In a recent update, Mirae Asset Securities (MASVN) noted that global markets turned broadly higher after President Trump delayed tariffs on imports from the European Union. This reprieve, however, is seen as a strategic move by the US to increase negotiating power, as Trump’s tariff decisions face legal challenges ahead.

This dynamic leaves trade negotiations and deals uncertain as the 90-day tariff delay period ends, with the EU and China maintaining their tough stances and readiness to retaliate against US goods.

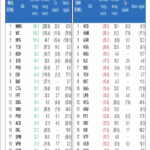

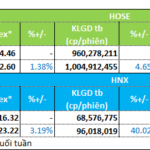

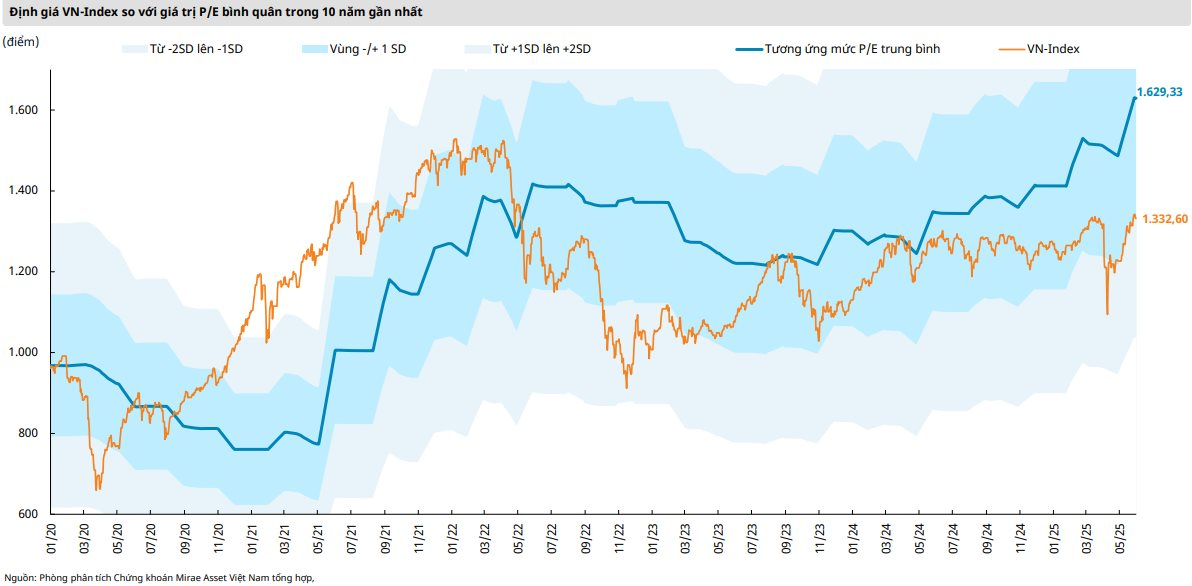

Back home, the VN-Index posted its fourth consecutive weekly gain, mirroring the previous week’s performance as buying interest cooled off in the final sessions when the market surpassed the 1,340-point resistance level. To start the month of June, the VN-Index edged slightly higher to 1,336.3 points.

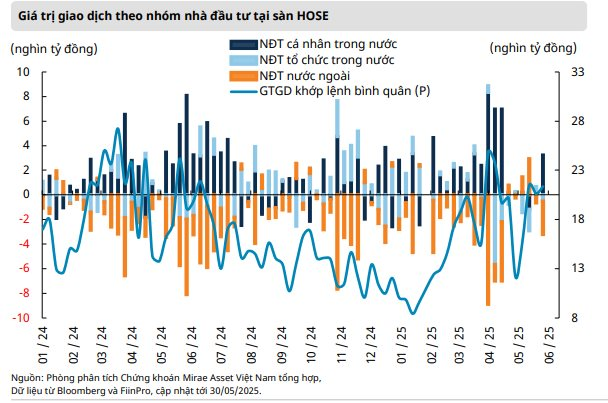

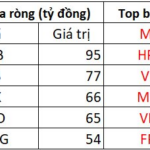

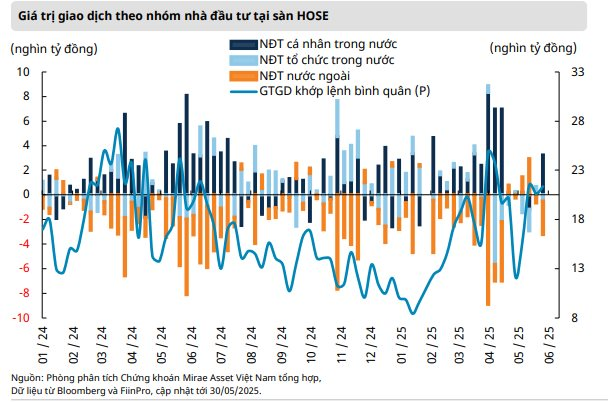

Year-to-date, foreign investors have net sold nearly VND39 trillion, with selling pressure spread across stocks like HPG, STB, and VCB, while buying focused on NVL, VHM, and NLG.

New support expected at 1,310-1,320 points

Despite the market surpassing expectations by conquering the 1,340-point peak, Mirae Asset believes that recent fluctuations are not indicative of a mid to long-term downward trend but rather reflect the cyclical nature of the market.

Notably, the VN-Index successfully broke through the peak after the tariff shock in early April, registering a 106-point gain throughout May (+8.67% month-over-month) despite ongoing trade negotiation uncertainties.

In the near term, MASVN analysts anticipate corrective phases in upcoming sessions to establish a new equilibrium for June, with support expected at 1,310–1,320 points before resuming the uptrend.

However, Mirae Asset maintains a cautious stance in the short term due to persistent sectoral divergence and the recent rally being largely driven by Vingroup stocks. Additionally, the sharp short-term surge warrants consolidation before sustaining the mid to long-term uptrend.

“Hence, the June rally will depend on the diffusion of cash flow to various sectors along with the return of large-cap, leading stocks in sectors such as Banking, Retail, and Technology,” the report emphasized.

The Stock Market in June: What to Expect After a Brilliant May

The VN-Index ended May with the strongest gain since the beginning of the year, but it now faces profit-taking pressure at the old peak. Analysts remain cautious, suggesting that the market will continue its accumulation trend to absorb profit-taking selling pressure while awaiting new supportive information.

The Big Property Player: Individual Nets 1.2 Trillion VND Buying Real Estate Stocks

Today, individual investors recorded a net buy of 1,219.2 billion VND, including a net buy of 940.5 billion VND in matched orders. Focusing on matched orders, they net bought in 12 out of 18 sectors, mainly in the Real Estate industry.