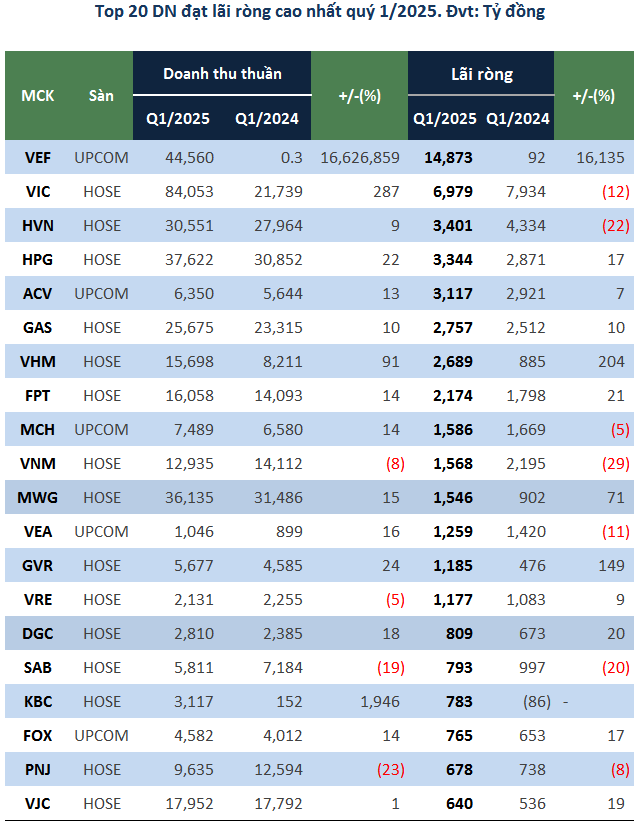

According to data from VietstockFinance, as of May 23, 2025, 1,018 companies on the stock exchange (excluding banks, insurance, and securities groups) have published their financial statements for the first quarter of 2025. Total revenue reached over 1 quadrillion dong, a 21% increase compared to the same period last year. Net profit was nearly 77.2 trillion dong, a 30% increase.

Of these, 834 companies were profitable, 183 incurred losses, and only one company (TPH) had a net profit of exactly zero dong.

Among the profitable group, 448 companies increased their profits, 304 decreased, and 76 turned from losses to profits. Only 6 companies maintained their profit levels.

On the loss-making side, 74 companies reduced their losses, 55 increased their losses, 53 turned from profits to losses, and 1 company maintained its loss level.

14 companies with impressive profits, and a surprising new leader

Source: VietstockFinance

|

The profit landscape for the first quarter of 2025 welcomes a fresh breeze as the top spot is no longer held by familiar names but belongs to a completely new entity – Vietnam Exhibition Fair Center Joint Stock Company (UPCoM: VEF), a subsidiary of Vingroup (HOSE: VIC).

| VEF’s net profit over the years |

VEF surprised the market with a record net profit of nearly 14,900 billion dong in the first quarter – higher than the total profit of many previous years combined and equivalent to 93% of the plan for 2025. Net revenue was nearly 44,600 billion dong, while in the same period last year it was only 268 million dong. Financial revenue soared to nearly 1,900 billion dong, almost 15 times higher than the previous year.

This exceptional performance was mainly due to the transfer of a part of the Vinhomes Global Gate project and the increase in financial revenue from joint business activities.

Although lower than its subsidiary by nearly 7,900 billion dong, the parent company – Vingroup Corporation – still maintained its second position in terms of profit for the whole market in the first quarter with 6,979 billion dong.

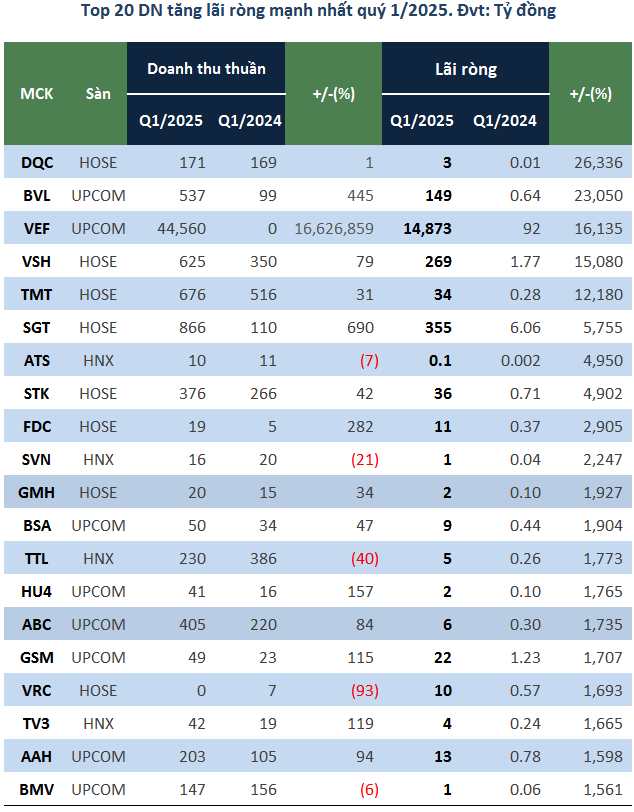

161 companies with exponential profit growth

Source: VietstockFinance

|

Electric Light Joint Stock Company (HOSE: DQC) led the market in profit growth rate in the first quarter of 2025, with a net profit of nearly 3 billion dong – more than 264 times higher than the figure of 11 million dong in the same period last year. This “light speed” growth did not come from net revenue but from streamlining the apparatus, reducing management and interest expenses.

Meanwhile, BV Land Joint Stock Company (UPCoM: BVL) achieved impressive growth thanks to a breakthrough revenue of over 537 billion dong, 5.4 times higher than the previous year; resulting in a net profit of nearly 149 billion dong, 232 times higher than the previous year.

According to BVL, the real estate market has recovered significantly after a long period of stagnation, improving sales performance in new projects. The company and its subsidiaries also made significant profits from investing, developing, and doing business in real estate. In addition, the construction projects were expedited for acceptance, making a positive contribution to the consolidated profit growth in the first quarter of 2025.

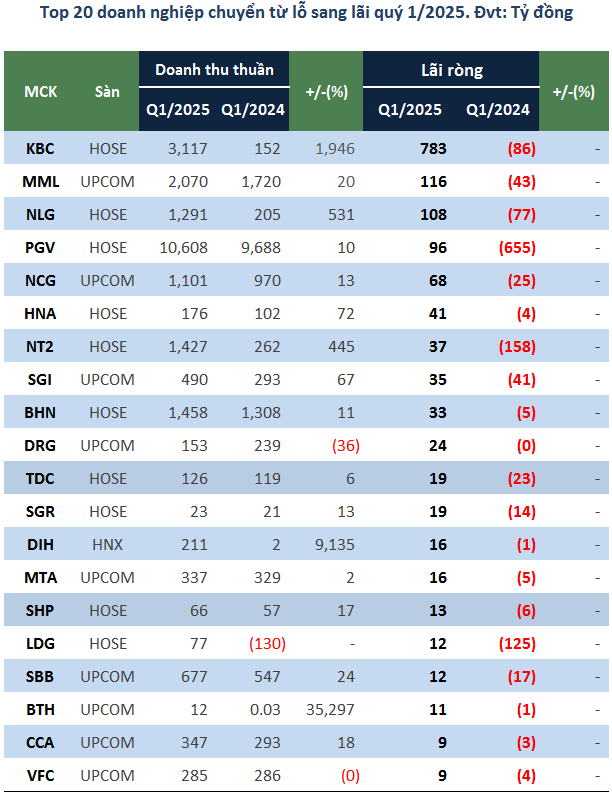

Escaping losses thanks to core revenue

The common factor between the two companies leading the “turnaround” list to escape losses in the first quarter of 2025 was the remarkable improvement in net revenue.

Source: VietstockFinance

|

Specifically, the net revenue of Kinh Bac Urban Development Corporation – JSC (HOSE: KBC) was nearly 3,117 billion dong, more than 20 times higher than the same period last year. Thanks to this, KBC turned from a loss of 86 billion dong in the first quarter of 2024 to a net profit of 783 billion dong.

This positive result was mainly due to land lease revenue at industrial park projects, while none occurred in the same period last year. In addition, real estate sales revenue reached 411 billion dong, 28 times higher thanks to the handover of the social housing project in Nen Town, Bac Giang Province.

Similarly, Masan MeatLife (UPCoM: MML) made a net profit of 116 billion dong, reversing the loss of 43 billion dong in the same period last year. Net revenue increased by 351 billion dong (up 20% over the same period) thanks to the growth in chilled meat, processed meat, and farm operations.

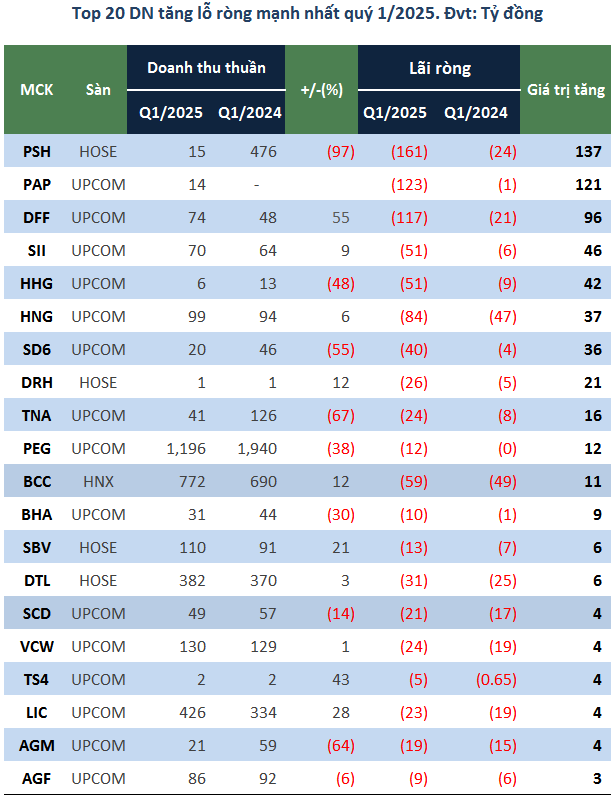

Losses continue to deepen

Source: VietstockFinance

|

While many businesses began to show signs of recovery, Southern Hau River Oil and Gas Investment and Trading Joint Stock Company (HOSE: PSH) went against the trend and continued to sink deeper into losses. In the first quarter of 2025, the company incurred a net loss of 161 billion dong, with the loss increasing by 137 billion dong compared to the same period. Net revenue plummeted by 97% to only 15 billion dong, indicating a worsening financial picture.

| PAP’s business results over the years |

Similarly, Phuoc An Oil and Gas Investment and Development Joint Stock Company (UPCoM: PAP) achieved net revenue of nearly 14 billion dong, the second quarter since 2016 with revenue, but the cost of goods sold reached 67 billion dong, and financial expenses were nearly 63 billion dong, causing PAP to continue to lose nearly 123 billion dong, bringing the accumulated loss to the end of the first quarter of 2025 to nearly 154 billion dong.

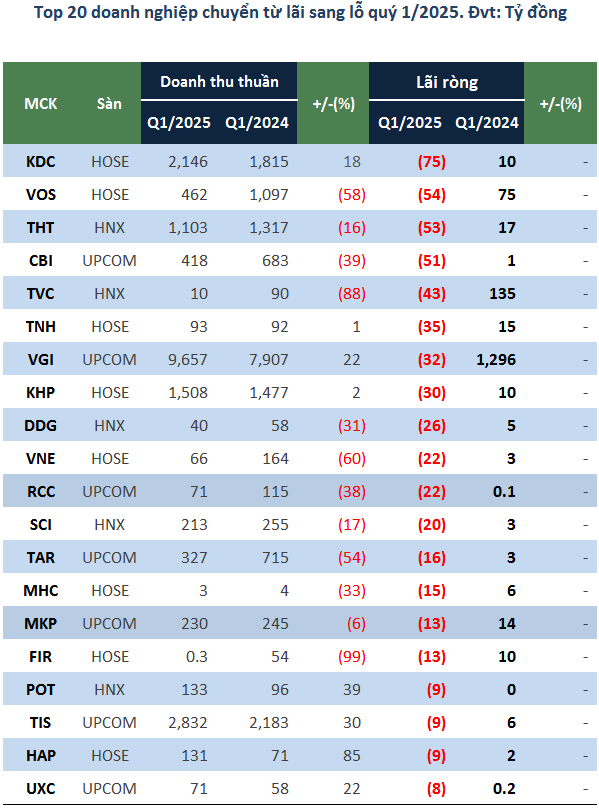

Under different pressures, the financial picture of many businesses has changed from bright to dark over the year. Typically, despite net revenue of over 2,146 billion dong in the first quarter of 2025, an 18% increase over the same period, the giant in the food industry – Kido Group Joint Stock Company (HOSE: KDC) still lost 75 billion dong, contrary to the profit of 10 billion dong in the same period last year.

The main reason is that the cost of goods sold increased faster than revenue growth, along with interest expenses increasing by one and a half times, significantly eroding profits.

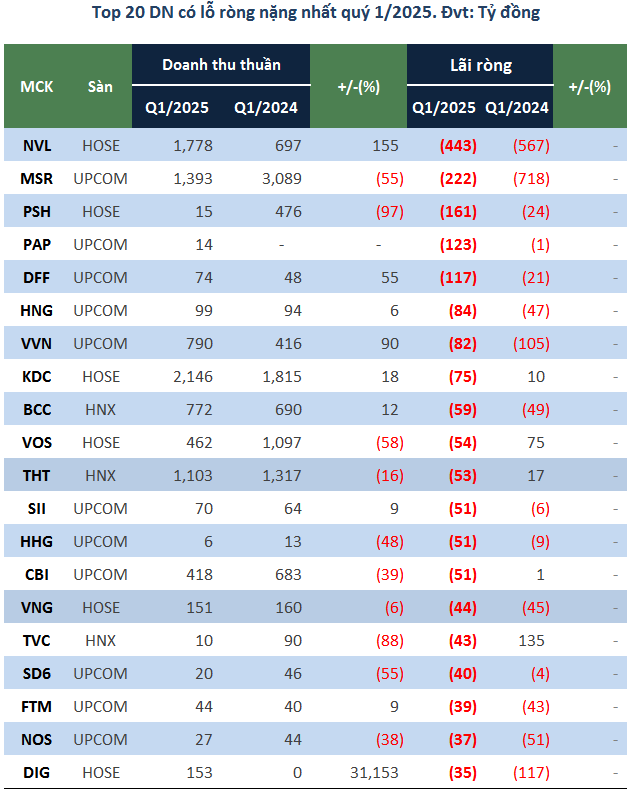

Source: VietstockFinance

|

A positive point in the profit picture of the first quarter of 2025 is that the company with the heaviest loss in the market has somehow narrowed its loss compared to the same period. Novaland Real Estate Investment Group (HOSE: NVL) lost 443 billion dong, a decrease compared to the loss of 567 billion dong in the first quarter of 2024.

This result is thanks to net revenue of over 1,778 billion dong, 2.5 times higher than the same period. Of which, revenue from the transfer of real estate accounts for the majority with more than 1,634 billion dong, 3.3 times higher thanks to the handover of projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, Palm City…

However, Novaland still made a net loss due to other losses of nearly 262 billion dong, mainly due to the absence of revenue from contract violation fines as in the same period last year (only collected 3 billion dong in the first quarter of 2025 compared to 331 billion dong in 2024).

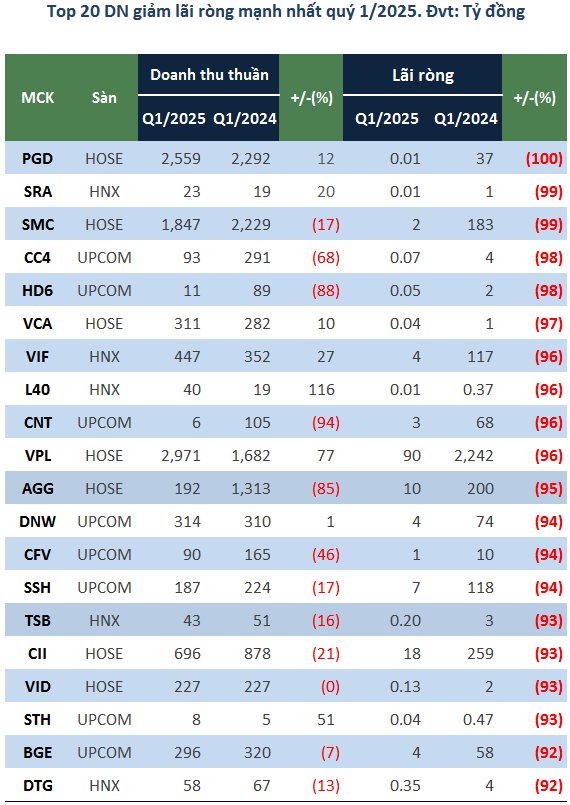

Source: VietstockFinance

|

Although not in a loss-making situation, many businesses struggled from the beginning of the year. Vietnam Low-Pressure Gas Distribution Joint Stock Company (HOSE: PGD) is a typical example, with a net profit of just over 13 million dong in the first quarter of 2025 – not even 0.1% compared to the figure of nearly 37 billion dong in the same period last year.

The main reason is that the cost of goods sold increased sharply compared to revenue, negatively affected by the fluctuations in the fuel market and oil prices.

Listed companies’ profit growth: A driving force for the stock market in the remaining months of the year?

According to experts from KBSV Securities Company (KBSV), the Vietnamese stock market has performed positively in the first quarter of 2025, largely thanks to the impressive profit growth of listed companies, the government’s commitment to promoting growth, and the continued maintenance of a low-interest rate environment.

However, given the volatile global context, KBSV remains cautious about market prospects for the rest of the year. The forecast for the whole market’s EPS growth is adjusted down to 5% (previously a higher level), mainly due to concerns about the risks associated with tax policies. The P/E valuation of the VN-Index is adjusted down to 11.09 times, from 14.6 times at the end of 2024 – significantly lower than the 10-year average of 16.6 times.

In addition, a report by SSI Securities Company also shows that as of May 5, the net profit of the whole market in the first quarter of 2025 still grew by 23% over the same period – although slower than the 29.5% in the previous quarter, but still marking the sixth consecutive quarter of growth.

Meanwhile, SSI believes that the profit outlook for the coming quarters is still uncertain. Many listed companies are confident in setting growth plans for 2025, but they also acknowledge that the instability surrounding tax policies could weaken growth momentum in the future.

– 12:00 02/06/2025

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

The Billionaire’s Boom: How Pham Nhat Vuong’s Wealth Surged by $2.9 Billion in May, Matching BIDV’s Market Cap and Surpassing the Next 12 Individuals’ Combined Net Worth

As of Tuesday, June 3, 2025, Mr. Vuong’s net worth surpasses the market capitalization of several prominent Vietnamese businesses listed on the stock exchange. His wealth exceeds that of industry giants such as Hoa Phat, FPT Corporation, PV Gas, Masan Consumer, and Vinamilk. Furthermore, his assets surpass those of notable banks, including Techcombank, MB, VPBank, and ACB.

Resilient Market in May: Who Were the Top Net Sellers?

“Institutional investors were the strongest net sellers in the past month, with a net selling value of up to 4,314.8 billion VND. Notably, they net sold 3,616.4 billion VND through order matching alone.”