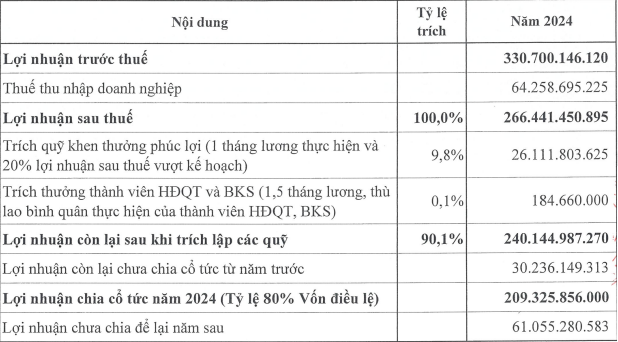

2024 was a prosperous year for NCTS, with a total revenue of nearly VND 950 billion and a profit after tax of over VND 266 billion, representing a 20% and 22% growth rate, respectively, compared to the previous year.

As a result, the Company’s management has decided to propose a dividend payout of VND 8,000/share (80% dividend ratio) for 2024, according to information disclosed in the AGM documents published on May 30. This equates to a total dividend payout of approximately VND 209 billion.

On the stock market, NCT’s share price has been on an upward trajectory after a period of stagnation, following the latest news about the cash dividend. As of 9:40 am on June 03, the stock was up by 0.67%.

|

NCTS distributes a significant portion of its profits as cash dividends

Unit: VND

Source: NCTS 2025 AGM Documents

|

NCTS’ business performance in the past year benefited from several favorable factors, resulting in better-than-expected growth in cargo handling volumes. The company’s total cargo handling volume in 2024 reached nearly 370.2 thousand tons, a nearly 23% increase compared to the previous year, outpacing the overall growth rate in the Noi Bai Airport cargo market.

The domestic cargo transportation demand was boosted by the post-Covid-19 economic recovery. Additionally, the growth of e-commerce created a need for small-scale and rapid cargo delivery, fostering the development of air cargo services.

In the international market, tensions in the Red Sea led to a container shortage and surging sea freight rates, causing some cargo that would typically be transported through the Suez Canal to be diverted to air freight.

Looking ahead to 2025, the Company’s management anticipates a challenging business environment but has not provided specific details. In the AGM documents published on the company’s website, NCTS has also not disclosed any proposals regarding its business plan for this year.

One crucial agenda item for the upcoming AGM is the election of five members to the Board of Directors and three members to the Supervisory Board for the 2025-2030 term.

Currently, the largest shareholder of NCTS is Vietnam Airlines (Vietnam Airlines, HOSE: HVN), holding over 55% of the company’s shares. The second-largest shareholder is the foreign investment fund, America LLC, which is a purely financial investor and has not appointed any representatives to the Board of Directors or the Supervisory Board in the previous term.

– 10:02 03/06/2025

The Investment in Cho Ray Phnom Penh Hospital Helps Tan Binh Real Estate Escape Losses

Despite hitting rock bottom in terms of revenue and significant provisions for doubtful debts, Tanbinh Real Estate JSC (TanbinhRes) managed to stay in the black in 2024. This was made possible by a reversal of nearly VND 24 billion from their indirect investment in Cho Ray Phnom Penh Hospital.

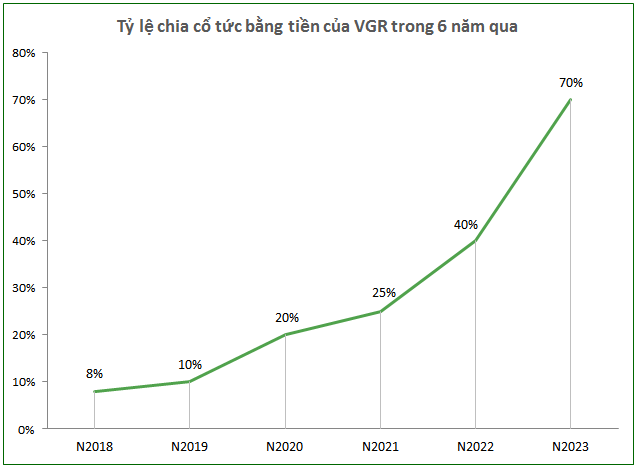

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

Unveiling the Mastermind Behind the Success of Chu Lai Open Economic Zone

“Chu Lai Industrial Infrastructure Development Company Limited (Cizidco) has recently released its 2024 audited financial statements, offering a glimpse into the company’s financial performance and strategic direction.”