Gold prices witnessed a downward trend during the week ending May 26 – June 1, with international market prices settling at $3,288 per ounce, a decrease of approximately $60 per ounce from the previous week. When converted to VND, the international gold price equates to approximately 104 million VND per tael, excluding taxes and fees.

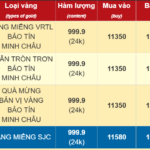

Domestically, SJC gold and gold ring prices experienced significant drops on the last day of the week, although they still maintained a considerable gap from global prices. Specifically, SJC gold prices ranged from 115.7 to 118.2 million VND per tael. Meanwhile, gold ring prices varied across brands. PNJ quoted gold ring prices at 110.5-113.6 million VND per tael, while Bao Tin Minh Chau applied a rate of 113-116 million VND per tael. SJC Company’s gold ring prices stood at 110.5-113.5 million VND per tael, and DOJI Group’s rates were 111-113.5 million VND per tael.

Over the past week, SJC gold prices dropped by approximately 3 million VND per tael, while gold ring prices decreased by around 1-1.5 million VND per tael.

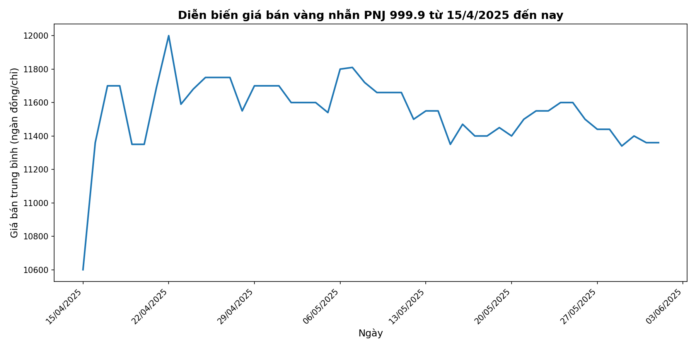

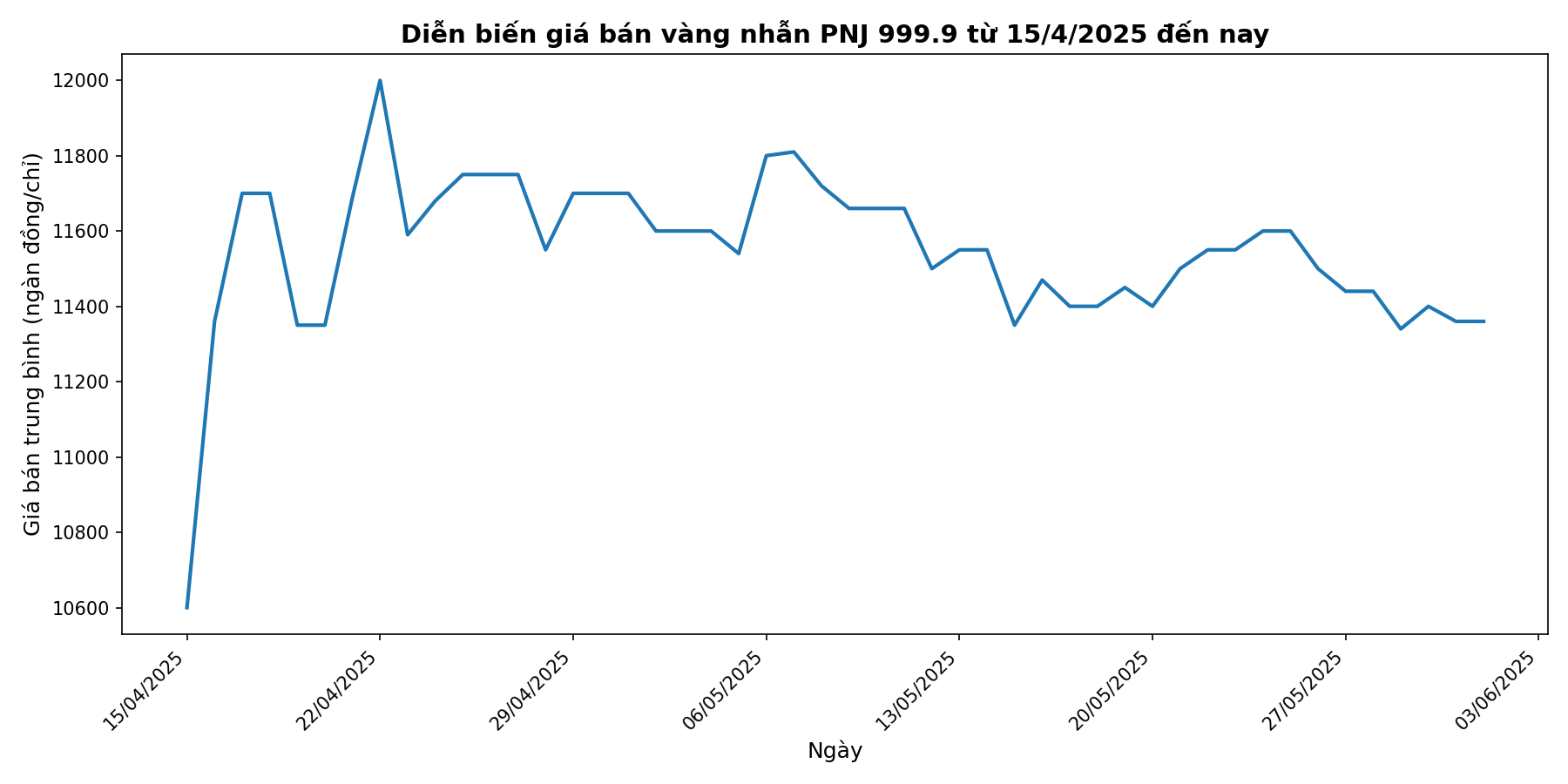

It is worth noting that the historical peak for SJC gold was approximately 124 million VND per tael (selling price) on April 22, 2025. During this same period, the price of 24k plain gold rings reached a record high of 120 million VND per tael. On the day gold prices peaked, not only did many people sell gold to lock in profits, but gold shops also witnessed a large number of customers making purchases.

Consequently, over the past month, SJC gold prices have adjusted by 6 million VND per tael. Gold ring prices have also witnessed a decline of 4-6 million VND per tael, depending on the brand.

Due to the significant difference between buy and sell prices (around 2-3 million VND per tael), many investors would incur substantial losses if they had bought gold at the peak and sold it at the current price. For instance, those who purchased SJC gold on April 22 and sold it now would face a loss of 8 million VND per tael. Assuming an investment of 1 billion VND in gold on that day, the investor would have lost more than 64 million VND by selling it today.

Surprising Developments in the Domestic Gold Market

The domestic gold market experienced several surprising developments last week. During a meeting with the Central Committee on Policies and Strategies, General Secretary To Lam directed a shift from an administrative mindset to a market-oriented approach with discipline. He emphasized moving from “tight control” to “open governance” and eliminating the notion of “if it can’t be managed, it should be banned.” He also stressed the need to align the gold market with market principles while ensuring state management.

Additionally, the General Secretary proposed breaking the state monopoly on gold bar brands in a controlled manner. The state would continue to manage gold bar production but could grant licenses to qualified enterprises, fostering a competitive environment. This approach would enhance supply diversity and stabilize prices. He also suggested expanding controlled import rights to increase gold supply, reduce the price gap between domestic and international markets, and curb gold smuggling across borders.

The State Bank of Vietnam also announced the results of its inspection of gold trading activities at major enterprises and banks. The inspection uncovered violations, including selling gold above the quoted price, which have been referred to the police for further investigation.

Outlook for International Gold Prices Next Week

In the international market, after a week of significant adjustments, the outlook for the coming week remains uncertain. The latest Kitco News Gold Survey showed a more balanced view among industry experts and retail traders regarding gold’s potential following a weak performance week. Optimists still outnumbered pessimists in both groups, despite the stock market’s muted response to tariff statements, which diminished a significant driver for precious metals.

In the Kitco News Gold Survey, out of 14 Wall Street analysts, six, or 43%, predicted higher gold prices for the week ahead. Four analysts, or 29%, expected lower prices, while four, or 29%, saw prices moving sideways.

Meanwhile, 2,490 votes were cast in the Kitco online survey, with retail investors slightly more optimistic after gold’s underwhelming performance. 1,633 voters, or 56%, anticipated higher gold prices in the week ahead, while 70 respondents, or 24%, predicted lower prices. The remaining 57 voters, or 20%, were neutral on gold’s short-term outlook.

Gold Prices Surge on Monday Morning, Defying Analysts’ Cautious Forecasts

Gold prices surged during the early morning trading session on Monday, June 2nd, soaring past the $3,300 per ounce mark and reclaiming the ground lost in the previous week’s trading.

“Commodity Market Update for May 30: Gold and Iron Ore Shine, While Oil, Rubber, Coffee, and Rice Dip”

The commodities market witnessed significant volatility during Thursday’s trading session as a second US court ruling blocked President Donald Trump’s administration from imposing sweeping tariffs.