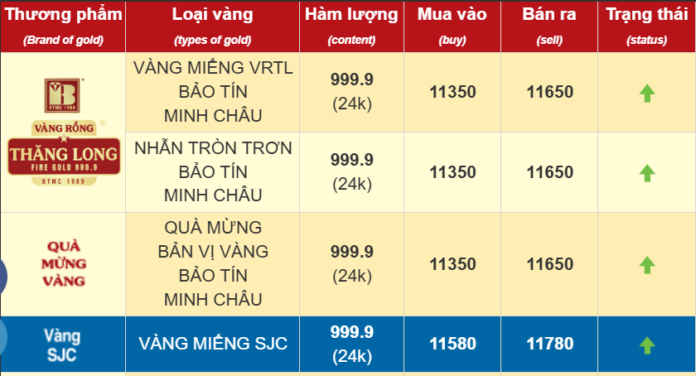

Gold prices in Vietnam witnessed a surprising U-turn on the afternoon of June 2nd, rebounding after a sharp decline earlier in the day. At 3:00 PM, SJC gold prices surged back up, with increments of up to 800 thousand VND per tael. At SJC Company, gold bullion traded at 115.8-117.8 million VND per tael, an increase of 800 thousand VND per tael compared to noon. Gold rings also saw a boost, priced at 111.2-113.8 million VND per tael.

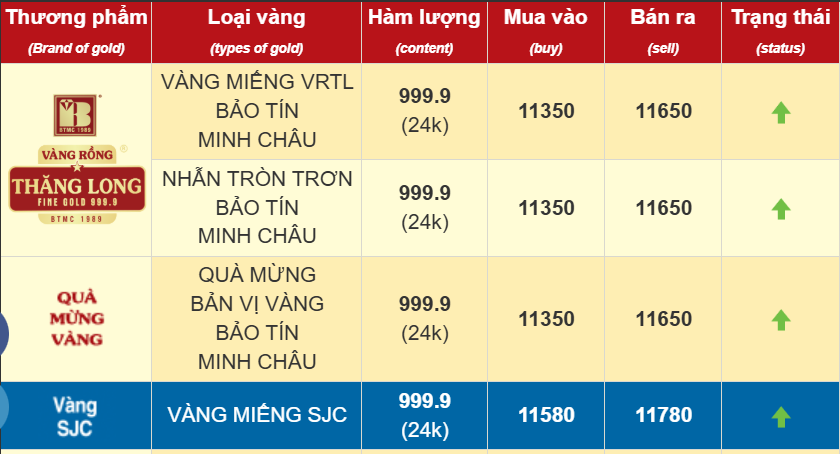

Similarly, at Bao Tin Minh Chau, SJC gold prices reversed their downward trend, climbing to 115.8-117.8 million VND per tael. Gold rings were listed at 113.5-116.5 million VND per tael.

In the international market, gold prices were also on the rise. Spot gold traded at $3,351 per ounce, a significant increase of $63 per ounce from the previous week’s close.

————————-

Update as of 10:30 AM: SJC gold prices took a significant dip, falling by approximately 0.5-1 million VND per tael. This decrease occurred despite rising international gold prices and a stable trend for plain gold rings.

Specifically, at Bao Tin Minh Chau, SJC gold prices were adjusted downward to 115.5-117.5 million VND per tael, a reduction of 500 thousand VND per tael for buyers and 1 million VND per tael for sellers.

Similarly, at SJC Company, gold bullion prices dropped to 115.5-117.5 million VND per tael, a decrease of 500 thousand VND per tael.

—————

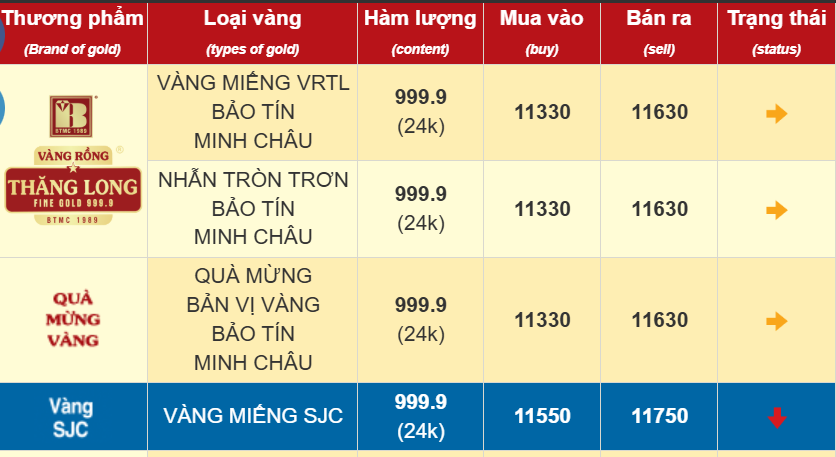

On the morning of June 2nd, domestic gold prices surged across the board compared to the previous week’s close, with SJC gold prices breaching the 118 million VND per tael mark.

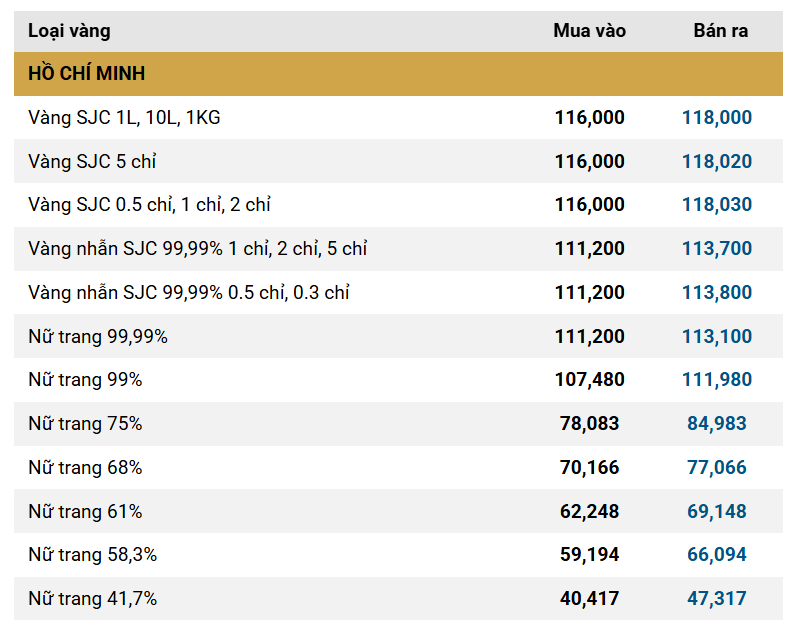

Specifically, at PNJ, SJC gold traded at 116.0-118.5 million VND per tael, an increase of 300 thousand VND per tael from the previous session. Plain gold rings with 24K purity were priced at 111.2-113.8 million VND per tael, reflecting a 700 thousand VND per tael jump for buyers and a 300 thousand VND per tael rise for sellers.

SJC Company quoted SJC gold bullion at 116.0-118.0 million VND per tael, with gold rings trading at 111.2-113.8 million VND per tael.

Bao Tin Minh Chau also raised its prices by 200-300 thousand VND per tael, listing SJC gold bullion at 116.0-118.5 million VND per tael. Plain gold rings were offered at 113.3-116.3 million VND per tael.

Towards the end of the previous week, the State Bank of Vietnam announced the results of its inspection into gold trading activities at major enterprises and banks. Consequently, information pertaining to violations, including the sale of gold at prices higher than the listed rates, was forwarded to law enforcement agencies for further investigation and resolution.

In the international arena, spot gold staged a robust recovery, reclaiming the $3,300 per ounce level. The precious metal was changing hands at $3,307 per ounce, marking a $20 per ounce ascent from the prior week’s close.

The latest Kitco News Gold Survey revealed a more balanced outlook among Wall Street analysts and retail investors regarding gold’s potential trajectory following a week of lackluster performance. Despite this, optimists continued to outnumber pessimists in both groups. The stock market’s muted response to tariff-related statements stripped gold of a significant catalyst.

Out of 14 analysts participating in the Kitco News Gold Survey, Wall Street professionals maintained a cautious stance following gold’s decline. Six analysts, constituting 43%, predicted an upward movement for gold in the upcoming week. In contrast, four analysts, or 29%, anticipated lower prices, while the remaining four analysts, accounting for 29%, foresaw a sideways market.

Meanwhile, the online survey attracted 2,490 votes from retail investors, with a slight majority leaning towards optimism after gold’s underwhelming performance. 163 respondents, equivalent to 56%, expected gold prices to climb during the week ahead, whereas 70 individuals, or 24%, projected a downward correction. The remaining 57 voters, making up 20% of the total, envisioned a period of consolidation for gold.

What’s the Deal with SJC’s Monopoly on Gold Bars Over the Past Decade?

In 2024, the volatile gold prices resulted in a significant revenue shift for SJC. The company raked in 32,193 billion VND, marking a notable surge of nearly 4,000 billion VND compared to 2023. This performance is especially noteworthy considering SJC’s previous monopoly on gold bullion, during which it boasted revenues surpassing 72,000 billion VND.

Gold Prices Plummet as Trump’s Tariffs are Blocked

The direct cause of the sharp drop in gold prices during the Asian session this morning was the news of legal hurdles facing Trump’s retaliatory tariff plans.