Upcoming ETF Portfolio Restructuring: Predictions and Insights

On June 6, 2025, FTSE is set to announce the constituent stocks of the FTSE Vietnam Index. This will be followed by MarketVector’s announcement of the MarketVector Vietnam Local Index on June 13, 2025. The completion of the entire portfolio restructuring of ETFs referencing these indices is expected on June 20, 2025.

In their latest report, BIDV Securities (BSC) has provided predictions for changes in the composition of these indices.

FTSE Vietnam Index (FTSE Vietnam ETF reference):

BSC Research forecasts no changes during this review period. However, they draw attention to SIP stock, which is close to the minimum trading value threshold set by the index and may be excluded if it fails to meet this criterion. Additionally, the significant price increases of large-cap stocks in the index (VIC, VHM, VRE) in Q2 2025 could result in DIG, DPM, FTS, HSG, PDR, PVD, TCH, VCG, VPI, and VTP failing to meet the minimum market capitalization requirement for retention in the portfolio.

MarketVector Vietnam Local Index – VanEck Vectors Vietnam ETF (V.N.M ETF) reference:

BSC predicts no changes for this review. However, they note that HDG stock is close to the cumulative market capitalization threshold applicable to stocks already in the index.

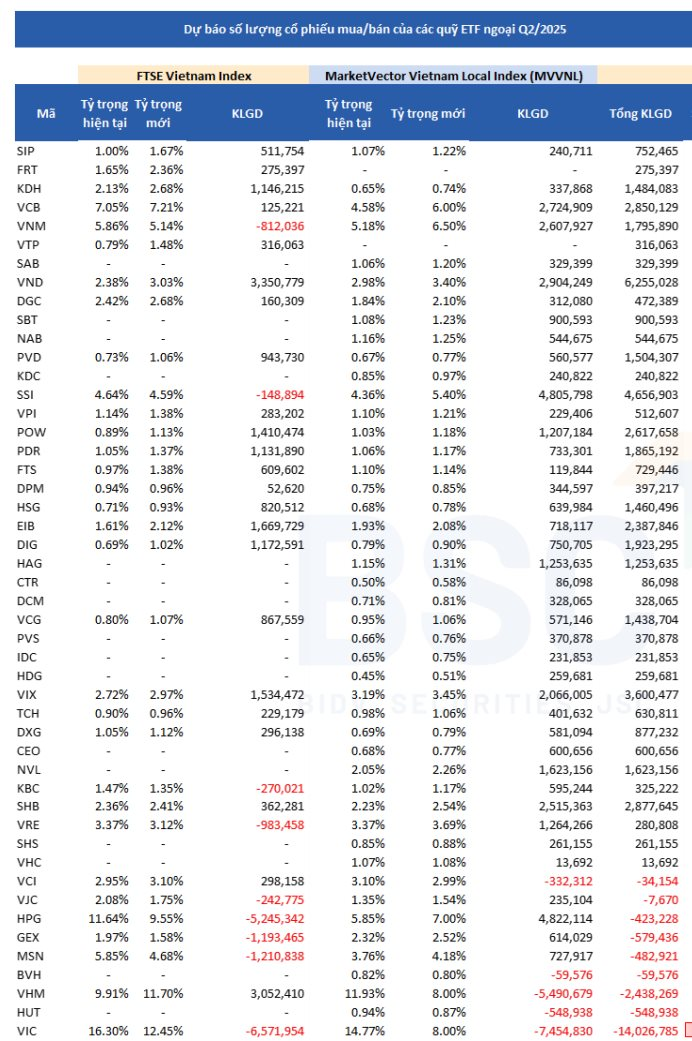

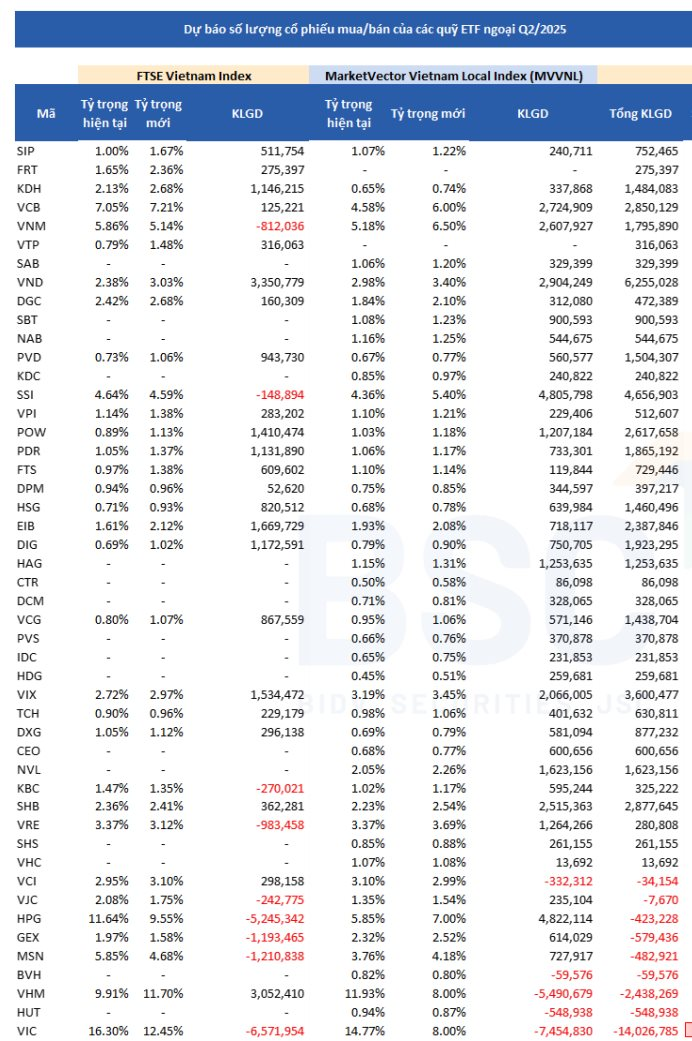

BSC forecasts that the two ETFs may purchase over 4.6 million SSI stocks, 6.3 million VND stocks, 3.6 million VIX stocks, 2.9 million SHB stocks, 2.8 million VCB stocks, and more.

On the other hand, the two foreign funds may sell 14 million VIC stocks, 2.4 million VHM stocks, nearly 600,000 GEX stocks, and over 500,000 HUT stocks…

Figure 1: Illustration depicting the potential ETF portfolio restructuring.

V.N.M ETF and FTSE Vietnam ETF are among the oldest foreign ETFs in Vietnam. As of May 30, 2025, V.N.M ETF’s portfolio size reached $416 million (VND 10,800 billion). In terms of portfolio composition, VIC currently holds the highest weight at 14.43%, followed by VHM (11.74%), HPG (5.77%), and VNM (5.17%), among others.

Figure 2: Pie chart illustrating the composition of the V.N.M ETF portfolio.

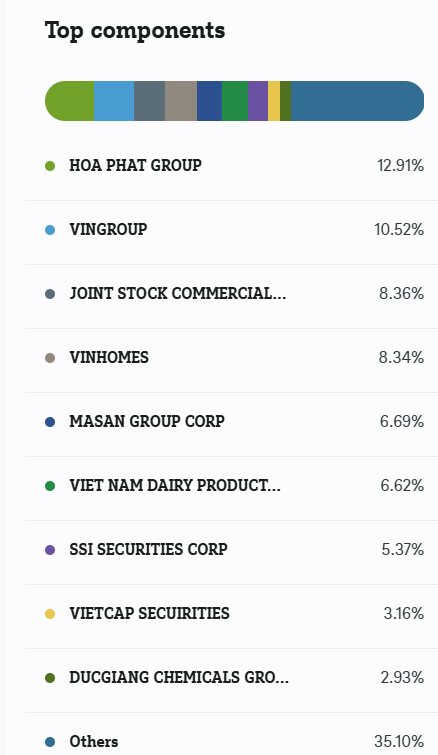

Meanwhile, the FTSE Vietnam ETF has a scale of approximately $355 million (VND 7,100 billion), investing entirely in Vietnamese stocks. The FTSE Vietnam ETF tracks the FTSE Vietnam Index, comprising 32 stocks. Within this index, HPG, VIC, VCB, VHM, MSN, VNM, and others are the top constituents.

Figure 3: Bar graph showcasing the composition of the FTSE Vietnam ETF portfolio.

Let me know if there are any other adjustments or refinements you would like me to make to this text. I can also provide suggestions for further optimization if needed.

Which Stocks Will the VNM ETF and FTSE ETF Hunt in the 2nd Quarter of 2025?

“Yuanta Securities forecasts the constituent stocks and the quantity of shares to be bought/sold for ETFs tracking benchmark indices. “

The Two Large-Scale ETFs Gear Up to Purchase Tens of Millions of Shares in the Securities Group

Two large-scale ETFs, comprising of diverse stocks such as VIX and VCI, are set to make a significant impact on the market. With a combined worth of tens of millions of shares, these ETFs are poised to offer a unique opportunity for investors seeking exposure to a wide range of industries and sectors.

What Stocks Will the VNM ETF and FTSE ETF Seek in the 4th Quarter Restructuring of 2024?

The VTP stock is anticipated to be included in two stock index baskets: the FTSE Vietnam Index and the MarketVector Vietnam Local. This inclusion is expected to boost the stock’s visibility and liquidity, attracting more investors and potentially leading to increased trading volume and enhanced market presence. With this development, the VTP stock is poised to gain traction and prominence in the Vietnamese market and beyond.