Jardine Matheson: The Conglomerate Behind Strategic Investments in Vietnam

In a recent development, Tran Ba Duong, Chairman of the Board of THACO, mentioned the sale of shares in THACO and its member companies to raise capital for the high-speed rail project. THACO aims to increase its capital by selling stakes to other investors, with Tran Ba Duong and his family retaining 51% ownership.

According to THACO, the group signed an agreement with Jardine Cycle & Carriage Limited (JC&C) on October 31, 2023, to facilitate this capital increase, with JC&C agreeing to purchase shares at a price equivalent to 20 times THACO’s consolidated profit in 2027.

JC&C, a long-standing partner of THACO since its investment in 2008, currently holding 26.6% of the shares, will play a crucial role in providing the necessary finances for THACO’s high-speed rail project, should it be approved. In February 2019, when JC&C acquired a significant number of THACO shares, they valued the company at a staggering $9.4 billion. Furthermore, at the end of 2023, JC&C also purchased THACO-issued bonds worth VND 8,680 billion.

A Brief History of Jardine Matheson

Jardine Matheson, the parent company of JC&C, is a nearly 200-year-old conglomerate headquartered in Hong Kong, with a diverse range of investments in Vietnam. Founded in 1832 by two Scottish businessmen, William Jardine and James Matheson, the company moved its headquarters to Hong Kong in 1842 when the region was ceded to the British. Interestingly, Jardine Matheson was responsible for constructing China’s first railway during the Qing dynasty, the Shanghai-Woosung line, which was completed in 1876. They also built the Shanghai-Nanking line between 1904 and 1908.

JC&C’s Strategic Investments in ASEAN and Vietnam

JC&C has been instrumental in executing Jardine Matheson’s financial investments in Vietnam. The company was a significant shareholder in ACB for several years, divesting in late 2017. In addition to their investment in THACO, JC&C currently holds a 41.4% stake in REE and a 10.6% stake in Vinamilk, two listed companies with a combined investment value of over VND 27,000 billion.

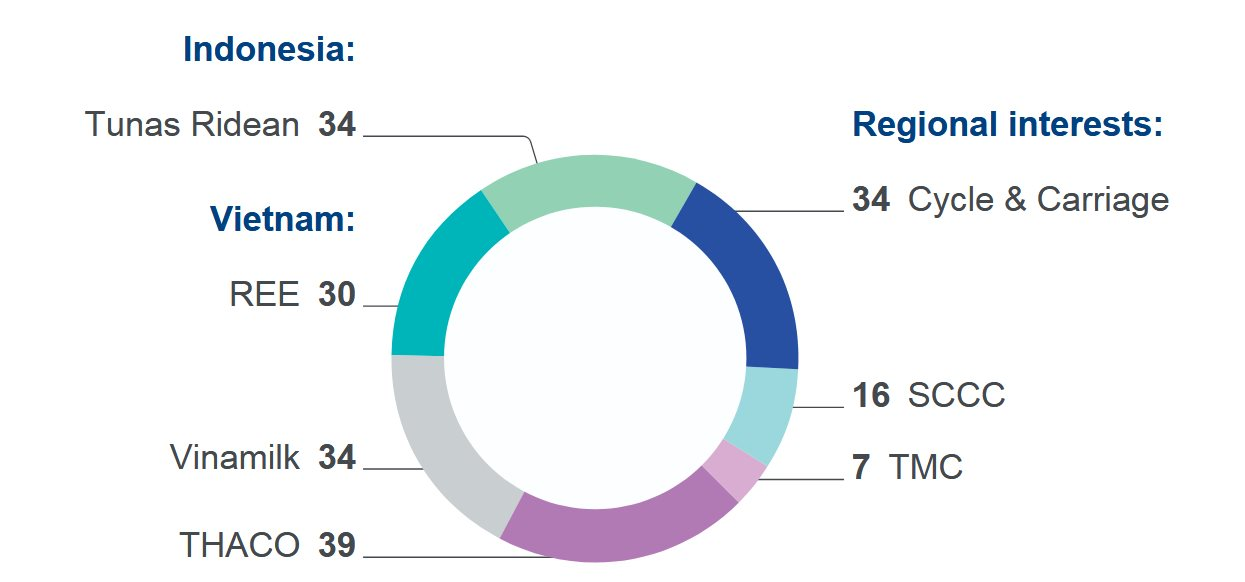

According to Jardine Matheson’s 2024 annual report on JC&C’s operations, the underlying net profit reached $194 million. Notably, Vietnamese companies in which JC&C holds stakes made the highest contributions, with THACO leading at $39 million, followed by Vinamilk at $34 million, and REE at $30 million. JC&C attributed THACO’s growth to improved performance in the automotive sector, benefiting from a 50% reduction in registration fees for domestically produced and assembled vehicles.

THACO’s revenue and after-tax profit for 2024 were reported as $2.92 billion and $152 million, respectively.

Jardine Matheson’s Diverse Investments in Vietnam

Jardine Matheson’s investments in Vietnam extend beyond listed companies. In Hanoi, the group owns two of the city’s most prestigious office buildings: 63 Ly Thai To, opposite the Opera House, and Central Building, located at the intersection of Hai Ba Trung and Ba Trieu streets. These properties are managed by Hongkong Land, their real estate subsidiary.

Hongkong Land re-entered the Vietnamese market in 2015, partnering with Son Kim Land to develop The Nassim, a premium project in District 2, Ho Chi Minh City. They are also involved in projects in the Thu Thiem New Urban Area.

Another notable presence in Vietnam is Jardine Schindler Group, a joint venture between Jardine Matheson and Schindler, which is one of the largest providers of elevators and escalators in the country. They have been partners in several high-end real estate projects, including VietinBank Tower, Thang Long Number One Apartment Building, Lotte Center Liễu Giai, and Vinhomes Central Park.

Jardine Matheson’s Ventures in the F&B Sector

Jardine Matheson has a foothold in Vietnam’s F&B sector through its partnership with Bầu Kiên, holding a 25% stake in KFC Vietnam via Jardine Restaurant Group (JRG). JRG also holds the franchise rights for Pizza Hut in the country. Additionally, through its association with Maxim’s Caterers, a subsidiary of Dairy Farm, Jardine Matheson is involved in bringing the Starbucks brand to Vietnam, along with other markets in the region.

In the realm of retail, Jardine Matheson’s subsidiary, Dairy Farm, operates Guardian, a prominent health and beauty care chain with over 500 brands and 99 stores across major cities in Vietnam, as well as the Giant supermarket chain.

Recall Alert: 294 Cosmetic Products Recalled, Including Popular Brands Like Oxy, Pantene, Biore, and More.

The Ministry of Health has taken decisive action by revoking 294 cosmetic product registration certificates from seven businesses. This bold move impacts a wide range of well-known products that were commonly consumed in Vietnam through either imported or official distribution channels.

Mr. Pham Anh Tuan: Nearly 86 Million Accounts “Wiped Out” Post-Biometric Authentication

“Prior to the implementation of the new authentication requirements by the State Bank of Vietnam, the country boasted an impressive 200 million bank accounts. However, once the new biometric verification process was enforced, the number of active accounts stood at 113 million individual accounts and over 711,000 organizational accounts. These are the accounts that have successfully undergone the rigorous process of biometric data verification, ensuring the integrity and security of Vietnam’s national population database.”

The Ultimate Guide to the Bien Hoa – Vung Tau Expressway: Unveiling the Transformation After Two Years of Construction in Dong Nai

After almost two years of construction, the Bien Hoa – Vung Tau expressway, spanning through Dong Nai province, has witnessed significant progress with asphalt paving completed on numerous sections and nearly 100% of the required land area cleared.