Diversification Strategies

India, the world’s second-largest consumer of gold after China, has turned its “gold-hoarding culture” into a national financial strategy. Notably, the gold mobilization program encourages people to deposit their gold in banks to earn interest instead of keeping it idle. The Indian government also issues Sovereign Gold Bonds (SGBs). Citizens can invest in SGBs and receive a fixed interest rate, reducing gold import pressure and improving national gold management.

With a modest national gold reserve of approximately 200 tons compared to other powers, Singapore focuses on infrastructure and institution-building rather than reserves. To execute this strategy, the Singaporean government offers legal incentives such as VAT exemption on investment gold and stringent privacy and transparency standards. Additionally, Singapore boasts modern storage infrastructure, with gold vaults located in tax-free zones, operated by reputable international organizations like Le Freeport and Malca-Amit.

Singapore’s gold storage infrastructure

Geographically positioned among major gold-consuming markets (China, India, and Southeast Asia), Singapore maintains a neutral stance in Western-Chinese tensions, earning the trust of the ultra-wealthy and banks for gold deposits. Singapore also plans to promote gold-related financial products, such as ETFs.

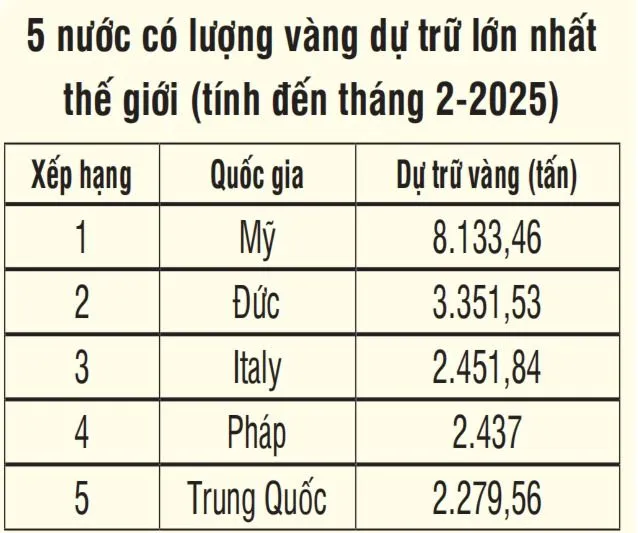

Germany, the second-largest gold reserve holder after the US, views gold as pivotal to its financial stability strategy. This stems from its history of hyperinflation during the Weimar Republic and post-World War II. A unique aspect of Germany’s gold strategy is its decision to repatriate its gold. For decades, most of Germany’s gold was stored in the vaults of the US (New York), UK (London), and France (Paris), facilitating financial transactions during the Cold War.

However, since 2013, the German Central Bank (Bundesbank) has been implementing a plan to bring most of this gold back to Frankfurt. Germany does not use gold as a tool for geopolitical confrontation or EUR internationalization. Instead, its strategy is defensive, safeguarding financial credibility, social stability, and trust in its monetary policy.

Flexibility and Strategic Vision

Over the past two decades, China has implemented policies to control its domestic gold market while promoting gold as a financial instrument. One of its most significant moves was establishing the Shanghai Gold Exchange (SGE), the first platform in China to allow transparent market-price gold transactions for institutions and individuals, breaking free from previous rigid controls.

Shanghai Gold Exchange

China has also expanded gold import rights to more commercial banks, albeit under the tight control of the People’s Bank of China (PBoC). This approach enhances the domestic market’s flexibility in accessing international gold supplies and reduces pressure on state reserves. China has vigorously developed a gold-based financial ecosystem, including gold certificates, gold futures contracts, and personal gold savings accounts.

In its foreign strategy, China actively pursues gold acquisition with three strategic objectives. First, reducing USD dependence: Gold carries no credit risk, is unaffected by Fed policies, and cannot be frozen like government bonds. Amidst rising tensions with the US, gold becomes a firewall protecting national assets.

Second, gold supports the internationalization of the RMB, bolstering confidence in cross-border RMB transactions, especially with emerging or non-Western-aligned nations. Third, it counters systemic risks and safeguards against severe financial sanctions, as seen with Russia, where foreign reserve asset freezes dealt the heaviest blow. China also encourages its citizens and commercial banks to hold gold, forming a domestic “gold belt.”