This was shared by Mr. Tran Hoang Son, Director of Securities Market Strategy at VPBank (VPBanks) on the Vietnam and its indexes show on June 02, 2025.

The June macro outlook is unpredictable.

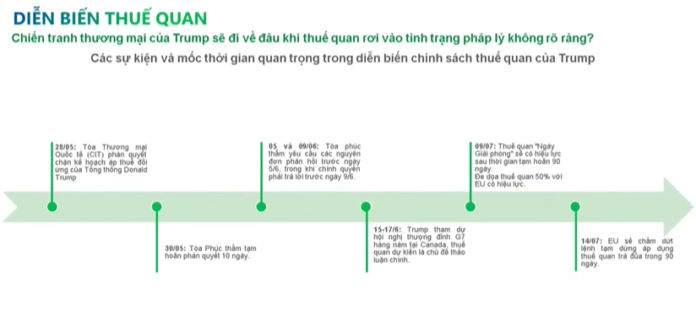

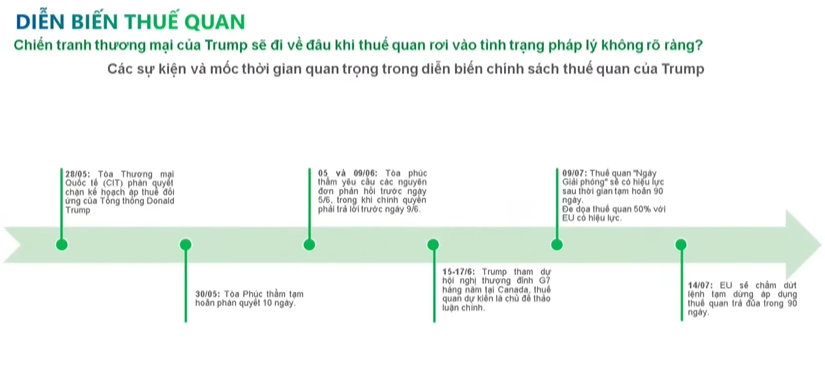

On May 28, the Court of International Trade (CIT) ruled to block President Donald Trump’s plan to impose countervailing duties. The Court of Appeals is currently staying the ruling for ten days. On June 5 and 9, the Court of Appeals will request responses from the parties regarding the ruling. If CIT presents a more compelling argument, the dispute may be elevated to the Supreme Court.

Reaching the Supreme Court could take a significant amount of time, during which the countervailing duties may be suspended. In this case, the Trump administration may resort to using other laws to impose taxes, with ceilings on tax rates. Additionally, the use of these laws would require invoking other statutes with distinct requirements, making the implementation more time-consuming.

Consequently, legal aspects of tariffs will likely capture investors’ attention in June or July. A suspension would benefit import-export businesses with the US. However, if the Supreme Court approves, the original plan will be reinstated.

Source: VPBanks

|

In June, the Fed is expected to maintain interest rates. Recently, key inflation indicators such as CPI, PPI, and PCE suggest that inflation in the US is showing significant signs of cooling down. The Fed is data-dependent and will observe if inflation is impacted by tariffs, which have a lag effect and may be reflected in the May or June reports.

Hence, the Fed will pause and monitor the situation. The earliest expected rate cut is predicted for September, when tariff-induced inflation is fully reflected in the economy.

In Europe, economies continue to grow slowly, especially in Germany. European inflation is clearly cooling down, so the ECB will continue to cut interest rates, at least twice more this year. In Asia, the Bank of Korea (BoK) recently lowered interest rates as well.

Asian countries are anticipated to follow suit to boost growth, awaiting a signal from the Fed. China has consistently reduced interest rates and recently lowered the reserve requirement ratio. Thus, Asia is in a phase of declining interest rates, and economic stimulus packages continue to be introduced in Asian countries, particularly in Southeast Asia.

Support for exports and domestic consumption will be further promoted. The Vietnamese economy may receive additional positive signals as interest rates gradually decrease, and inflation cools down.

Regarding exchange rates, when the USD Index (DXY) fell below 100, the currencies of most regions appreciated, notably the GBP, EUR, and JPY. The VND exchange rate will continue to fluctuate within the permitted range this year, as predicted by the State Bank of Vietnam and other organizations, likely not exceeding 3%.

Preparing for the September-October wave

According to VPBanks’ expert, the May candle was a “healing” one, almost entirely covering the April candle’s body. In the medium term, the market remains in a sideways trend that has persisted since mid-2024. Weekly candles are intertwined, and the trading range is between 1,200 points at the lowest and 1,300-1,320 points at the highest. Considering both weekly and monthly candles, the market is in an accumulation phase.

However, this accumulation phase has lasted for many months. Referencing similar phases in 2004-2005 and 2014-2015, we can observe that the market experienced strong upward movements afterward. Mr. Son anticipates a similar accumulation phase leading to an upward trend, as the Fibonacci sequence suggests an upward trajectory.

In April, a long-legged Doji candle appeared, typically followed by an upward movement. In May, the VN-Index reached a high of nearly 1,348 points and encountered some Fibonacci resistance levels. Hence, it is normal to see corrective sessions at the beginning of June. If there is a mid-June or end-June correction, mid-term investors can consider buying to prepare for the September-October wave.

Source: VPBanks

|

Additionally, on a macro level, the Politburo issued Resolution 68, which could transform Vietnam’s economy for at least the next 50 years. This period is pivotal, with numerous resolutions and policies being introduced. Private enterprises will be the first to benefit.

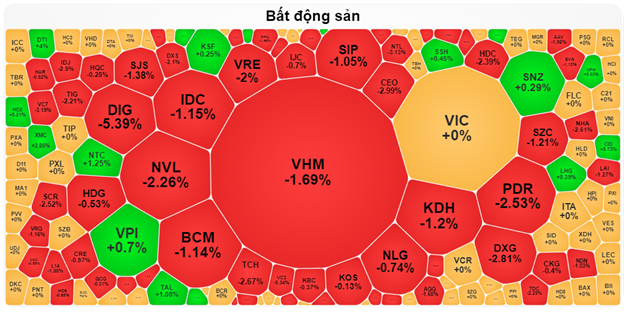

For instance, since the beginning of the year, real estate businesses facing legal and planning challenges have witnessed policy easing, and their stock prices have surged significantly. This phenomenon results from low valuations and government intervention.

Given these factors, the market may experience fluctuations in the coming months but is poised for an upward trajectory.

– 11:13 03/06/2025

Unlocking the Billion-Dollar Opportunity: Vietnam’s 22-Ton Export Venture to China

As we forge ahead into 2025, Vietnam is poised to make a strategic move in the billion-strong market.

The Capital of Triumph – Gamuda Land: Strengthening the Strategic Alliance

On May 31st, Khai Minh Land – a member of Khai Hoan Land Corporation (HOSE: KHG) – and Gamuda Land reinforced their strategic partnership by announcing Khai Minh Land as the official distributor for the SpringVille project. This collaboration underscores the enduring and robust relationship between the two companies.

Abolishing the Building Permit: Alleviating Citizens and Businesses from Unnamed Fees

According to experts, eliminating the requirement for construction permits is essential to eradicate the pervasive “permission culture”. This move will empower citizens and businesses by eliminating unnecessary fees and streamlining the construction process.