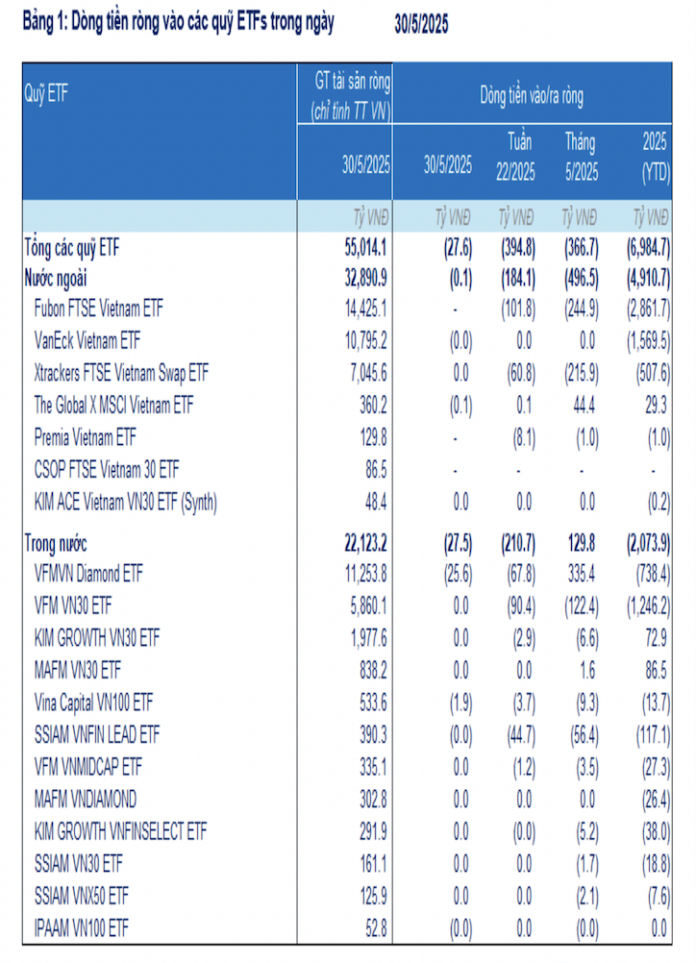

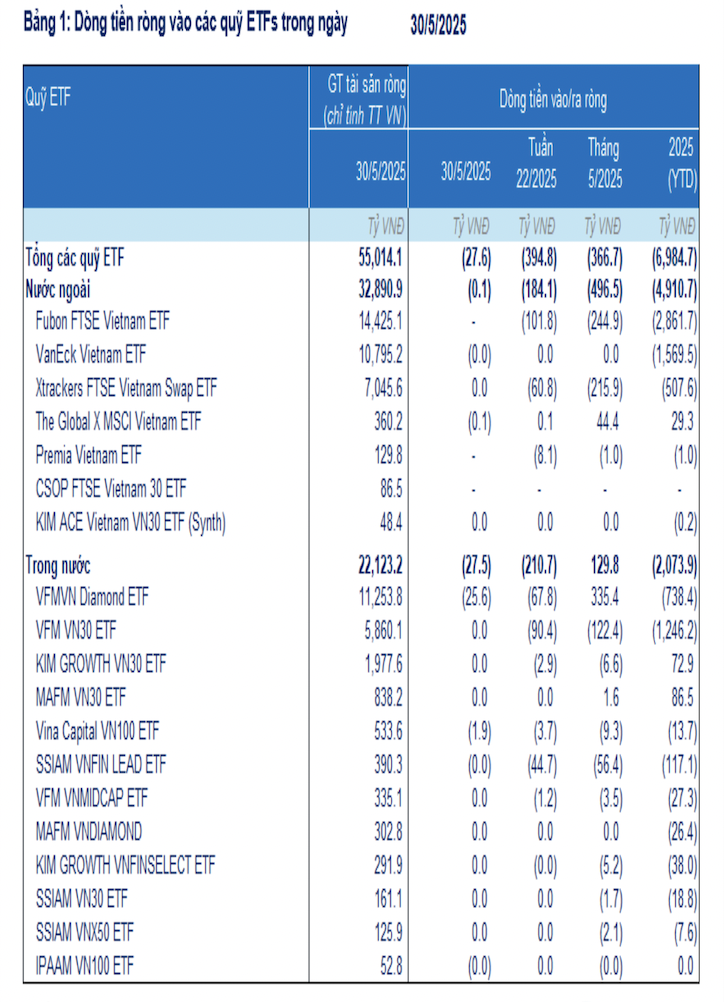

For the week of May 26-30, 2025, ETFs investing in the Vietnamese stock market experienced a net withdrawal of over VND 394 billion. This withdrawal trend was observed in 10 out of 19 funds, predominantly in the foreign fund Fubon FTSE Vietnam ETF.

Foreign ETFs witnessed net outflows of more than VND 184 billion, mainly from the Fubon FTSE Vietnam ETF (VND -101.8 billion). The Xtrackers FTSE Vietnam ETF also experienced net outflows of nearly VND 61 billion.

Similarly, domestic ETFs faced net withdrawals of over VND 210 billion, largely from the VFM VN30 ETF (-VND 90.4 billion). Additionally, the VFM VNDiamond ETF saw net outflows of almost VND 68 billion, while the SSIAM VNFIN LEAD ETF had outflows of over VND 44 billion.

Regarding Thai investments through depositary receipts (DRs): Thai investors sold more than 1 million DRs in the VFM VNDiamond ETF (FUEVFVND01), amounting to VND 33.7 billion. They also sold 100,000 DRs in the VFM VN30 ETF (FUEVFVND01), equivalent to VND 2.5 billion.

In May 2025, ETFs recorded net outflows of over VND 366 billion, bringing the year-to-date net withdrawals to nearly VND 7 trillion (lower than the 2024 figure of VND 21.8 trillion). As of May 30, 2025, the total net asset value of ETFs (considering only allocations in Vietnam) stood at VND 55 trillion, a 3.2% decrease compared to the end of 2024. The top stocks sold by the funds during the week of May 26-30, 2025, were VIC, VHM, HPG, TCB, and VCB.

On June 2, 2025, the Fubon FTSE Vietnam ETF experienced additional net withdrawals of nearly VND 27 billion, bringing the year-to-date net outflows to over VND 2,800 billion. The Fubon FTSE Vietnam ETF maintained its net selling of stocks, estimated at over VND 27 billion. The top sold stocks were HPG (-89,000 shares, -VND 2.3 billion), SSI (-55,000 shares, -VND 1.3 billion), SHB (-49,000 shares, -VND 700 million), VIC (-47,000 shares, -VND 4.6 billion), and VHM (-44,000 shares, -VND 3.4 billion).

Meanwhile, the VFM VNDiamond ETF and the VEM VN30 ETF faced net withdrawals of approximately VND 32 billion and VND 13 billion, respectively.

Despite consecutive net withdrawals, the performance of the investment funds showed improvement in April. The difference between the year-to-date performance and the four-month performance in 2025 indicates that most funds have significantly narrowed their losses, with closed-end funds being the most notable.

Additionally, several open-end funds and ETFs have even recovered their previous losses after a sharp decline in April 2025, when the market reacted negatively to the news of the US imposing retaliatory tariffs of up to 46% on imports from Vietnam.

This highlights the ability of open-end funds and ETFs to respond more swiftly and flexibly compared to closed-end funds. Notably, the Fubon FTSE Vietnam, ETF DCVFMVN30, and DCDS funds, with their focus on large-cap stocks such as the Vin Group (VIC, VHM, VRE), and GEX, demonstrated this agility.

In particular, Fubon’s performance improved, with only a 1.4% decline in April, a cumulative increase of 5.1% over four months, and a year-to-date gain of 14.5%, second only to the VanEck Vietnam ETF.

However, foreign investors have shown signs of reversing this trend by net buying Vietnamese stocks recently.

Foreign capital inflows into Vietnam turned positive in May 2025, recording a net purchase value of VND 3,500 billion (USD 136.5 million). This was the first net buying month since January 2024 and the largest net buying value since January 2023, indicating a shift in foreign investor sentiment. This development reduced the total net selling value since the beginning of the year to VND 35,700 billion (USD 1.4 billion) as of the end of May 2025 (compared to VND 27,800 billion/USD 1.1 billion in the same period last year). The transaction ratio of foreign investors decreased to 11.4% from 12.3% in April 2025.

The convergence of favorable factors—including easing trade tensions through agreements between the UK, China, and the US; positive progress in the second negotiation between Vietnam and the US; and supportive policies for the private sector—has contributed to rekindling foreign investors’ optimism toward the Vietnamese stock market after more than a year of net selling.

This turnaround in capital flows is particularly significant given the substantial net selling by foreign investors in the previous quarters, amounting to VND 13,100 billion (USD 510.9 million) in Q4/2024 and VND 16,000 billion (USD 624.0 million) in Q2/2024. Although foreign investors’ transaction ratio currently stands at 11.4% of the total market, their positive turnaround signals strong confidence in the resilience and recovery potential of the Vietnamese market amid rising geo-political risks.