In its recently published analysis report, Vietcombank Securities (VCBS) forecasts that Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) will continue to achieve impressive profit growth in 2025, driven by positive credit growth and a rebound in non-interest income.

VCBS anticipates that HDBank’s credit growth will surpass the industry average in 2025, reaching 31.2%. This growth will be primarily driven by the bank’s strong lending capabilities, increased public investment projects, and a recovering real estate market.

HDBank’s home loan segment is expected to perform well, considering the limited new supply in the southern region and anticipated improvements in the real estate market due to regulatory adjustments and legal frameworks. Additionally, the bank’s strategic initiatives, including discounts, promotions, interest rate support, and enhanced benefits for young customers, will further boost credit growth in this sector, along with the revival of construction and renovation activities for business purposes.

HDBank’s strategy focuses on developing a versatile bank that finances key sectors of the economy, such as infrastructure, transportation, power, energy, and logistics. The bank also emphasizes secured business lending, especially to small and medium-sized enterprises (SMEs), supply chain and value chain financing, key public investment projects and green credit, and housing loans, particularly for young customers and social housing. HDBank also offers investment banking services and new products such as custody and financial leasing.

In terms of growth opportunities, at the beginning of 2025, the Government and the State Bank of Vietnam demonstrated their trust in HDBank by selecting it to acquire DongA Bank. This decision provides a basis for the bank to receive a higher credit limit compared to the industry average.

HDBank’s official acquisition of DongA Bank and its transformation into Vikki Digital Bank mark a significant step forward in the bank’s digitalization and brand repositioning strategy. This transition is more than just a technical restructuring; it ushers in a new phase of development for HDBank, providing an independent foundation to accelerate its comprehensive digital banking model.

Vikki Digital Bank is positioned as a next-generation digital bank, catering to young, dynamic customers who value personalized and flexible financial services. With a mission to promote inclusive digital finance, Vikki not only expands access to banking services but also contributes to the development of a smart digital ecosystem that meets the diverse needs of users in the digital era.

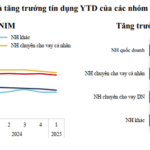

In its updated report, VCBS expects the pressure on HDBank’s net interest margin (NIM) in 2025 to be lower than the industry average. This is attributed to the bank’s lower loan-to-deposit ratio (LDR) and short-term capital for medium and long-term loans, combined with continued improvement in CASA, which will drive down the bank’s funding costs.

According to VCBS, the industry’s LDR has been gradually increasing in recent years, indicating that credit expansion has outpaced capital mobilization. This trend could pose liquidity challenges, especially in a volatile interest rate environment. In contrast, HDBank’s LDR is currently at a moderate level (71% as of Q1/2025), and its short-term capital for medium and long-term loans stood at 20.6% as of Q1/2025.

“Therefore, we believe that HDBank still has room to increase short-term, low-cost deposits and/or medium and long-term loans to improve its NIM compared to the industry average,” the VCBS report said.

The analytics team also noted that by strengthening chain financing, HDBank could improve its current account savings account (CASA) ratio. The large ecosystem of customers through Vietjet, Vinamilk, and Petrolimex enterprises also enables the bank to offer diverse financial products and services.

“We believe that HDBank’s NIM level in 2025 may slightly decrease compared to 2024, but the downward pressure will be lower than the industry average for private banks, estimated at 5.04% for the whole of 2025,” VCBS forecasted.

Additionally, VCBS assessed that the direct impact of US tariff policies would not be significant, as the proportion of loans to customers directly exporting to the US market accounts for less than 1.5% of HDBank’s total outstanding loans. Moreover, favorable developments in the negotiation process between the US and Vietnam have helped mitigate risks associated with tariff policies.

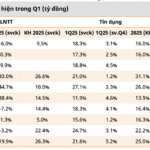

Based on these assessments, VCBS estimates that HDBank’s pre-tax profit for 2025 will reach VND 20,781 billion, representing a 24.2% increase compared to the performance in 2024, with expected credit growth of 31.15%.

Sharing a similar outlook, Shinhan Vietnam Securities (SSB) believes that HDBank can maintain its positive growth trajectory in the coming years and achieve a pre-tax profit of over VND 20,000 billion in 2025.

According to SSB, HDBank has a strategy focused on versatile retail banking, targeting small and medium-sized enterprises and customers in second-tier cities and rural areas by developing specialized digital financial products and services tailored to their needs. This targeted approach is evident in the bank’s impressive performance, with asset and profit growth exceeding 25% annually during the 2019-2023 period.

Assuming credit growth of over 20% for 2025, with growth drivers evenly distributed between corporate and individual customers, SSB projects HDBank’s pre-tax profit for 2025 to reach VND 20,963 billion, a 25% increase compared to 2024. Additionally, the expected decision to increase the foreign ownership limit to 49% for banks under mandatory transfer will create more favorable conditions for HDBank to attract foreign investment.

In another positive development, on May 29, Moody’s upgraded HDBank’s credit rating to Ba3, placing it on par with VPBank and Techcombank. This upgrade recognizes the bank’s enhanced financial strength and governance capabilities.

The Power of Persuasive Writing: Crafting Compelling Copy for Business Loans

The corporate lending arm of the banking group has experienced robust growth in the past two years, with impressive returns on equity as credit shifted towards business loans. However, the first-quarter results indicate a challenging year ahead for these banks to sustain growth and maintain their NIM at a similar level.

A Brokerage Firm Lowers Profit Forecast for Banking Sector in 2025, Now Projected at 14% Growth

The securities firm has downgraded its profit growth forecast for the banks under its coverage, lowering its projection from the previous range of 15-17% to below 14% as adverse factors continue to mount.

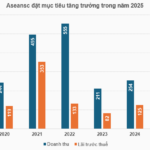

Aseansc Aims for Over $13 Billion in Profits in 2025, Elects Two New Board Members

The annual general meeting (AGM) of Asean Securities Joint Stock Company (Aseansc) unveiled ambitious plans for the year 2025. The Board of Directors proposes to achieve a revenue of VND 323 billion and a pre-tax profit of VND 131 billion, marking a significant 27% and 5% increase, respectively, from the previous year’s performance. To ensure a complete board, the assembly will also elect two new members to the Board of Directors, filling vacancies from expiring terms.

Digital Financial Solutions: OCB’s Revolutionary Approach at the 2025 Banking Industry Digital Transformation Event

“Oriental Commercial Joint Stock Bank, widely known as OCB, revolutionized the ‘Banking Industry Digital Transformation Event 2025’ with an array of superior digital products, thereby crafting an all-encompassing financial ecosystem. “