VCG remains a promising prospect with a target price of 26,400 VND per share

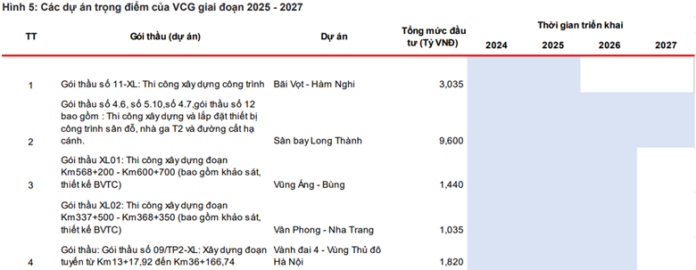

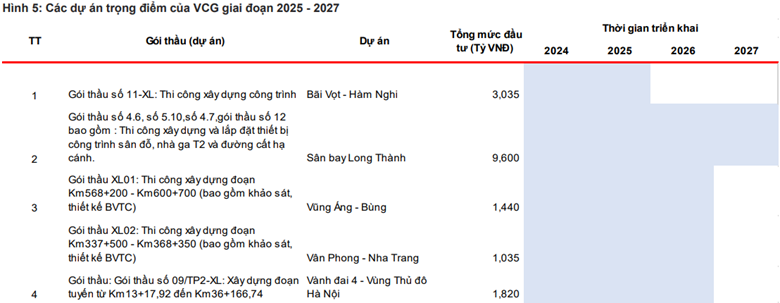

MBS Securities (MBS) maintains a positive outlook for Vietnam Construction and Import-Export JSC (HOSE: VCG) amidst the government’s push for public investment projects. VCG’s backlog is forecasted to grow by 6% in 2025, reaching 20,200 billion VND, as they secure contracts for projects like the Nam Dinh – Thai Binh expressway and packages in the Long Thanh airport.

With experience in the North-South expressway component projects, VCG is well-positioned to win more public investment contracts, aligning with the government’s long-term goal of completing 3,000 km of expressways by 2030. Looking ahead to 2026, MBS predicts a 5% increase in backlog to 21,600 billion VND, including projects like the Hanoi Ring Road 4.

Discussions with construction enterprises reveal expectations for improved gross profit margins starting in 2025, as winning bid prices are higher, and enterprises no longer need to reduce 5% of the value through the designated bidding method used in previous years. However, as bid prices didn’t meet expectations, MBS adjusted the 2025 gross profit margin down by about 1%, resulting in a 4% margin for 2025 and a slight improvement to 4.2% in 2026.

Source: MBS

|

VCG’s real estate segment revenue for 2025 is projected at 2,274 billion VND, an impressive 118% increase from the previous year, driven by the handover of the Cho Mo project and a few products at Green Diamond. In 2026, with contributions from the Cat Ba Amatina project, real estate segment revenue is expected to reach 3,281 billion VND, marking a 44% year-over-year increase.

Specifically, in 2025, pre-sale revenue in the real estate segment is anticipated to come from the Cho Mo and Cat Ba Amatina projects. MBS adjusted the 2025 pre-sale forecast down by about 8% from the previous estimate due to the delayed launch of the Cat Ba project. Pre-sale revenue is expected to reach 1,000 billion VND, an 11% increase, mainly driven by the Cho Mo project. In 2026, with expectations that Cat Ba Amatina will benefit from accelerated infrastructure development, pre-sale revenue is projected to reach 1,400 billion VND, a 40% increase.

MBS adjusted the gross profit margin for VCG’s real estate segment upward by 15 percentage points to 43% in 2025 due to the Cho Mo project’s more favorable gross margin. In 2026, the gross margin is expected to reach 46% with the launch of the Cat Ba project.

Regarding the hydropower segment, MBS forecasts a 3% growth in revenue in 2025, reaching 575 billion VND, as hydropower output is expected to be favorable. In 2026, with the potential return of La Nina, a 1% increase in revenue is anticipated.

VCG’s electricity output is projected to grow by 3% and 2%, reaching 550 and 560 million KWH, respectively, thanks to more favorable weather conditions and increased electricity consumption. According to EVN’s predictions, electricity demand could reach 342 billion KWH (a 10.5% increase) to meet economic development needs.

Selling prices at large hydropower plants are expected to remain stable at 900–1,000 VND per KWH, and VCG will benefit from EVN’s increased mobilization of hydropower due to its lower prices compared to small hydropower plants. Therefore, MBS forecasts a selling price of 970 VND per KWH (a 1% increase) for 2025, remaining stable for 2026.

In the water segment, thanks to increased output, revenue is expected to reach 1,100 billion VND in 2025. In 2026, with improved selling prices and output, revenue is projected to grow by 8%.

Specifically, in 2025, MBS forecasts a 5% increase in water output to 87 million cubic meters to meet favorable consumption needs, supporting an 8% GRDP growth. In 2026, output is expected to increase slightly by 2%.

According to the Hanoi People’s Committee, Viwaco’s retail water price will remain unchanged at 8,500 VND per cubic meter in 2025. In 2026, the price is expected to increase by 6% (in line with the 2021-2023 period), and output is projected to reach 13 million cubic meters, a 3% increase.

Overall, thanks to the improved performance in the construction and real estate segments, MBS maintains a positive outlook on VCG with a target price of 26,400 VND per share.

See more here

PLX remains attractive with a target price of 38,000 VND per share

ACB Securities (ACBS) reported that Vietnam Oil and Gas Group (HOSE: PLX) released its Q1/2025 financial statements, showing a 9.6% decrease in revenue to 67,861 billion VND and a significant 81.3% drop in after-tax profit to 211 billion VND compared to the same period last year. Despite a 3.4% increase in domestic consumption volume, the decrease in revenue and profit was due to an 8.7% decline in Brent oil prices during the same period.

The lower oil prices negatively impacted PLX’s inventory value, as the company maintains a 20-day inventory while retail fuel prices are adjusted every 7 days according to Decree 80/2023/ND-CP. Consequently, the gross profit margin decreased to 5.5% from 6.2% in the previous year, despite positive adjustments in the cost formula for calculating fuel prices since July 2024, with RON95 increasing by 5.6% and diesel by 13.6% compared to the previous adjustment.

Additionally, the decrease in profit margin resulted from an estimated 9% drop in fuel selling prices. Selling and management expenses increased by 5.3%, mainly due to higher personnel costs and depreciation. The ratio of these expenses to revenue also increased to 5.3% from 4.6% in the previous year.

However, after-tax profit was positively impacted by a 70% increase in financial income, reaching 128 billion VND. Financial expenses decreased by 21.7% due to lower interest expenses and foreign exchange losses.

The sixth draft of the Decree on Trading in Petroleum Products, recently submitted by the Ministry of Industry and Trade to the government (April 2025), includes the following key points: Market-based pricing mechanism: Petroleum business enterprises and traders will independently calculate and announce wholesale and retail fuel prices within their distribution system. The government will not set a base price as currently but will only intervene according to the Price Law to stabilize the market when there is a declaration of emergency, accident, disaster, epidemic, or abnormal fluctuations in the market price of petroleum products. Traders are allowed to buy and sell petroleum products among themselves, instead of only buying from petroleum business enterprises as in previous drafts.

If approved, the new decree is expected to positively impact PLX’s business results (from 2026) as large petroleum business enterprises like PLX are granted more autonomy. However, this draft is facing mixed reactions from economic experts and small distribution enterprises. Therefore, ACBS has not yet reflected the impact of this policy in its valuation model.

Regarding oil price forecasts, ACBS has lowered its projection for the average Brent oil price for the year to USD 68 per barrel due to the adverse effects of countervailing tax policies implemented by President Donald Trump and OPEC’s faster-than-expected increase in production volume.

In April and May 2025, oil prices dropped significantly (from USD 74.4 per barrel at the end of March 2025 to the USD 63-65 range), suggesting that Q2 results are unlikely to show improvement. With oil prices potentially stabilizing and becoming more positive after the impact of US countervailing tax policies subsides, ACBS expects PLX’s business results to improve in Q3 and Q4.

Accordingly, ACBS forecasts PLX’s 2025 business results to include revenue of 254.6 trillion VND (a 10.4% decrease) and after-tax profit of 2,405 billion VND (a 23.9% decrease).

Using the discounted cash flow (DCF) method, ACBS maintains a positive outlook on PLX with a target price of 38,000 VND per share.

See more here

PVS remains promising with a target price of 33,000 VND per share

SSI Research assesses that the EPC segment of Vietnam Oil and Gas Technical Services Corporation (HNX: PVS) achieved impressive growth of 122% in Q1/2025, benefiting from significant projects (such as the upstream Lot B project and Orsted’s wind farm project) and improved profit margins. Notably, PVS boasts a substantial backlog of USD 2.5 billion and is poised to secure additional contracts worth USD 400 million in the short term, expected from a domestic oil and gas project.

SSI Research shares that PVS’s management remains optimistic about the company’s short-term prospects, as conveyed during an analyst meeting, backed by a substantial backlog from large projects and potential business development opportunities.

However, profit margins remain under pressure as the company plans to invest significant capital in the coming years. This strategic move will strengthen its core business capabilities and prepare PVS for new business areas, including nuclear power, CCS, and wind power export projects, among others.

Consequently, SSI Research has adjusted its profit margin assumptions for the 2025–2027 period downward (from 2.5% to 1.2%) for the EPC/EPCI segment.

|

PVS’s Projected Business Results

|

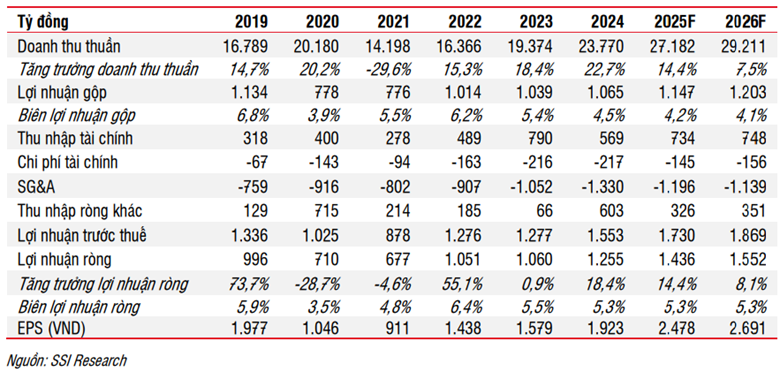

SSI Research estimates that consolidated revenue for 2025 and 2026 will increase by 14.4% and 7.5%, respectively, driven by significant projects. EPS for 2025 and 2026 is projected to reach 2,478 VND and 2,691 VND, equivalent to growth rates of 14% and 8%, respectively.

Currently, PVS is trading at projected P/E and P/B ratios of 11x and 0.9x for 2025, respectively, which are relatively low compared to its historical range (P/E of 9x–30x and P/B of 0.7x–1.1x). Based on the discounted cash flow (DCF) valuation method and relative valuation, SSI Research sets a one-year target price of 33,000 VND per share, implying a 22.7% upside potential, and maintains a positive outlook on PVS shares.

SSI Research perceives limited downside risk due to the current P/B of 0.9x and a net cash (cash minus short-term and long-term debt) position of 29,850 VND per share in 2025. Potential catalysts include better-than-expected short-term profit results, announcements of new EPC contract wins, and news about business expansion into new areas.

See more here

Expanding Phu Quoc Airport: Government Tasks Kien Giang Province to Select Investors

The Vietnamese government has entrusted the People’s Committee of Kien Giang province with a pivotal task: to select a capable domestic investor and spearhead the expansion of Phu Quoc International Airport. This project underscores the airport’s dual civilian and military significance, necessitating a meticulous and tailored approach to ensure a seamless blend of functionality and strategic requirements.

Building a 140km-plus Expressway Linking Binh Thuan, Lam Dong, and Dak Nong

The proposed investment in a highway connecting the three provinces of Binh Thuan, Lam Dong, and Dak Nong is an ambitious project. With an approximate length of 140.6 km, this highway will be a significant infrastructure development in the region. The route is designed to traverse through breathtaking landscapes, connecting communities and fostering economic growth. The Binh Thuan province will boast a 43.9-km stretch of this highway, while Lam Dong and Dak Nong will be graced with 61.9 km and 34.8 km of this road, respectively. This highway promises to be a game-changer for the region, offering a faster and more efficient transportation network.

Can Surplus Office Spaces Post-Merger be Transformed into Social Housing?

Amid challenges in developing social housing across the country, the Land Management Authority has proposed an innovative solution. They suggest repurposing surplus government offices, resulting from mergers, into social housing. This proposal offers a potential win-win situation by addressing the need for social housing while making efficient use of existing resources.