Silver prices surge at Phu Quy Group, a renowned jewelry company in Vietnam.

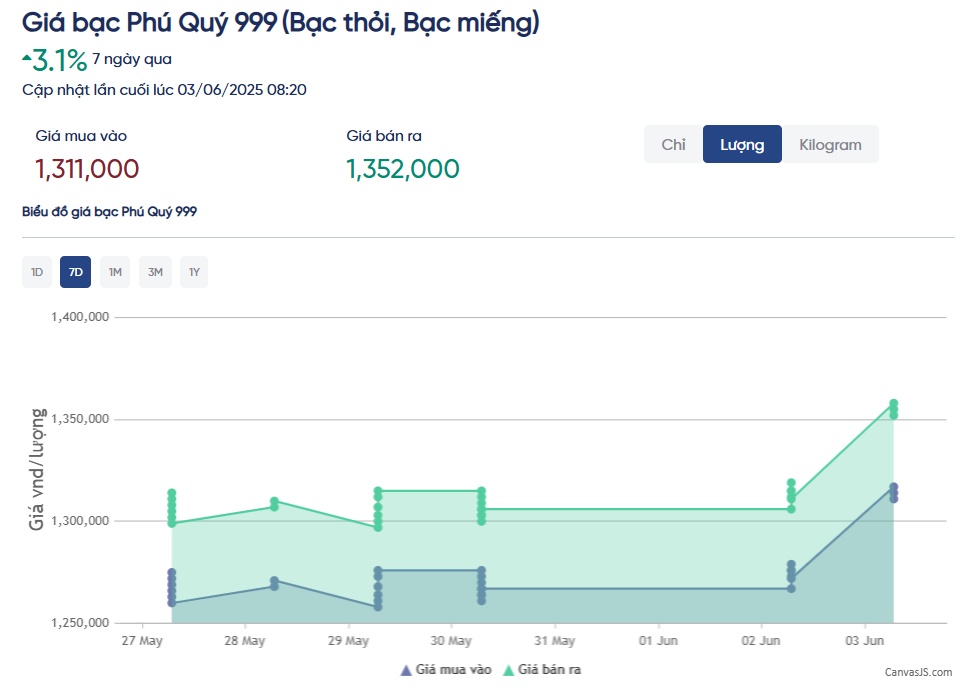

Phu Quy Group, a prominent name in Vietnam’s jewelry industry, witnessed a significant surge in silver prices today. The group’s buy and sell rates stood at 1,311,000 VND and 1,352,000 VND per tael in Hanoi, marking a notable 3.7% increase from the previous day’s rates.

Meanwhile, the price of 999 fine silver bars weighing 1kg experienced a substantial jump, with buying and selling prices reaching 34,959,913 VND and 36,053,243 VND per bar, respectively, as of 8:31 AM on June 3rd. This reflects an increase of over 1 million VND per kilogram.

Globally, silver prices climbed to 34.1 USD per ounce, or approximately 869,000 to 875,000 VND per ounce, mirroring the upward trend witnessed in the Vietnamese market.

Global tensions fuel safe-haven demand for precious metals.

The surge in silver prices comes amidst escalating trade tensions between the United States and China, prompting investors to seek refuge in safe-haven assets. Former US President Donald Trump’s accusations of China breaking trade agreements, coupled with his decision to impose higher tariffs on steel and aluminum imports from China, have injected uncertainty into global financial markets.

Multiple factors are supporting the upward momentum in silver and gold prices today. The US dollar index has weakened considerably, while crude oil futures prices have soared to around 62.75 USD per barrel. Additionally, the yield on 10-year US Treasury bonds sits at 4.45%, reflecting mounting concerns over America’s burgeoning national debt.

While the silver market currently lacks a distinct breakout catalyst, experts believe that the precious metal continues to find support from expectations of robust global industrial demand.

James Hyerczyk, a market analyst at FX Empire, offers his insight: “The market is awaiting crucial economic data this week, including the ISM manufacturing index and the US non-farm payrolls report.”

These employment figures are crucial for assessing inflation risks and gauging the Federal Reserve’s potential adjustments to interest rate policies.

Moreover, speeches from Federal Reserve officials this week could significantly influence expectations for the trajectory of interest rate cuts.

According to James Hyerczyk, silver retains a stable support base amid cooling global inflationary pressures, positive trade prospects, and lingering financial concerns in the US.

In summary, silver prices are likely to sustain their recovery trend in the short term, provided that US economic data remains favorable and the Federal Reserve maintains its accommodative monetary policy stance.