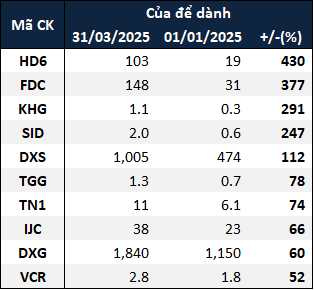

Although the industry’s modest 2% increase in reserves, several businesses have experienced significant growth.

|

Top 10 Real Estate Companies with the Highest Increase in Reserves (in trillion VND)

Source: VietstockFinance

|

A notable example is Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company (HOSE: FDC). The company’s reserves consist of revenue from advance leasing activities, classified as unearned revenue. As of the end of 2024, this amount stood at over 31 billion VND in the short term. However, by the end of March 2025, the value had increased to 148 billion VND, a 4.8-fold increase, mainly due to the additional 99 billion VND in long-term advance leasing revenue.

In 2024, FDC completed and commenced operations of the Fideco office building project at 28 Phung Khac Khoan, District 1, Ho Chi Minh City. The leasing revenue from this project contributed to FDC’s impressive performance, resulting in a net profit of nearly 11 billion VND in Q1/2025, a 30-fold increase compared to the same period last year.

The duo of Dat Xanh Group Joint Stock Company (HOSE: DXG) and Dat Xanh Real Estate Service Joint Stock Company (HOSE: DXS) also demonstrated significant growth in their reserves. As of March 31, 2025, DXG and DXS recorded reserves of over 1,800 billion VND and 1,000 billion VND, respectively, reflecting a 60% increase and a more than double (2.1-fold) increase compared to the beginning of the year. This growth is mainly attributed to advance payments made by individuals for the purchase of apartments and land plots.

At the Annual General Meeting of Shareholders, Mr. Luong Tri Thin, Chairman of the DXG Strategic Council, assessed that since 2024, the market has shown signs of recovery, and especially in 2025, the recovery has been very positive. The company has nearly completed 15,000 products, sufficient for business operations during the period of 2025-2027.

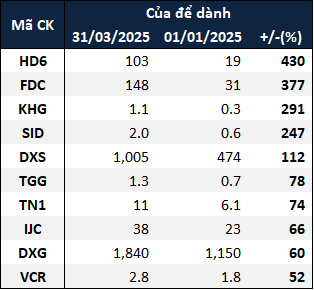

Vinhomes leads the industry in reserves

Vinhomes Joint Stock Company (HOSE: VHM) continues to be the real estate business with the highest reserves in the market, amounting to over 50 trillion VND, a 6% increase compared to the beginning of the year.

|

Top 10 Real Estate Companies with the Largest Reserves (in trillion VND)

Source: VietstockFinance

|

According to VHM, their sales revenue in Q1/2025 reached 35 trillion VND, more than double (2.2 times) the figure from the same period last year. As of the end of Q1, their unfulfilled sales stood at 120 trillion VND, a 7% increase compared to March 2024. This positive performance is mainly driven by the strong results from major urban areas, particularly Vinhomes Wonder City in western Hanoi, which was launched in mid-March 2025.

Following VHM is Nova Land Real Estate Investment Group Joint Stock Company (HOSE: NVL), with reserves exceeding 18.3 trillion VND, a slight decrease of 3%. This change may be due to the company’s delivery of projects in Q1, such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City. Consequently, NVL recorded a remarkable 1,634 billion VND in net revenue from real estate transfers in the first three months of the year, triple (3.3 times) the figure from the previous year.

NVL is expediting the progress of projects in Ho Chi Minh City, such as The Grand Manhattan and Victoria Village (high-rise area), aiming to complete and commence delivery by the end of this year or early next year.

Another real estate business with reserves surpassing the 10 trillion VND mark is Saigon VRG Real Estate Investment Joint Stock Company (HOSE: SIP), with reserves of over 12.4 trillion VND, a 3% increase. Similar to VHM, SIP’s reserves primarily consist of advance revenue from land and factory leasing in industrial parks.

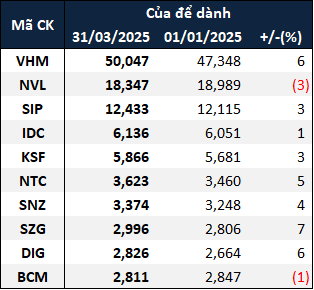

39 businesses experienced a decrease in reserves

In contrast to the businesses with impressive reserve figures, 39 companies witnessed a decline compared to the beginning of the year. The company with the most significant decrease was DRH Holdings Joint Stock Company (HOSE: DRH), with a reduction of 83%, leaving them with 92 billion VND in reserves.

|

Top 10 Real Estate Companies with the Largest Decrease in Reserves (in trillion VND)

Source: VietstockFinance

|

DRH’s reserves comprise entirely of short-term advance payments from customers. According to the audited financial statements for 2024, this amount represents the progress payments made by customers for the Aurora apartment and commercial services project, developed by a subsidiary of DRH.

Despite the substantial decrease in reserves, DRH’s net revenue for Q1 only reached approximately 911 million VND, falling short of covering the cost of goods sold, resulting in a net loss of nearly 26 billion VND (compared to a loss of nearly 5 billion VND in the same period last year). Notably, DRH’s net revenue was derived solely from the service provision segment, while the real estate sales segment contributed zero revenue. Conversely, the company’s interest expense nearly tripled (3.7 times) to approximately 34 billion VND during this period.

Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR) also experienced a significant decrease in reserves, with an 80% drop to 27 billion VND. The majority of this reserve consists of advance payments made by customers for the Quy Nhon Iconic project.

At the end of February 2025, Mr. Nguyen Van Dat, Chairman of PDR’s Board of Directors, shared that the Quy Nhon Iconic project had finalized the land use fee calculation. Phase 1 of the project has been fully sold, and Phase 2 is expected to be ready for sale in mid-March 2025. Along with Thuan An 1&2, these projects are anticipated to significantly contribute to PDR’s business results this year.

In Q1/2025, PDR achieved net revenue of nearly 438 billion VND, a 2.7-fold increase compared to the same period last year, and a net profit of nearly 51 billion VND, a slight decrease of nearly 4%.

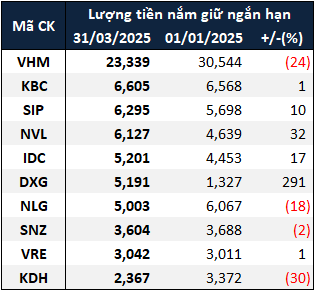

Short-term cash holdings decreased by nearly 5%

In addition to reserves, short-term cash holdings (cash and cash equivalents + short-term deposits) are another crucial aspect for businesses. While reserves increased by over 2%, the short-term cash holdings of the 102 real estate businesses surveyed decreased by nearly 5%, totaling 92.3 trillion VND.

VHM, despite a 24% reduction, maintained its position as the industry leader in cash holdings, with over 23 trillion VND. DXG joined the top 10 companies with the highest cash holdings, reaching approximately 5.2 trillion VND, a nearly fourfold (3.9 times) increase from the beginning of the year. Conversely, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) experienced a 30% decrease in short-term cash holdings, leaving them with nearly 2.4 trillion VND.

|

10 Real Estate Companies with the Highest Cash Holdings as of March 31, 2025 (in trillion VND)

Source: VietstockFinance

|

|

“Advance payments from customers” and “Unearned revenue” are two items that investors consider as the “reserved funds” of a company, as they will be recognized in the financial statements when the time for accounting comes. |

Ha Le

– 10:00 06/03/2025

A Southern Giant Eyes Northern Expansion with Land Acquisitions

“Vietnam’s leading real estate developer, Nam Long, has set its sights on expanding its reach to the northern market. With an ambitious vision, the company’s subsidiary, Nam Long ADC, is spearheading this endeavor by introducing an affordable housing project, marking their first venture into this region.”

The Tax Defaulters: Unraveling the Story of Billion-Dollar Debts in Binh Duong Province.

On November 26, the Binh Duong Provincial Tax Department disclosed a list of tax debtors to the State budget as of October 31, 2024. The list comprises 365 individuals and businesses delinquent in tax payments, totaling over VND 1,400 billion. Notably, several prominent names feature on this list, highlighting the significance of tax compliance among all entities and individuals.