Hoà Phát Group Joint Stock Company (code: HPG-HOSE) announces the record date for shareholders to receive dividends in shares.

Accordingly, HPG plans to issue approximately 1.28 billion new shares, equivalent to an issuance value of VND 12,793 billion at a ratio of 20% (holding 10 shares will receive 02 new shares). The source of funding for this issuance is from undistributed post-tax profits as per the 2024 audited financial statements.

The record date is June 27, and the ex-dividend date is June 26. After this issuance, Hòa Phát’s charter capital will increase to VND 76,755 billion.

This issuance plan replaces the previous proposal of a 5% cash dividend and a 15% stock dividend, which was put forward in late March 2025.

The reason for paying dividends entirely in shares is to ensure the safety of cash flow with a defensive strategy amid global uncertainties, especially the US tax policy.

According to the 2024 management report, Mr. Tran Dinh Long holds 1.65 billion HPG shares, equivalent to a holding ratio of 25.8%, making him the largest shareholder. Mr. Long’s wife, Ms. Vu Thi Hien, holds 440 million HPG shares, equivalent to 6.88% of capital. His son, Tran Vu Minh, holds nearly 147 million HPG shares (2.3% of capital). Tran Vu Minh’s company, Dai Phong Trading and Investment Company, holds 3 million HPG shares (0.05%). In addition, Mr. Long’s four siblings hold a total of nearly 2.9 million shares (0.05%).

Thus, the total holding ratio of Mr. Tran Dinh Long and related shareholders is over 35%. With this ratio, Mr. Long and related shareholders will receive approximately 448 million HPG shares in the upcoming issuance.

On May 14, Mr. Nguyen Ngoc Quang, a member of the Board of Directors, successfully sold 8.5 million HPG shares through a matched transaction. After this transaction, Mr. Quang’s holding decreased to 104.571 million shares, equivalent to a holding ratio of 1.63%.

Also, on May 14, Mr. Nguyen Quang Minh, son of Mr. Quang, received 5.5 million HAG shares from his father. Following this transaction, Mr. Minh holds 5.5 million shares, representing a 0.09% stake in HAG.

Previously, HAG announced that from May 5, 2025, Hòa Phát is permitted to export steel pipe products (LWRPT) to the US market and perform self-certification of origin without being subject to anti-dumping taxes.

According to HPG, this achievement stems from Hòa Phát successfully proving that the source of the base steel used to produce steel pipes exported to the US is from Vietnam.

This information is per the final conclusion of the US Department of Commerce (DOC) in its administrative review of the anti-dumping (AD) and countervailing duty (CVD) investigations on steel pipes (LWRPT) from China imported into the US.

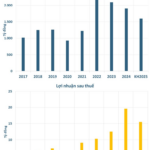

In terms of business results, in Q1/2025, Hòa Phát recorded over VND 37,900 billion in revenue and VND 3,300 billion in after-tax profit, up 22% and 16%, respectively, compared to the same period in 2024. Thus, HPG has fulfilled approximately 22% of its full-year revenue plan and 22% of its full-year profit plan.

Also, in Q1/2025, HPG produced 2.66 million tons of crude steel, up 25% over the same period. Sales volume of hot-rolled steel coils, high-quality steel, construction steel, and steel billets reached 2.38 million tons, up 29% compared to Q1/2024.

The Investment in Cho Ray Phnom Penh Hospital Helps Tan Binh Real Estate Escape Losses

Despite hitting rock bottom in terms of revenue and significant provisions for doubtful debts, Tanbinh Real Estate JSC (TanbinhRes) managed to stay in the black in 2024. This was made possible by a reversal of nearly VND 24 billion from their indirect investment in Cho Ray Phnom Penh Hospital.

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.