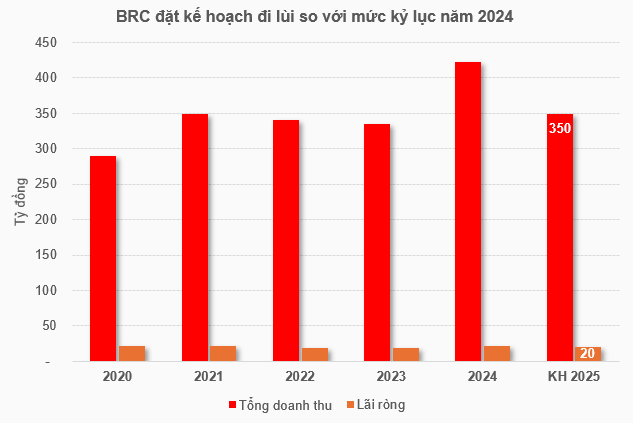

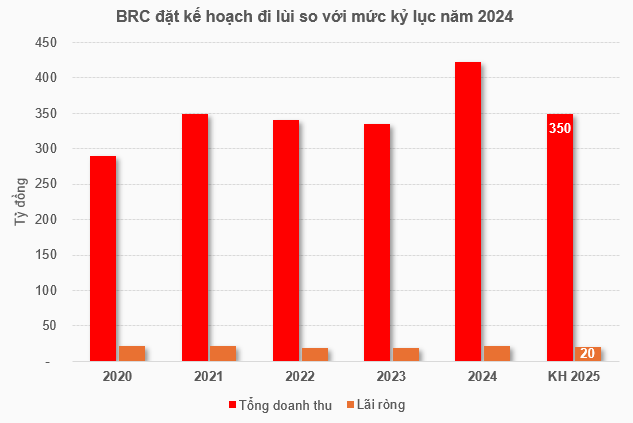

The General Meeting approved the 2025 business plan with a total revenue of nearly VND 350 billion, a 17% decrease from the 2024 performance, including VND 105 billion from export activities, a 14% reduction. The net profit was over VND 20 billion, a 6% drop.

In terms of output, the Company planned to produce and consume 163,500 square meters of fabric-core conveyor belts, 14,500 square meters of steel-core conveyor belts, 19 million inches of courroies, and 1.95 million kg of technical rubber, all lower than the 2024 performance.

Regarding the shareholders’ queries about the reason for the retrogressive plan, the BRC Management Board attributed it to the cement industry’s incomplete recovery, slow debt collection, and the Company’s cautious approach. Additionally, exports to the US market faced tax-related challenges, impacting export revenue. Furthermore, the life cycle of steel-core conveyor belts is quite long, so customers did not need replacements in 2025, leading to a lower consumption plan than in 2024.

Source: VietstockFinance

|

The General Meeting approved a total capital requirement of over VND 1.3 billion for equipment purchases, fully funded by equity capital. For profit distribution, the meeting approved a dividend ratio of 10%, equivalent to nearly VND 12.4 billion for 2025. For 2024, the ratio was 12%, totaling over VND 14.8 billion.

Apart from inquiries about the business plan, the discussion also noted a shareholder’s suggestion to hold the meeting earlier in the first quarter. BRC‘s leadership responded that the Company always strives to organize the meeting as early as possible. However, the audited financial statements are typically completed in March, after which the audit results are presented to the owner for approval of the voting criteria for the meeting, making it impractical to hold the meeting in the first quarter.

The meeting also considered a shareholder’s proposal to increase remuneration for members of the Board of Directors and the Supervisory Board. In response, BRC representatives emphasized that since the members have primary occupations and incomes from their specialized units, the remuneration from the Company serves as an allowance for their part-time roles.

As per the approved agenda, the remuneration for 2025 will be VND 4 million/person/month for Board members and VND 2.5 million/person/month for Supervisory Board members. In 2024, the Board of Directors and the Supervisory Board received a total remuneration of VND 302 million.

– 10:28 02/06/2025

Aseansc Aims for Over $13 Billion in Profits in 2025, Elects Two New Board Members

The annual general meeting (AGM) of Asean Securities Joint Stock Company (Aseansc) unveiled ambitious plans for the year 2025. The Board of Directors proposes to achieve a revenue of VND 323 billion and a pre-tax profit of VND 131 billion, marking a significant 27% and 5% increase, respectively, from the previous year’s performance. To ensure a complete board, the assembly will also elect two new members to the Board of Directors, filling vacancies from expiring terms.

“Thaigroup and LPBS Nominate Members for HAGL’s Board of Directors”

The Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) has unveiled its slate of nominees for the Board of Directors and Supervisory Board for the upcoming term (2025-2030), to be elected at the forthcoming 2025 Annual General Meeting of Shareholders. Notably, alongside current members, the nomination list features several candidates from the large shareholder group holding 121 million HAG shares.

“THACO Proposes High-Speed Rail Investment for North-South Corridor, Envisioning a 7-Year Construction Timeline”

“Vietnam’s leading automotive manufacturer, Truong Hai Auto Corporation (THACO), has expressed its interest in investing in the country’s high-speed North-South railway project. In a recent proposal to Prime Minister Pham Minh Chinh, THACO has showcased its ambition to diversify its portfolio and contribute to the nation’s infrastructure development.”