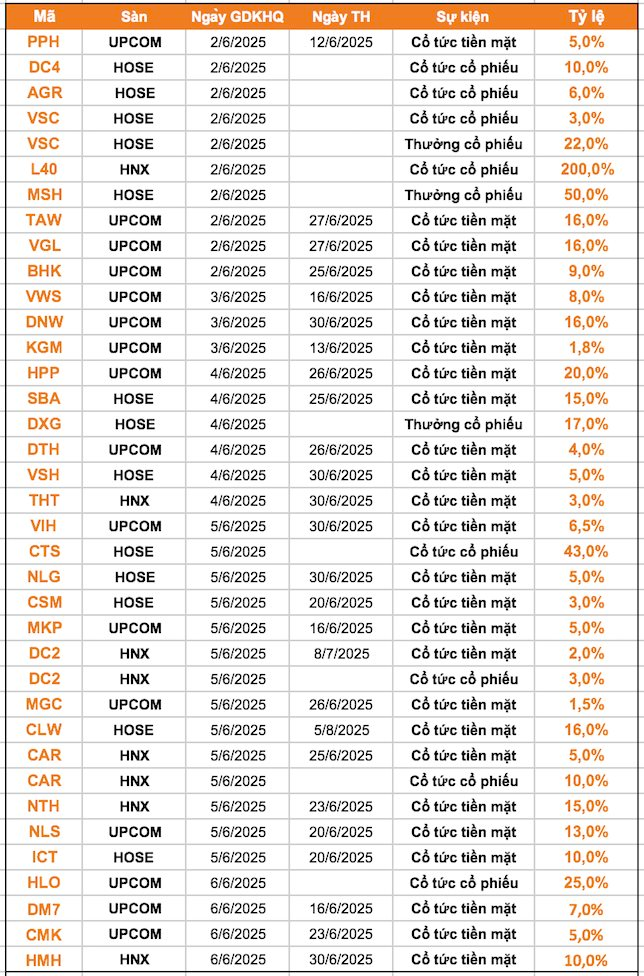

According to statistics, 34 companies announced dividend lock-in dates for the week of June 2nd to 6th, with 24 companies paying dividends in cash. The highest dividend rate was 20%, while the lowest was 1.5%.

Additionally, five companies paid dividends in stocks, two companies offered bonus shares, and three companies provided a mix of cash and stock dividends.

MSH – Vietnam Textile and Garment Corporation

announced that June 3rd would be the record date for issuing bonus shares to increase charter capital from owner equity.

Specifically, MSH plans to issue over 37.5 million bonus shares at a ratio of 2:1, meaning shareholders owning two shares will receive one new share. The source of this issuance will be from undistributed post-tax profits as of December 31, 2024, according to the audited financial statements.

Following the issuance, MSH’s charter capital will increase from over VND 750 billion to VND 1,125 billion.

VSC – Vietnam Container Shipping Joint Stock Company

announced that June 3rd would be the record date for issuing shares to pay 2024 dividends and increase charter capital from owner equity.

Accordingly, VSC plans to issue nearly 9 million shares as dividends at a ratio of 100:3, meaning shareholders owning 100 shares will receive three new shares. The source of capital for this issuance will be from undistributed post-tax profits stated in the audited 2024 financial statements.

Additionally, VSC plans to issue 65.89 million bonus shares at a ratio of 100:22, meaning shareholders owning 100 shares will receive 22 new shares. The capital source for this issuance will be from the investment development fund (nearly VND 619.5 billion) and share premium (over VND 39.4 billion), based on the company’s audited separate financial statements for 2024.

HPP – Hai Phong Paint Joint Stock Company

announced that June 5th would be the record date for paying the remaining 2024 dividends in cash. The ex-dividend date is June 4th, and the expected payment date is June 26th.

The payment ratio is 20% (VND 2,000/share). With nearly 7.96 million shares currently in circulation, HPP is expected to spend nearly VND 16 billion on this dividend payment.

Earlier in the year, HPP had paid the first installment of 2024 dividends at a rate of 10% (VND 1,000/share). Thus, after completing this final dividend payment, the company will have fulfilled its 2024 dividend plan with a total ratio of 30%, equivalent to approximately VND 24 billion.

L40 – Construction and Investment Joint Stock Company No. 40

recently announced that June 3rd would be the record date for issuing bonus shares to shareholders at a ratio of 200% (shareholders owning one share will receive one right, and one right will entitle them to two new shares).

With 3.6 million shares currently in circulation, L40 plans to issue an additional 7.2 million bonus shares. All issued shares will not be restricted from transfer. After this issuance, the company’s charter capital will increase from VND 36 billion to VND 108 billion.

On June 5th,

DXG – Dat Xanh Group Joint Stock Company

will finalize the list of shareholders entitled to receive bonus shares to increase charter capital from owner equity.

Accordingly, Dat Xanh plans to issue over 148 million bonus shares to shareholders at a ratio of 100:17, meaning shareholders owning 100 shares will receive 17 new shares. Fractional shares, if any, will be canceled.

The capital source for this issuance is VND 1,480 billion, comprising VND 1,200 billion from undistributed post-tax profits stated in the audited 2024 consolidated financial statements and over VND 280 billion from share premium based on the company’s audited separate financial statements for 2024.

Furthermore,

CTS – Vietinbank Securities Joint Stock Company

announced that June 6th would be the ex-dividend date for shareholders entitled to receive stock dividends.

Accordingly, CTS will issue 63.95 million shares as dividends, equivalent to an issuance ratio of 43%. The ratio of rights execution is 100:43, meaning shareholders owning 100 shares will receive 43 new shares.

The capital source for this issuance is from undistributed post-tax profits up to the end of 2024, based on the audited 2024 financial statements.

“Exclusive Provider to VinFast Offers Lucrative Dividends and Stock Bonuses.”

Introducing a dynamic opportunity for investors and stakeholders alike – with a successful share offering, this company’s chartered capital is set to soar to an impressive 697 billion VND.

The Big Capital Boost: Businesses Amplify Their Ambitions

The Orient Commercial Joint Stock Bank has unveiled plans to issue over 197 million OCB shares, while Chuong Duong Joint Stock Company is set to privately offer 30 million CDC shares. In a similar move, Dong A Joint Stock Company aims to boost its charter capital by issuing an additional 34 million GDA shares.