Alpha Seven Group JSC’s Ambitious Plans for 2025

At the recent Annual General Meeting of Shareholders, Alpha Seven Group JSC (HNX: DL1) approved ambitious plans for the upcoming year. The company aims to achieve a revenue of 1,200 billion VND, a significant increase of 2.3 times their 2024 performance, and a remarkable after-tax profit of 120 billion VND, which is 4.6 times higher than the previous year.

Despite a recorded revenue of 525 billion VND in 2024, the company’s after-tax profit took a hit, decreasing to 26 billion VND. Net profit stood at a mere 1.4 billion VND, a far cry from the 45 billion VND achieved in previous years.

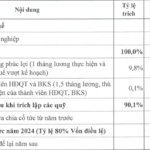

Heeding the proposal of major shareholder Mr. Bui Phap, who holds 24.01% of DL1’s capital and currently serves as Chairman of Duc Long Gia Lai JSC (DLG), the meeting also approved a 10% stock dividend for 2024. Consequently, DL1 will issue over 10.6 million shares as dividends.

Furthermore, the company plans to issue nearly 64 million shares to the public at a price of 10,000 VND per share between 2025 and 2026, subject to the approval of the State Securities Commission of Vietnam.

The proceeds from this issuance are earmarked for two primary purposes:

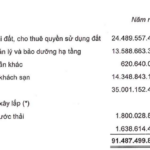

– 529.5 billion VND will be utilized to acquire 17.65 million shares, equivalent to a 70.6% stake, in Duc Long Dak Nong BOT and BT JSC from the existing shareholder at a price of 30,000 VND per share.

It is worth noting that Duc Long Dak Nong BOT and BT JSC currently has a charter capital of 250 billion VND, with Duc Long Gia Lai Group (DLG) as its parent company, holding a 70.6% stake, while DL1 owns the remaining 29%.

– The remaining 108 billion VND will be contributed to DLG Ansen Electronics LLC (a wholly-owned subsidiary of DL1) to enable the settlement of its debts with credit institutions.

Interconnectedness between DL1 and Duc Long Gia Lai Group (DLG)

Shareholders raised questions regarding the interconnectedness between DL1 and Duc Long Gia Lai Group (DLG), given their shared major shareholder, Mr. Bui Phap, and their joint investments in Duc Long Dak Nong and Duc Long Gia Lai Construction Investment JSC.

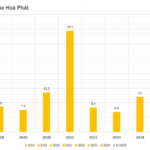

DL1 was once a subsidiary of DLG but gained independence in 2017 when DLG divested its entire stake. In 2024, DL1 acquired Mass Noble Investments Limited from DLG for 255 billion VND. Since 2016, after the acquisition of Mass Noble, electronic components have been the primary revenue driver for Duc Long Gia Lai Group, peaking in 2019 and subsequently declining. In 2023, revenue from this segment stood at 573 billion VND.

Additionally, Paul Anthony Murphy, a former member of DLG’s Board of Directors, was elected to the Board of DL1. Furthermore, Mr. Bui Minh Duc, Vice Chairman of DL1, is the son of Mr. Bui Phap, Chairman and largest shareholder of DLG.

Caption: Mr. Bui Minh Duc, Member of DL1’s Board of Directors, is the son of Mr. Bui Phap, Chairman and largest shareholder of DLG.

Addressing these concerns, CEO Nguyen Dinh Trac asserted that the two companies have no shared capital, ownership, or business areas and are independently capitalized. While there was a certain level of interconnection in the past, it no longer exists as of 2022.

Regarding DL1’s acquisition of Duc Long Dak Nong BOT and BT JSC, Mr. Trac explained that the company aims to venture into infrastructure investment to secure a stable cash flow, targeting an average profit of 80-100 billion VND per year, thus fulfilling their goal of achieving an after-tax profit of 120 billion VND.

US Tariffs Impact on China-based Factory

Another notable aspect is the impact of US tariffs on DL1’s subsidiary, Mass Noble, whose factory is based in China. Additionally, one of DL1’s significant partners, Skyworth, is also a Chinese company.

Concerning the tariffs imposed by the US, Mr. Trac acknowledged that the US tariffs on Chinese imports have been a significant challenge this year, affecting the company’s 2025-2035 strategy. Nonetheless, the management team remains confident in the growth of the electronics manufacturing industry. Mass Noble boasts a talented team of research and development engineers and has full command of the technology, ensuring DL1’s prowess in this business sector.

Mr. Trac further revealed that the localization rate of TV production at the High-Tech Park in Thu Duc City has reached 55%, qualifying the company for preferential tariffs. DL1 aims to increase this localization rate further and has already mastered TV production technology, with a daily production capacity of 1,500-2,000 units. Additionally, the company is geared towards manufacturing electronic boards and consistently updating its technology through partners and suppliers, ensuring they remain unaffected by US tariff policies.

Sale of District 7 Project to a Shareholder of a Company within the Huong Viet Ecosystem

During this meeting, shareholders also inquired about DL1’s decision to exit the real estate sector by divesting its entire 49% stake in Van Gia Long Investment Construction JSC, the developer of the Sunshine Apartment project (commercially known as Duc Long Golden Land) in District 7, Ho Chi Minh City.

Mr. Trac explained that while the Van Gia Long project is aesthetically pleasing, the current policies and legal procedures in Ho Chi Minh City have hindered its progress. As a result, DL1 chose to offload this non-income-generating asset.

The transferee of Van Gia Long’s shares is Mr. Nguyen Duc Toan, a shareholder in a company within the Huong Viet ecosystem, who has no affiliation with either DL1 or DLG. Mr. Toan has already made the full payment of 340 billion VND, which is lower than the original price of 448 billion VND recorded in DL1’s reviewed semi-annual financial statements for 2024.

Mr. Trac affirmed that DL1 intends to divest from other inefficient projects in the future and focus on more promising acquisitions.

Steelmaker Hoa Phat Issues Almost 1.3 Billion New Shares for June Dividend

As of its latest issuance, Hoa Phat’s chartered capital stands at an impressive 76,755 billion dong, making it the largest among non-financial enterprises listed on the stock exchange.

“Vietlott Rakes in $340 Million from Lottery Ticket Sales, Rising to the Second Largest Company in the Industry but Ranking 22nd in Profit”

Vietlott is the proud holder of the record for the largest lottery prize in Vietnamese history. With a jaw-dropping jackpot of over 314 billion VND in the Power 6/55 draw, and a first-time ever occurrence of 30 lucky winners taking home a special prize of 3 billion VND each in the Max 3D+ lottery, Vietlott has truly made history.