DL1’s Annual General Meeting for 2025 was held on 01/06/2025 – Photo: Thuong Ngoc

|

DL1’s General Meeting of Shareholders approved the 2025 business plan with revenue and after-tax profit targets of 1,200 billion VND and 120 billion VND, respectively, doubling and quadrupling the 2024 figures.

A 10% dividend payout for 2024 was approved as proposed by Mr. Bui Phap.

Vice Chairman and CEO, Mr. Nguyen Dinh Trac, assured that by the end of 2025, the company would achieve its targeted revenue of 1,200 billion VND and after-tax profit of 120 billion VND as per the business plan. As CEO, he committed to fulfilling the 2025 business goals.

Notably, DL1’s initial annual meeting documents proposed no dividend payout for 2024. However, upon the recommendation of major shareholder Mr. Bui Phap (holding 24.01% of DL1’s capital and currently serving as Chairman of DLG) on 20/05/2025, a 10% stock dividend for 2024 was added to the agenda and approved by the General Meeting of Shareholders. Accordingly, DL1 will issue over 10.6 million shares as dividends for 2024.

Additionally, the company plans to offer nearly 64 million shares to the public at a price of 10,000 VND per share between 2025 and 2026, pending approval from the State Securities Commission.

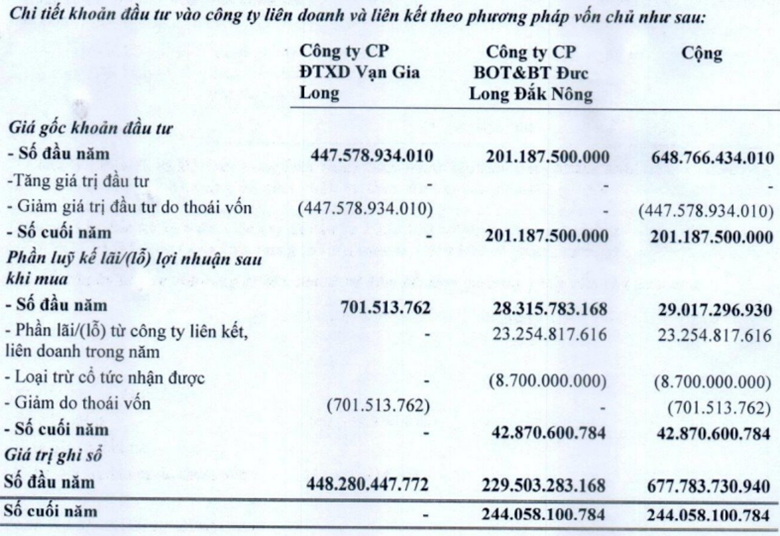

| BOT and BT Duc Long Dak Nong Company currently has a charter capital of 250 billion VND. DLG Group JSC holds a 70.6% stake as the parent company, while DL1 owns 29%. As of Q1/2025, DL1 invested in 7.25 million shares of Duc Long Dak Nong (29%) at a cost of over 201 billion VND, equivalent to 27,750 VND per share. |

With the expected proceeds of over 637 billion VND from the public offering, DL1 intends to use 529.5 billion VND to acquire 17.65 million shares (equivalent to a 70.6% stake) of BOT and BT Duc Long Dak Nong Company from the existing shareholders at a price of 30,000 VND per share. The remaining amount of nearly 108 billion VND will be contributed to DLG Ansen Electronics Company Limited (a wholly-owned subsidiary of DL1) for debt repayment to credit institutions.

Also related to DLG, the DL1 General Meeting approved the resignation of Mr. Phan Duc Hieu as a member of the Board of Directors, effective 22/05/2025, and elected Mr. Paul Anthony Murphy in his place.

According to his resume, Mr. Paul Anthony Murphy is currently the Executive Director of Ansen Investment Company Limited, an indirect subsidiary of DL1. Additionally, he served as a member of the Board of Directors of DLG from 2018 until his recent resignation at the DLG Annual General Meeting on 30/05/2025.

What is the relationship between DL1 and DLG?

Given the above meeting agenda, DL1 shareholders inquired about the relationship between DL1 and DLG, noting several similarities between the two companies. Both have Mr. Bui Phap as a major shareholder; in 2024, DL1 acquired Mass Noble Investments Limited from DLG; they have jointly invested in the same entity, Duc Long Dak Nong and Duc Long Gia Lai Construction Investment JSC; and Mr. Paul Anthony Murphy, a former member of DLG’s Board of Directors, was elected to DL1’s Board. Furthermore, according to DL1’s 2024 audited financial statements, the company used the expanded Duc Long Gia Lai bus station in Pleiku City as collateral for DLG’s bond issuance on 31/12/2014.

Responding to shareholder inquiries, Mr. Nguyen Dinh Trac clarified that the two companies have no shared capital, ownership, or business areas and are independently owned. While there was a certain relationship between the companies in the past, it no longer exists as of 2022.

DL1’s acquisition of BOT and BT Duc Long Dak Nong is part of its strategy to invest in infrastructure projects to generate stable cash flow and average profits of 80-100 billion VND per year, thus achieving its targeted after-tax profit of 120 billion VND. DL1 currently has no overdue debts and is not financially distressed; instead, it is sought after by credit institutions for lending opportunities.

Vice Chairman and CEO of DL1, Mr. Nguyen Dinh Trac – Photo: Thuong Ngoc

|

Mr. Bui Minh Duc, a member of DL1’s Board of Directors, is the son of Mr. Bui Phap, Chairman and largest shareholder of DLG.

Mr. Bui Minh Duc, Member of the Board of Directors of DL1 – Photo: Thuong Ngoc

|

Has DL1’s TV manufacturing plant achieved a 55% localization rate?

Regarding tariff issues with the US, a DL1 shareholder raised concerns about the impact of tariffs on Mass Noble’s operations, as its electronics component manufacturing plant is located in China, which has been affected by the Trump administration’s tariff policies. Additionally, given that Skyworth, a significant partner of DL1, is also a Chinese company, the shareholder worried about potential legal issues if Skyworth were to import goods into DL1 to circumvent tariffs.

Furthermore, the shareholder inquired about the long-term financial investment provision of nearly 28 billion VND at the end of 2024, which appeared shortly after the acquisition of Mass Noble.

Outside DL1’s 12,000m2 electronics manufacturing plant in the High-Tech Park, Thu Duc City. Photo: Thuong Ngoc

|

In response, Mr. Trac acknowledged that the tariffs imposed by the US on imports from China have been a significant shock this year, impacting the company’s 2025-2035 strategy. While acknowledging the impact of US tariffs, the CEO affirmed the electronics component industry’s growth potential. Mass Noble has a team of research and development engineers and has “complete mastery” of the technology, enabling DL1 to dominate this business area.

Mr. Trac stated that the localization rate in TV manufacturing at the Thu Duc City Hi-Tech Park plant has reached 55%, qualifying the company for preferential tariffs. DL1 aims to further increase the localization rate in the future. The company has mastered TV manufacturing technology, with a production capacity of 1,500-2,000 units per day. This year, DL1 aims to produce electronic circuit boards while continuously updating new technologies through partners or suppliers, ensuring no impact from US tariff policies.

It is noteworthy that the 55% localization rate in TV manufacturing mentioned by DL1’s CEO is quite remarkable. During a discussion on 27/05/2025, Mr. Luong Minh Huan, Director of the Enterprise Development Institute of the Vietnam Chamber of Commerce and Industry (VCCI), stated that the localization rate in Vietnam’s electronics industry currently stands at around 5-10%, and electronic products in the Vietnamese market are assembled with mostly imported components, resulting in low technology content.

Why did DL1 exit the real estate sector by divesting from Van Gia Long, the developer of the Sunshine Apartment project in District 7, Ho Chi Minh City? Shareholders sought more information about the transferee of Van Gia Long.

Mr. Trac acknowledged that Van Gia Long’s project is attractive, but with the current policies of Ho Chi Minh City, there would be certain legal procedures to continue the project, which the city has not been able to resolve for many years. Therefore, DL1 decided to divest from unprofitable projects that do not generate cash flow or profits.

The CEO shared that the transferee of Van Gia Long is Mr. Nguyen Duc Toan, a shareholder of a company within the Huong Viet ecosystem, with no relation to DL1 or DLG. Mr. Toan has fully paid the amount of 340 billion VND.

Mr. Trac added that DL1 will continue to divest from inefficient projects and focus on more promising M&A opportunities in the future.

However, according to DL1’s reviewed semi-annual financial statements for 2024, the original value of its 49% stake in Van Gia Long was nearly 448 billion VND, while the transfer price to Mr. Toan was only 340 billion VND. This raises the question of whether DL1 sold Van Gia Long at a loss.

The transfer of Van Gia Long was approved by DL1’s Board of Directors in a resolution dated 31/12/2024, and the company’s 2024 audited financial statements reflect a reduction in the investment value of Van Gia Long on the same date. Despite the significant difference between the original and transfer prices, DL1’s 2024 audited financial statements do not show any abnormal losses from this divestment.

|

DL1 recorded a reduction in its investment value in Van Gia Long as of 31/12/2024

Source: DL1’s 2024 Audited Financial Statements

|

Ha Le

– 12:16 02/06/2025

The Foreign Independent Director Resigns Following Đức Long Gia Lai’s Sale of its Electronics Component Business

Mr. Paul Anthony Murphy, a British national, has tendered his resignation from his role as a Board Member of DLG Group Joint Stock Company (HOSE: DLG). This development comes as a notable move shortly after DLG divested its entire stake in its electronic components subsidiary, a business area under Mr. Murphy’s stewardship.

The Dragon Breathes On: Đức Long Gia Lai Avoids Bankruptcy Proceedings

The People’s Court of Gia Lai decided not to initiate bankruptcy proceedings against Duc Long Gia Lai Corporation as the conglomerate remains solvent and has been consistently servicing its debt obligations to Lilama 45.3.