The market experienced a surprisingly positive start to the month of June. Despite a lack of significant positive news, the Vn-Index witnessed a sharp decline at the beginning of the session, falling by over 10 points. However, funds were immediately injected into the market, and the index gradually recovered to close at 1,336.30, a gain of 3.70 points.

The breadth improved towards the end of the session, with 201 gainers and 125 losers. There was a rotation between sectors and within individual stocks within the same sector. Notably, the VinGroup stocks turned negative, with VIC and VHM declining by 0.41% and 0.77%, respectively, while VRE fell by 2.91%.

On the other hand, mid and small-cap stocks in the real estate sector, such as DIG and PDR, surged to the daily limit, and other stocks like KDH, NVL, VPI, SSH, and CEO also performed well. The market anticipates that new legal developments will provide relief to real estate businesses regarding project investments. Banks also witnessed strong growth, including TCB, STB, MBB, SHB, and EIB, benefiting from the positive outlook for the real estate market.

The securities sector followed suit, with VND expected to be heavily purchased by two ETFs during the upcoming restructuring period, rising by 4.14%. Other stocks in this sector, such as VDS, CTS, FTS, SHS, and MBS, also attracted buying interest, mostly supported by banks.

Funds are flowing into domestically-focused sectors, including banks, securities, and public investment. Stocks such as VCG, PC1, HUT, CC1, CII, and C4G performed excellently. On the flip side, sectors affected by tariffs, such as industrial real estate, ports, and logistics, faced selling pressure as tensions in the US-China trade war showed signs of escalating again, resulting in a sea of red for most stocks in these sectors.

The total matched transaction value on the three exchanges reached VND 23,000 billion, with foreign investors net selling VND 167 billion. Specifically, they net sold VND 129.2 billion in matched transactions. Their top net bought sectors in matched transactions were Financial Services, Construction & Materials. The top net bought stocks included SHB, EIB, VIX, VND, MWG, VCG, EVF, GVR, NVL, and KBC.

On the selling side, their top net sold sector in matched transactions was Basic Resources. The top net sold stocks included HPG, VIC, VRE, STB, FPT, HCM, PVD, DXG, and HAH.

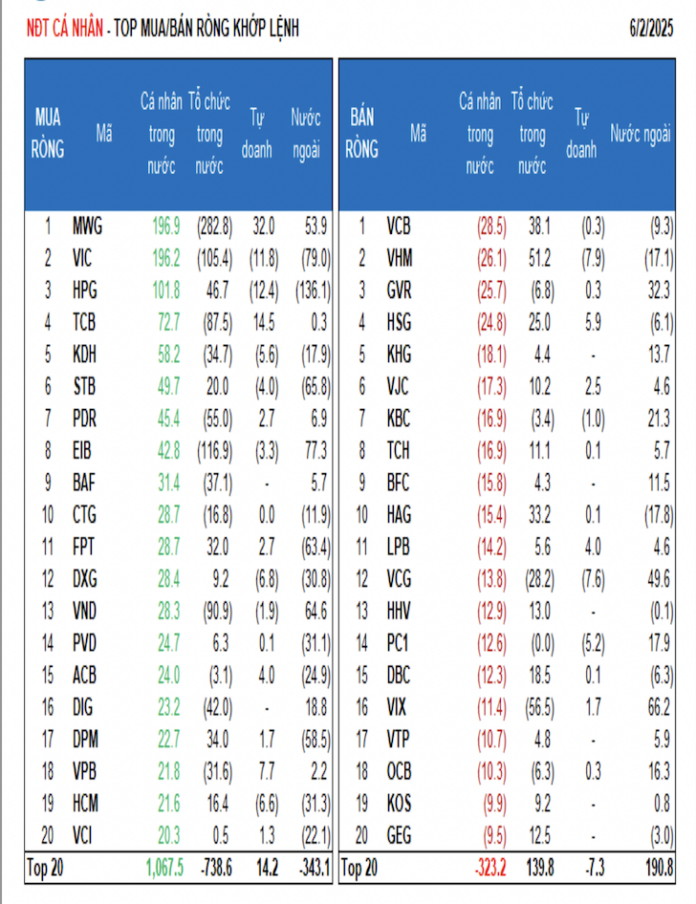

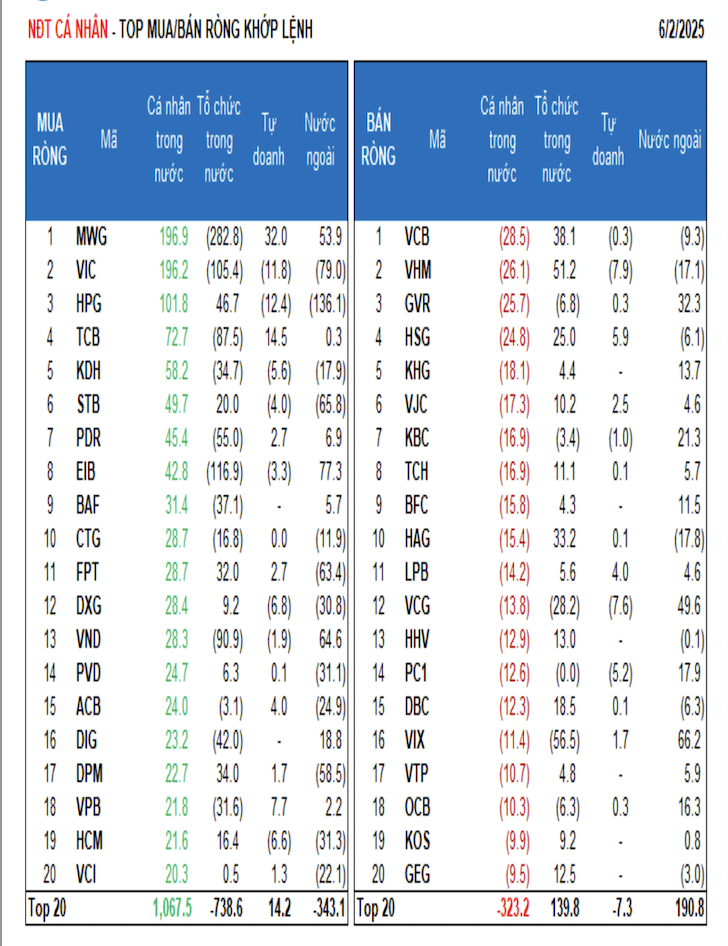

Individual investors net bought VND 1,219.2 billion, of which VND 940.5 billion was net bought in matched transactions. In matched transactions, they net bought 12 out of 18 sectors, mainly in the Real Estate sector. Their top net bought stocks included MWG, VIC, HPG, TCB, KDH, STB, PDR, EIB, BAF, and CTG.

On the net selling side in matched transactions, they net sold 6 out of 18 sectors, mainly in the Travel & Leisure and Chemicals sectors. The top net sold stocks included VCB, VHM, GVR, HSG, KHG, VJC, TCH, BFC, and HAG.

Proprietary trading arms of securities firms net sold VND 146.6 billion, of which VND 9.4 billion was net bought in matched transactions. In matched transactions, they net bought 10 out of 18 sectors. The top net bought sectors were Banks and Retail. The top net bought stocks included MWG, MBB, TCB, VPB, HSG, GAS, SBT, SAB, HDB, and VIB. The top net sold sector was Real Estate. The top net sold stocks included NLG, HPG, VIC, VHM, VCG, PLX, DXG, HCM, SSI, and KDH.

Domestic institutions net sold VND 861.4 billion, of which VND 820.6 billion was net sold in matched transactions. In matched transactions, they net sold 8 out of 18 sectors, with the largest net selling in the Banking sector. The top net sold stocks included MWG, SHB, EIB, VIC, VND, TCB, VIX, PDR, EVF, and DIG. The top net bought sector in terms of value was Basic Resources. The top net bought stocks included VRE, VHM, HPG, VCB, DPM, HAG, FPT, HSG, HAH, and HDB.

The value of negotiated transactions today reached VND 2,391.7 billion, up 45.9% from the previous session and contributing 10.3% of the total trading value. Notable transactions today included those between domestic institutions in large-cap stocks (FPT, MWG, VHM), EIB, and KBC. Additionally, individual investors continued to trade in bank stocks (SSB, VPB, EIB, MSB, HDB) and large-cap stocks (FPT, MWG, MSN).

The allocation of funds increased in Real Estate, Banking, Retail, Oil & Gas, Aviation, Power Production & Distribution, Consumer Goods, and Personal Finance, while it decreased in Securities, Steel, Agricultural & Marine Products, Software, Warehousing, and Maintenance.

In terms of matched transactions, the allocation of funds increased in mid and small-cap stocks (VNMID and VNSML) while decreasing in large-cap stocks (VN30).

Market Pulse June 2nd: Energy Sector Surges, VN-Index Recaptures Green Territory

The trading session concluded with the VN-Index climbing 3.7 points (+0.28%), reaching 1,336.3. Meanwhile, the HNX-Index witnessed a rise of 2.95 points (+1.32%), ending at 226.17. The market breadth tilted towards gainers, as 438 stocks advanced against 323 decliners. Similarly, the VN30 basket saw a slight dominance of greens, with 16 gainers, 13 losers, and 1 stock remaining unchanged.

The Billion-Dollar Fund Management Industry: Unveiling the Bond Market’s Top Players

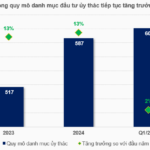

As of Q1 2025, the investment portfolio of the fund management industry – the primary source of revenue – stood at nearly VND 601 trillion, a modest 2% increase from the start of the year. The industry boasts 19 companies with portfolios worth thousands of billions of dong, one more than at the beginning of the year. Companies backed by the insurance industry continue to dominate in terms of the scale of entrusted assets.

Market Pulse June 2nd: Blue Chips Dive, VN-Index Down Over 8 Points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. By the mid-session break, the VN-Index had dropped 0.62%, settling at 1,324.4 points. In contrast, the HNX-Index climbed 0.66% to reach 224.69 points. The market breadth was negative, with 353 declining stocks against 306 gainers.