The market is buzzing with anticipation as internal drivers such as the prospects of a stock market upgrade and predictions of large-scale foreign ETF purchases of VND stocks have fueled a surge of interest. VND and APG stocks soared to their daily limit-up prices, propelled by strong foreign buying, while other stocks like MBS, HCM, VIX, SSI, and VCI also witnessed significant gains.

This positive sentiment permeated the entire market, pushing the Vn-Index up by nearly 11 points, just shy of the 1,350 mark. The breadth was impressive, with 195 gainers dominating over 119 decliners.

Banks contributed the most to the index’s gains, with TCB and VCB leading the charge, adding 2.5 points to the Vn-Index. The sector was awash with green, as BID, CTG, VPB, HDB, and SHB also posted solid gains, averaging nearly 1% across the board.

The real estate sector lost some steam, with VIC and VHM registering modest gains while VRE closed below the reference price. Other heavyweights like NVL, KDH, and SNZ hovered around the flatline. Mid and small-cap stocks attracted cash flow, with most basic materials stocks in steel, rubber, metals, and fertilizers trading positively. Information Technology made a comeback, with FPT up 1.15% and CMG gaining 2%.

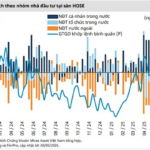

Overall, the market sentiment remains upbeat despite the ongoing uncertainty surrounding US tariffs. Domestic investors are also buoyed by the return of foreign investors to the buying side. Turnover on the three exchanges exploded, with matched orders reaching VND19.5 trillion, including a remarkable net buy figure of VND913.3 billion by foreign investors. Their net buy value for matched orders alone stood at VND464.8 billion.

Foreign investors focused their net buying on the Financial Services and Banking sectors. Top net bought stocks included VND, SHB, NLG, VNM, VIC, DCM, HCM, VCI, HSG, and VHM. On the selling side, they offloaded Information Technology stocks, with top net sold stocks including VRE, FPT, STB, KDH, ClI, PVD, VCG, MSN, and HHS.

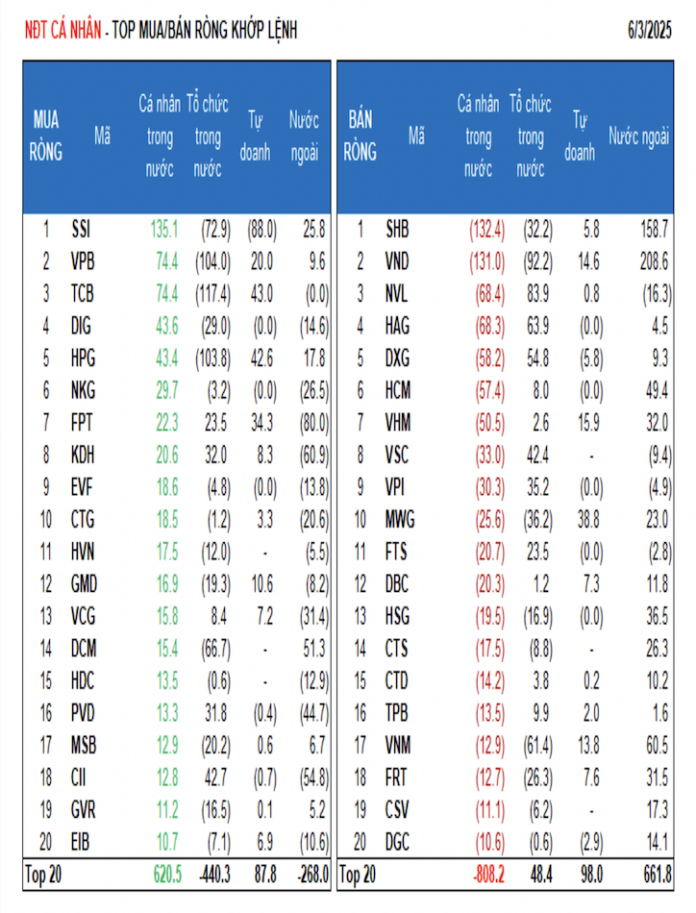

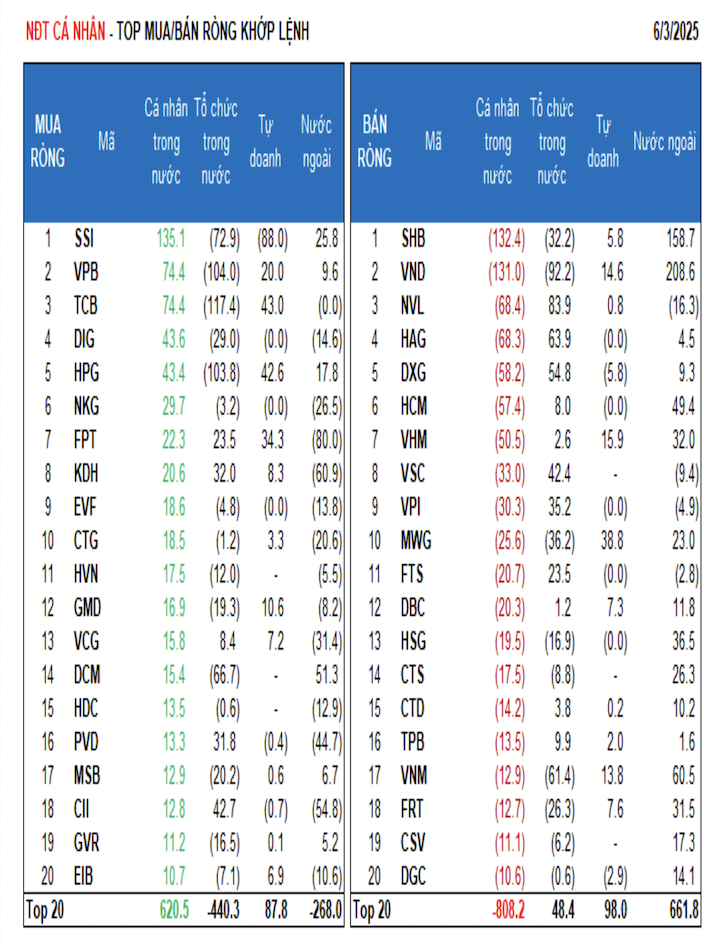

Individual investors posted a net sell figure of VND80.6 billion, including a net sell of VND238.1 billion in matched orders. In terms of matched orders, they net bought 8 out of 18 sectors, mainly Basic Resources. Their top net bought stocks included SSI, VPB, TCB, DIG, HPG, NKG, FPT, KDH, EVF, and CTG. On the net selling side, they offloaded 10 out of 18 sectors, primarily Real Estate and Financial Services. Top net sold stocks included SHB, VND, NVL, HAG, DXG, HCM, VSC, VPI, and MWG.

Proprietary trading arms of securities firms posted a net sell figure of VND419.9 billion, including a net buy of VND136.9 billion in matched orders. In terms of matched orders, they net bought 11 out of 18 sectors, with Banking and Basic Resources leading the way. Top net bought stocks included TCB, HPG, MWG, FPT, VIC, VPB, STB, VHM, VND, and VNM. On the net selling side, they offloaded Financial Services stocks, with top net sold stocks including SSI, VCI, NLG, MBB, VCB, PNJ, DXG, DGW, DGC, and DPM.

Local institutions posted a net sell figure of VND352.7 billion, including a net sell of VND363.6 billion in matched orders. In terms of matched orders, they net sold 11 out of 18 sectors, with Banking accounting for the largest value. Top net sold stocks included TCB, VPB, HPG, VND, SSI, VIC, DCM, VNM, MWG, and ACB. On the net buying side, they focused on Real Estate. Top net bought stocks included VRE, NVL, HAG, DXG, CII, VSC, HAH, STB, VPI, and KDH.

The value of negotiated transactions reached VND2,974.6 billion, up 24.4% from the previous session and contributing 10.2% to the total trading value. Today’s notable transactions included the sale of over 17.1 million GEX shares by local proprietary trading arms to local institutions and individual investors, worth VND581 billion.

Additionally, foreign institutions bought over 37.5 million APG shares (valued at VND412.6 billion) from local institutions and individual investors.

Cash flow allocation shifted towards Securities, Chemicals, Aquaculture & Seafood, and Electrical Equipment while decreasing in Real Estate, Banking, Construction, Retail, Oil & Gas, and Power Production & Distribution, and Personal Items.

In terms of matched orders, cash flow allocation increased in the mid-cap sector (VNMID) while decreasing in the large-cap (VN30) and small-cap (VNSML) sectors.

“MBS Director: Official Word on Tariffs Needed for Market Boom”

The stock market remains jittery over news of tariffs, trade tensions, monetary policy, and currency issues.

The Stock Market Boom: A Surge in Stock Prices

The VN-Index surged past 1340, thanks to a robust rebound from large-cap stocks, but the spotlight this morning belonged to the securities group. Dominating market liquidity, 5 out of the top 10 stocks traded were from the securities sector, and foreign investors’ net purchases also favored these securities stocks.

“VN-Index to Surpass 1,500 Points This Year: VNDirect Names 3 Stock Groups to Attract Investments”

“VNDirect anticipates that the downward trend of the DXY index, coupled with the potential upgrade of the Vietnamese market by FTSE in September, will serve as positive catalysts for the stock market in 2025. This upgrade has the potential to attract increased foreign investment and boost the country’s economic outlook, making it an opportune time for investors to capitalize on the market’s growth potential.”