The stock market surged unexpectedly today, spurred by a rally in securities stocks. While they may not have led the index, they certainly led the sentiment. Investors who took profits are now feeling a sense of “FOMO” as the market rebounds.

Today’s trading volume surged to over 25.4k billion matched orders on the two exchanges, indicating a significant return of funds. Foreign investors also joined the rally, creating a highly enthusiastic trading environment.

Securities stocks had an inspiring rally, with VND even hitting the ceiling, and many others trading in the hundreds of billions of dollars. A strong rally in securities stocks often signals new opportunities, possibly fueled by rumors spreading across trading rooms about a potential shift to T+2 and an upgrade. Such information usually serves as a post-hoc explanation, as the prerequisite remains liquidity.

Today’s liquidity was abundant. If we look at the market’s reaction during previous unsuccessful breakout attempts, liquidity was poor, trading was lackluster, and there were no suitable signals for a breakout. This time is no different; securities and small real estate stocks are mainly driving the rally, while blue chips are restraining the index. This remains a form of differentiation, with money flowing into mid-cap and small-cap stocks. VN30 basket liquidity contributed only a quarter of the total increase in HSX.

Simply put, money is flowing back into stocks with compelling stories and expectations, regardless of the index. In fact, compared to the pre-tariff shock period, most securities and small real estate stocks are still at low levels. The first profit-taking occurred during the last three sessions of the previous week, coinciding with VNI retesting 1340 and retreating. It’s not unusual for money to continue flowing in and pushing prices higher, as it did today.

Of course, it can be frustrating to have taken profits only to see prices recover to or above the selling price. This is a common occurrence, as few can time the market precisely. Market movements are unpredictable, but the one thing we can control is our investment strategy. Each short-term trade is a segment of buying low and selling high; taking profits is a success. Regardless of subsequent price movements, treat it as a new trade or a new strategy rather than comparing it to a closed position.

I maintain the view that the current market lacks the momentum to initiate a new price cycle, even if VNI breaks new highs. Opportunities exist in select stocks, and participation should be limited, preferably below 50% of capital.

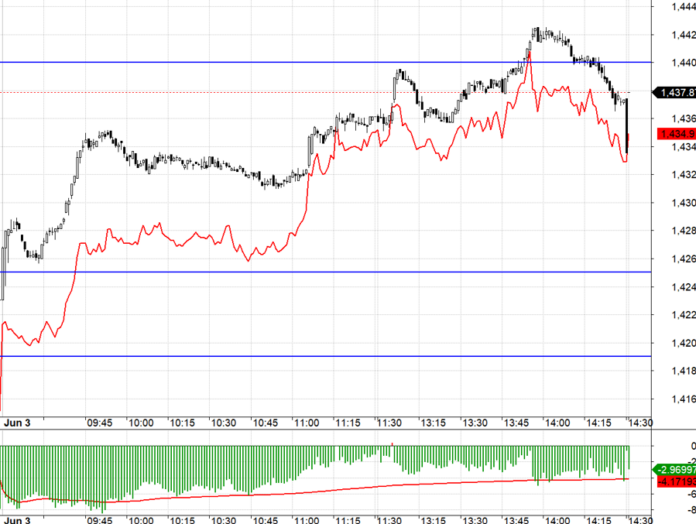

Today’s derivatives market also reflected a noticeable shift in sentiment. Initially, the market rallied, with VN30 starting around 1425.xx, but F1 offered a wide discount of over 8 points. It wasn’t until the afternoon, when VN30 approached 1440.xx, that F1 narrowed the basis. Such a market is challenging to trade.

With the dynamic movement in mid-cap and small-cap stocks, the market continues to offer selective opportunities rather than a broad trend. The strategy remains speculative with a small position, and actively managing Long/Short exposure with derivatives.

VN30 closed today at 1437.87. Near-term resistances are at 1442, 1451, 1462, 1468, and 1473. Supports are at 1430, 1423, 1414, 1408, and 1400.

“Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, opinions, and investment strategies expressed are those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the opinions and investment strategies presented in this blog.