The VN-Index surged 6.0% in May 2025, making Vietnam the top-performing market for the month, thanks to positive signals from global trade agreements and robust domestic momentum, according to VnDirect statistics.

During this period, the authorities announced two important resolutions: Resolution 68-NQ/TW and Resolution 198/2025/QH15, which included significant reforms to boost the private economic sector.

A crucial factor in May was the initial signs of a de-escalation in US-China trade tensions. While the SHCOMP index only rose modestly by 1.0% from the previous month, the S&P 500 saw a strong rebound of 2.7%, offsetting the 1.5% decline in April 2025. This reflected investors’ stabilizing sentiment amid concerns about the risk of an economic recession during Trump’s tenure.

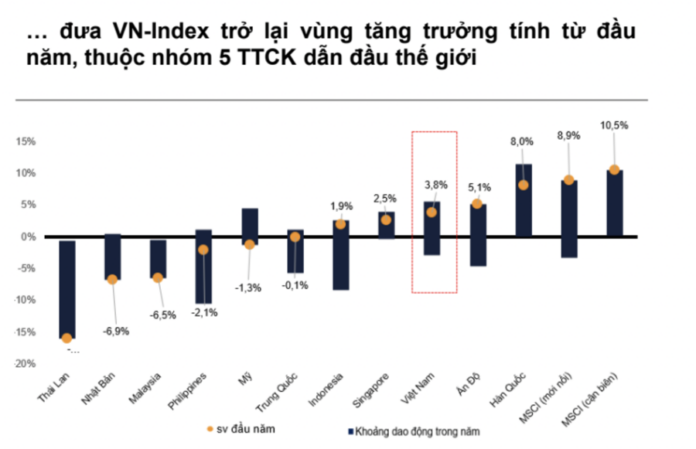

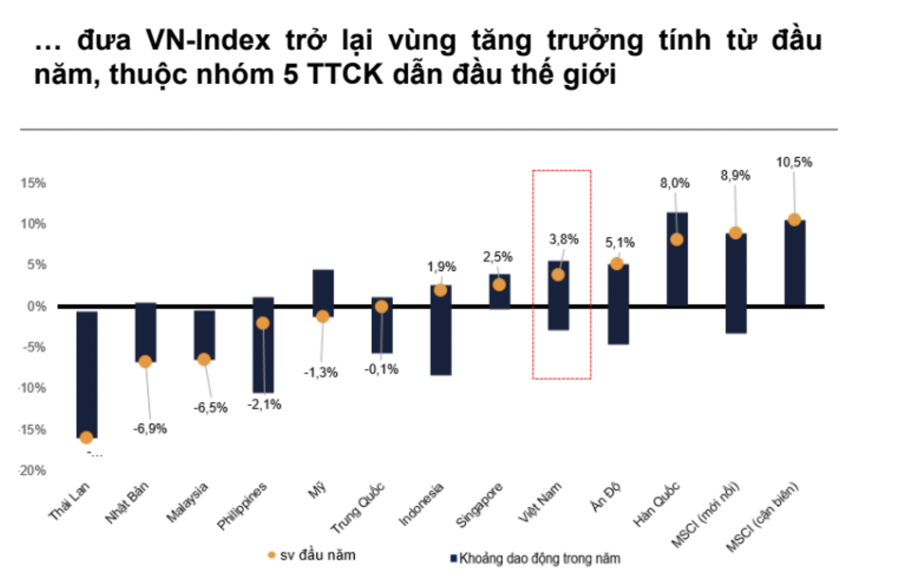

The May rally pushed the VN-Index into positive territory for the year, with a cumulative gain of 3.8% year-to-date.

The MXFM and MXEF indices recorded significant gains of 10.5% and 6.9% year-to-date, respectively, while the SET and Nikkei were in the red, with corresponding declines of 16.0% and 6.9%. The SET’s decline reflected investor skepticism about the government’s ability to stimulate growth beyond the tourism sector, persistent foreign capital outflows, and ongoing political instability. Nikkei’s plunge was mainly due to the strengthening yen, which put pressure on the profits of Japan’s leading export corporations.

The impressive 6.0% gain in the VN-Index in May 2025 was mainly driven by the Vin group of stocks. The Real Estate sector led the charge with a 17.7% month-over-month increase, led by VHM, which rose 13% from the previous month, and VIC, which soared 33% after VinSpeed proposed investing in the $61.4 billion high-speed North-South railway project.

Prime Minister Pham Minh Chinh directed an expedited appraisal of this project at a meeting on May 20, consistent with Resolution 68/NQ-TW, which opens the door for private sector participation in key national infrastructure projects. This month was truly a “golden period” for Vingroup, as VPL debuted on May 13, surging 20% above its reference price of VND 71,300 per share.

The Travel & Entertainment group came in second, with HVN surging 18.5% due to impressive Q1/2025 financial results, posting an after-tax profit of VND 3.4 trillion ($130.8 million), surpassing expectations and completing 56.9% of its full-year plan. 2) During the May 2025 Annual General Meeting of Shareholders, a capital mobilization plan of VND 9 trillion was approved, of which 86.3% of the shares offered will be sold to SCIC in the form of pre-emptive rights.

Year-to-date, the Real Estate sector continues to lead the market with a remarkable 67.6% gain, while the Banking sector has risen modestly by 2%. In the Q1/2025 earnings season, the average NIM of 25 banks under review declined from 3.34% (in Q4/24) to 3.04%, mainly due to banks being forced to lower lending rates to maintain competitiveness, while the cost of capital (COF) decreased at a slower pace due to pressure to retain depositors.

Nevertheless, the Banking sector recorded a robust Q1/25 ROE of 18.1%, reasonable P/B valuations, and a 16% credit growth outlook, supporting its long-term prospects.

Liquidity in May decreased by 6.0% year-over-year, reversing the expansionary trend of the previous month. Compared to the previous month, the average trading value on the three exchanges fell by 7.9% to VND 23.5 trillion ($916.5 million), with HoSE at VND 21.4 trillion ($834.6 million), down 8.8% month-over-month; HNX at VND 1.1 trillion ($42.9 million), a 16.1% decrease; and UPCOM at VND 1.1 trillion ($41.0 million), a 31.7% increase from the previous month.

May 2025 liquidity declined as investors continued to monitor the complex developments in trade tariff tensions, following record-high liquidity in Q4/25 when the market witnessed a panic-selling wave after America’s “Liberation Day.” Notably, HoSE’s liquidity rebounded strongly to VND 27.4 trillion ($1.1 billion) on May 14, following news of successful trade agreements between the UK, the US, and China, bolstering expectations for a similar positive outcome for Vietnam.

Foreign capital inflows into Vietnam turned positive in May 2025, recording a net buy value of VND 3.5 trillion ($136.5 million). This was the first net buying month since January 2024 and the largest net buy value since January 2023, indicating a turning point for foreign investors.

This development reduced the cumulative net sell value since the beginning of the year to VND 35.7 trillion ($1.4 billion) as of the end of May 2025 (compared to VND 27.8 trillion/$1.1 billion in the first five months of 2024). The transaction value ratio of foreign investors decreased to 11.4% from 12.3% in April 2025.

The convergence of favorable factors — including de-escalation signals in trade tensions from agreements between the UK, China, and the US; simultaneous progress in the second negotiation between Vietnam and the US; and supportive policies for the private economic sector — has rekindled foreign investor optimism toward the Vietnamese stock market after more than a year of net selling.

This turnaround in capital flows is particularly significant given the substantial net selling by foreign investors in the previous months, amounting to VND 13.1 trillion ($510.9 million) in April 2025 and VND 16 trillion ($624.0 million) in May 2024. Although foreign investors currently account for only 11.4% of total market transactions, their positive turnaround predicts strong confidence in Vietnam’s market resilience and recovery potential amid rising geo-political risks.

“Foreign Block Surprises With Net Buy of VND 900 Billion, While Proprietary and Institutional Traders Sell”

The foreign net buy-match mainly focused on the Financial Services and Banking sectors. The top foreign net buy-match orders included stocks such as VND, SHB, and NLG.

The Stock Market Boom: A Surge in Stock Prices

The VN-Index surged past 1340, thanks to a robust rebound from large-cap stocks, but the spotlight this morning belonged to the securities group. Dominating market liquidity, 5 out of the top 10 stocks traded were from the securities sector, and foreign investors’ net purchases also favored these securities stocks.

“The Stock Whisperer: Unveiling the Next FTSE Vietnam Index Contender”

The FTSE Vietnam Index is set for a potential shake-up, with SSI Research predicting the addition of HCM. This addition is anticipated as HCM satisfies all the requirements, and no stocks are expected to be removed.