Mr. Ho Huu Tuan Hieu – SSI Securities Corporation’s Investment Strategy Expert shares upcoming events

|

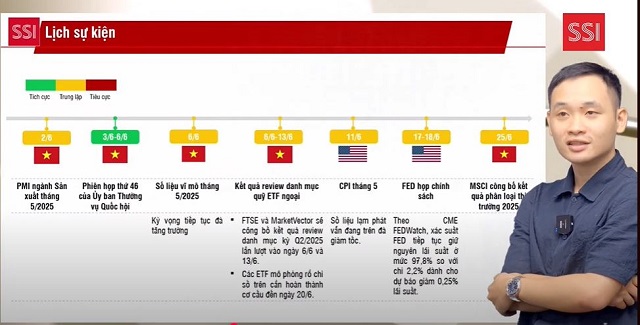

In the program, Mr. Ho Huu Tuan Hieu – Investment Strategy Expert from SSI Securities Corporation pointed out the notable events in the coming period.

Firstly, the manufacturing PMI was announced at 49.8, not much different from the previous month and still slightly negative since the beginning of the year, although export figures remain favorable. Macroeconomic data will also be released this week.

The 46th session of the National Assembly’s Standing Committee opened on June 3rd, with nearly 30 draft laws and resolutions up for discussion.

MSCI will also announce the market classification results by the end of June. While MSCI is not Vietnam’s target for an upgrade this year, the new development is that MSCI will divide the Frontier market into two categories. Previously, Vietnam was in the Frontier group and had the largest weight. Soon, Vietnam is likely to be classified as Frontier-2 due to unmet market access criteria, despite leading in quantitative criteria.

This year, Vietnam is still focusing on market development and adhering to FTSE criteria for upgrading.

This week, the US may announce tax conclusions for all countries. The negotiation round between Vietnam and the US could be reactivated in June. Therefore, this is the time for investors to anticipate information.

In addition, the US will announce the May CPI, and the Fed will hold a policy meeting in June.

Regarding market movements, the expert assessed that the market is slowing down and weakening. The last week of May was a week of market stagnation and slowdown, indicating increasing risks. Leading stocks in the market such as GEX, VHM, and VIC have stalled, dragging down many other stocks, indicating a weakening market.

Foreign capital inflows into Vietnam slowed down at the end of May and were even net sold by about $100 million last week. The selling streak has temporarily stopped in May, and improvement could lead to a recovery and net buying again.

June is expected to be a more vibrant month in terms of information related to trade tensions and final tax conclusions (expected around June 9). In addition, the third round of negotiations between Vietnam and the US may take place in early June. This information could have a significant impact on the market but is unpredictable.

Accordingly, SSI experts recommend a cautious trading strategy. It is advisable to maintain a balanced stock proportion of about 50%-70% and can be lower if the market moves negatively. Avoid aggressive trading or using margin at this time.

Proactively reduce the proportion of stocks that have performed well in the past period. If you must buy, maintain a low proportion, be cautious, and slow down the trading pace.

For potential mid- and long-term stocks that have not fully recovered or underperformed the market, this may be a time to consider disbursement.

– 14:48 03/06/2025