The stock market witnessed strong volatility during the first trading session of the week on June 2nd. The main index, VN-Index, remained in negative territory for most of the trading day as many Bluechip stocks underwent corrections. A sudden surge in buying pressure towards the end of the session pushed the VN-Index above the reference level. At the close, the VN-Index gained 3.7 points to reach 1,336.3 points. Amidst this backdrop, foreign investors continued their net selling trend, offloading approximately VND 159 billion worth of shares.

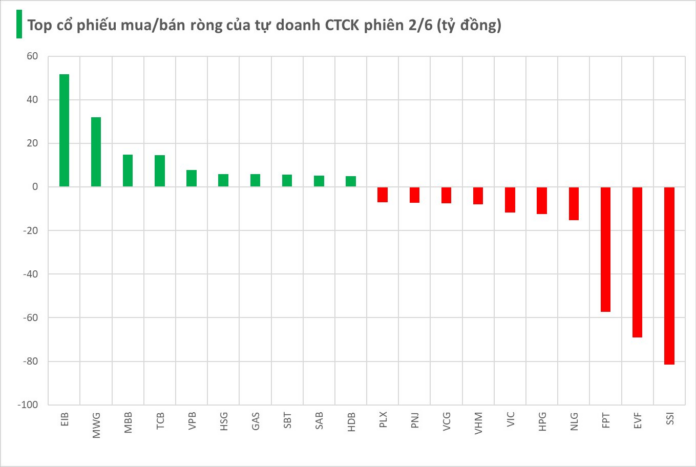

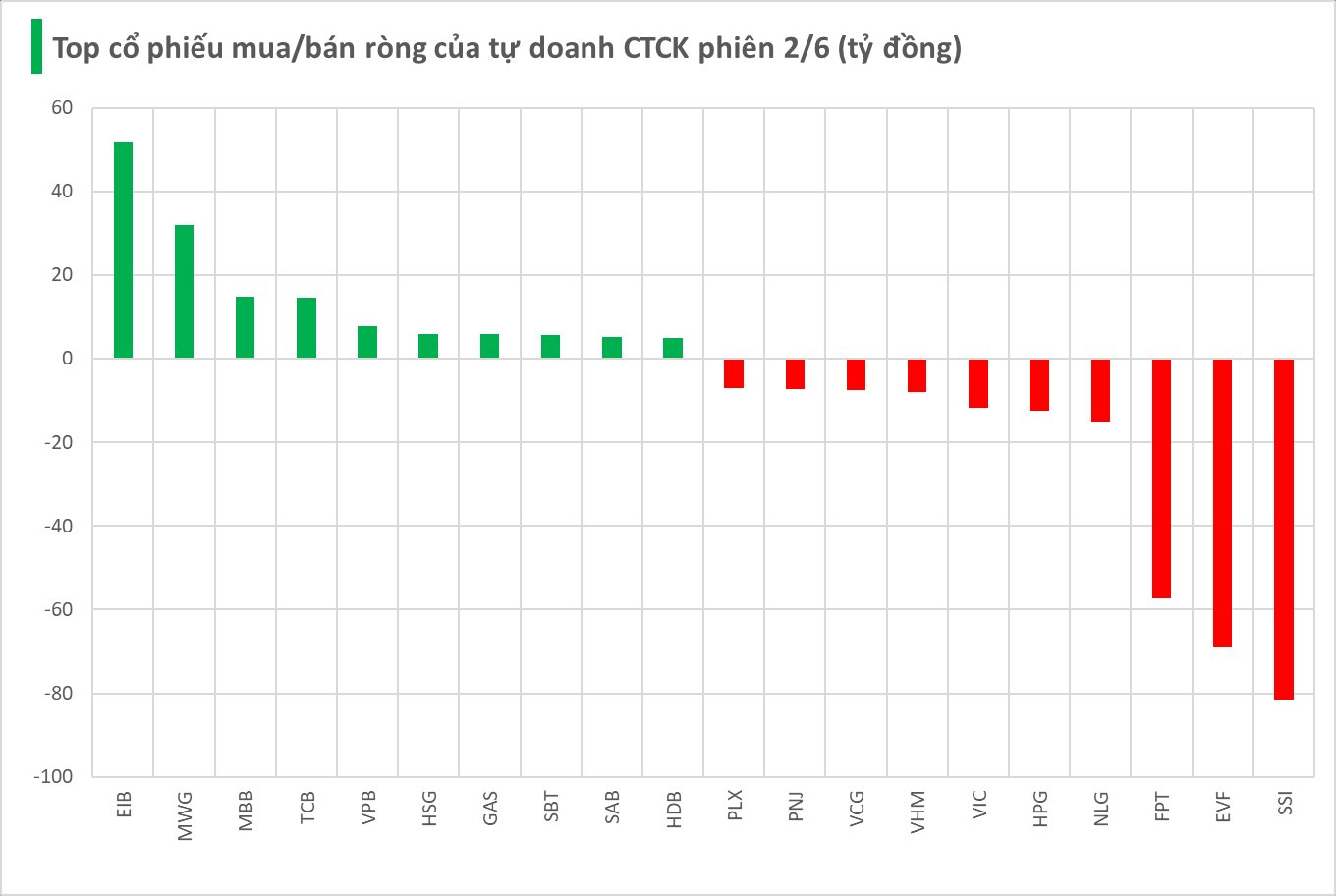

Securities companies’ proprietary trading activities resulted in a net sell position of VND 142 billion on the HoSE exchange.

Specifically, SSI witnessed the highest net selling pressure among securities companies, offloading VND 82 billion worth of shares. This was followed by EVF and FPT, which were net sold VND 69 billion and VND 57 billion, respectively. Other stocks that faced net selling pressure during today’s session included NLG, HPG, VIC, and VHM…

On the contrary, securities companies’ buying activities focused on EIB and MWG, resulting in net purchases of VND 52 billion and VND 32 billion, respectively. MBB was also net bought for VND 15 billion. Additional stocks that witnessed net buying pressure included TCB, VPB, HSG, and GAS…

The Big Property Player: Individual Nets 1.2 Trillion VND Buying Real Estate Stocks

Today, individual investors recorded a net buy of 1,219.2 billion VND, including a net buy of 940.5 billion VND in matched orders. Focusing on matched orders, they net bought in 12 out of 18 sectors, mainly in the Real Estate industry.

Market Pulse June 2nd: Energy Sector Surges, VN-Index Recaptures Green Territory

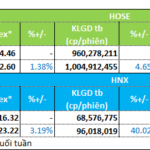

The trading session concluded with the VN-Index climbing 3.7 points (+0.28%), reaching 1,336.3. Meanwhile, the HNX-Index witnessed a rise of 2.95 points (+1.32%), ending at 226.17. The market breadth tilted towards gainers, as 438 stocks advanced against 323 decliners. Similarly, the VN30 basket saw a slight dominance of greens, with 16 gainers, 13 losers, and 1 stock remaining unchanged.