According to documents prepared for the upcoming Annual General Meeting to be held on June 20th in Ho Chi Minh City, SGN has set a consolidated revenue target of VND 1,392 billion for 2025, an 11% decrease from the previous year. More notably, net profit is forecasted to reach only VND 159 billion, a significant 41% drop compared to 2024.

This conservative business plan comes on the heels of SGN no longer providing ground handling services to Vietjet at Tan Son Nhat Airport since April 2025. According to the first-quarter financial report for 2025, this low-cost carrier contributed a substantial 38% to SGN‘s total revenue.

Beyond the loss of a major client, SGN‘s management also acknowledges the ongoing challenges faced by the tourism and aviation industries. Volatile oil and jet fuel prices are driving up operating costs, which directly impact ticket prices and, consequently, dampen passenger demand.

Global economic and political tensions continue to disrupt supply chains, affecting the overall business operations in these sectors. Additionally, the robust development of road transportation networks is reducing the reliance on domestic air travel—a trend that works against airport service companies like SGN.

Other macroeconomic factors, such as new US tax policies and foreign exchange rate fluctuations, are also viewed as direct risks to SGN‘s financial performance.

On a positive note, SGN‘s operations at Danang and Cam Ranh airports have remained stable during the first quarter of 2025.

Looking Ahead: The Long Thanh Airport Factor

Despite the short-term challenges, SGN remains optimistic about its future prospects, particularly with the upcoming opening of the Long Thanh International Airport. This new airport is expected to handle up to 80% of international flights currently operating at Tan Son Nhat Airport, presenting significant growth opportunities for SGN.

In preparation for this new phase, the Saigon – Long Thanh Ground Services Company, a joint venture between SAGS (75%) and HGS (25%), has recently commenced construction on a project to provide maintenance services for aircraft and ground support equipment at Long Thanh Airport.

Vietnam Airlines and the SAGS-HGS joint venture kick-start a major project at Long Thanh Airport

With its larger scale, Long Thanh Airport will offer more flight slots and accommodate a far greater number of flights compared to Tan Son Nhat Airport. This translates to SGN‘s potential to serve more airlines and flights, thereby substantially boosting its revenue.

However, SGN‘s success at Long Thanh is not solely dependent on infrastructure expansion but also on Vietnam’s ability to attract and sustain a robust international tourist influx. Whether passenger numbers will indeed surge with the airport’s opening in 2026 remains a critical question, and SGN‘s future prospects are intimately tied to this factor.

“The Long Thanh Airport will determine the Company’s survival in the coming years,” remarked Dang Tuan Tu, former Chairman of SGN, at the 2024 Annual General Meeting.

– 15:08 02/06/2025

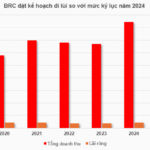

Why is Ben Thanh Rubber Moving Backward with its Business Plan?

At the 2025 Annual General Meeting held on May 30, the management of Ben Thanh Rubber Joint Stock Company (HOSE: BRC) shared insights into the reasons behind their conservative business plan for the year ahead.

“HBC’s Q1 Net Profit Down Despite Reversal of VND 104 Billion Allowance for Doubtful Accounts”

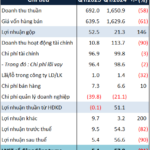

Despite a reinstatement of nearly VND 40 billion in management expenses, the Q1 2025 net profit of Hoa Binh Construction Group Joint Stock Company (UPCoM: HBC) witnessed a staggering 91% decline year-over-year.

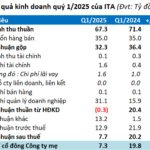

“ITA Turns a Profit with Alternative Income Streams, Points Finger at HOSE and SSC”

In the first quarter of 2025, Tan Tao Investment and Industry Corporation (UPCoM: ITA) managed to escape losses thanks to income from other sources, even as its core business operations continued to lag. This performance underscores the mounting challenge of achieving the company’s full-year profit target of VND 234 billion.