Hòa Phát Group’s Prospect Report (Code: HPG) by Vietcombank Securities (VCBS Research) recently stated that the company’s primary growth driver comes from the domestic market.

Domestic Market as the Main Growth Driver

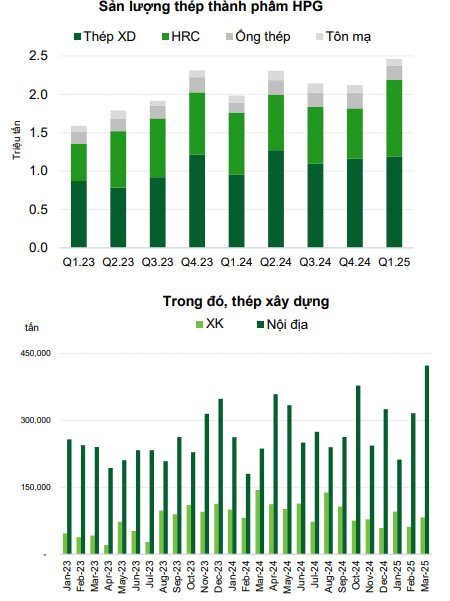

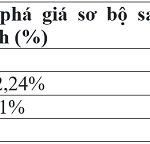

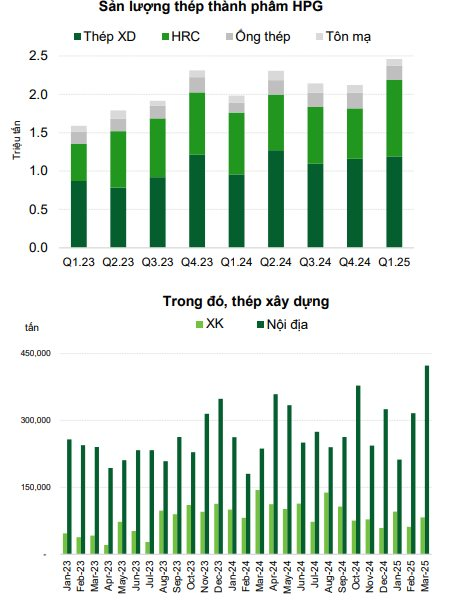

As of March 7, 2025, the anti-dumping duty on HRC steel (AD20 case) officially took effect with a duration of 120 days. In March 2025 alone, HPG’s consumption volume surged by 23% year-on-year to nearly 994,000 tons, mainly driven by a remarkable 85% increase in the domestic market, while exports decreased by 64% over the same period.

According to VCBS, only HPG and Formosa Ha Tinh (FHS) produce HRC products in Vietnam, with a total domestic consumption of 6.5 million tons and exports of 2.7 million tons in 2024. HPG holds a 44% market share, while FHS accounts for the remaining 56%, with a higher market share in both domestic sales and exports.

VCBS expects that HPG and FHS will benefit from Vietnam’s protective tariffs on HRC. Additionally, with FHS currently operating at 70% of its designed capacity, there is room for further expansion of approximately 1.5 million tons. VCBS Research anticipates that the anti-dumping duty on imported HRC from China, which is expected to be officially announced in July 2025, will remain unchanged from the temporary rate to support domestic production.

This will allow HPG to capitalize on the shift in HRC demand towards the domestic market, especially as imports from China (approximately 4-6 million tons per year) are projected to decline in the coming period.

In addition to the positive news on anti-dumping duties, Hoa Phat also received good news about the Dung Quat 2 plant, which began operations with a designed capacity of 2.8 million tons for 2025 and is expected to double to 5.6 million tons in 2026. The sales volume of HRC from Dung Quat 2 Phase 1 has been recorded since March 2025, with an estimated sales volume of 84% of the plant’s capacity. The output of Phase 1 will be mainly reflected in the second quarter of 2025.

Furthermore, the VCBS analysis team expects Hoa Phat’s production volume to increase due to infrastructure and transportation construction projects, as well as the government’s boost in public investment and rising demand for civil construction.

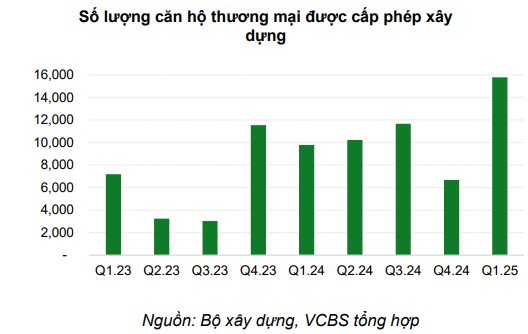

In April 2025, Hanoi issued Resolution No. 30, approving a list of 148 land plots with a total area of 840 hectares for pilot real estate projects in the area, aiming to remove legal obstacles and pave the way for the recovery of the civil real estate sector. According to the Ministry of Construction, the number of commercial apartments licensed for construction also shows significant improvement.

Challenges and Opportunities in the Export Market

For the export market, the analysis team expects 2025 to be a year of mixed opportunities and challenges. While the performance of HPG’s construction steel and HRC products is anticipated to be positive, the outlook for coated steel and steel pipes is less favorable. VCBS projects the ratio of output for the domestic and export markets in 2025-2026 to be 84/16 and 86/14, respectively.

Specifically, in the US market, the additional 25% tax imposed on steel imports (including CORE steel products) took effect on March 4, 2025, following the initial order in 2018, which excluded certain countries like Canada, Mexico, the EU, Japan, South Korea, Taiwan, Brazil, and Ukraine. This provides an opportunity for Vietnam to enhance its competitive advantage when exporting steel to the US market. From May 5, 2025, HPG can export steel pipes to the US market without being subject to anti-dumping duties by obtaining a certificate of origin for using Vietnamese-origin HRC. This facilitates HPG’s promotion of steel pipe exports to the US and allows domestic coated steel manufacturers using HPG’s HRC to be exempt from the above-mentioned anti-dumping duties.

Regarding the EU market, on April 7, the EU announced preliminary anti-dumping duties on imported HRC, with HPG’s competitor, FHS, facing a 12.1% duty, while HPG was exempted. Other countries, such as Japan (6.9%-33%), Egypt (15.6%), and India, were also granted temporary duty exemptions. The official duty rates are expected to be published on October 7, 2025.

In 2024, the EU imported approximately 10.8 million tons of HRC, of which Vietnam accounted for about 10%. According to VCBS, this presents an opportunity for HPG to export HRC to the EU market in the future, as competitors like FHS and other countries face higher duty rates.

Based on the above analysis, VCBS forecasts a 28% year-on-year growth in Hoa Phat’s revenue in 2025, reaching VND 178,041 billion (a record high). This growth is mainly attributed to a 30% increase in the steel segment. Specifically, construction steel volume is expected to rise by 9.4% due to robust public investment demand, while HRC volume is projected to increase by 55.4% due to the efficient utilization of Dung Quat 1+2 plants, reaching 78% of their designed capacity. For steel pipes and coated steel, VCBS forecasts growth of 13.9% and 3.4%, respectively.

The U.S. Imposes Temporary Anti-Dumping Duties on Vietnamese Hard Capsule Shells

The U.S. Department of Commerce (DOC) has announced its preliminary decision to impose a countervailing duty of 8.35% on imports of certain products from Vietnam. In this case, the DOC selected one mandatory respondent, and as a result, the margin of dumping determined for the mandatory respondent will be applied to all other producers and exporters in Vietnam.

The Heat is On: Vietnam’s Hot-Rolled Coil Steel Production Faces a Double Whammy

The domestic steel industry is facing a formidable challenge. Not only are they struggling to compete with the influx of cheap imported hot-rolled steel coils, but they are also now at risk of being investigated for dumping by their export markets. This puts them in a precarious position, as they navigate the delicate balance between staying competitive and avoiding potential trade sanctions.