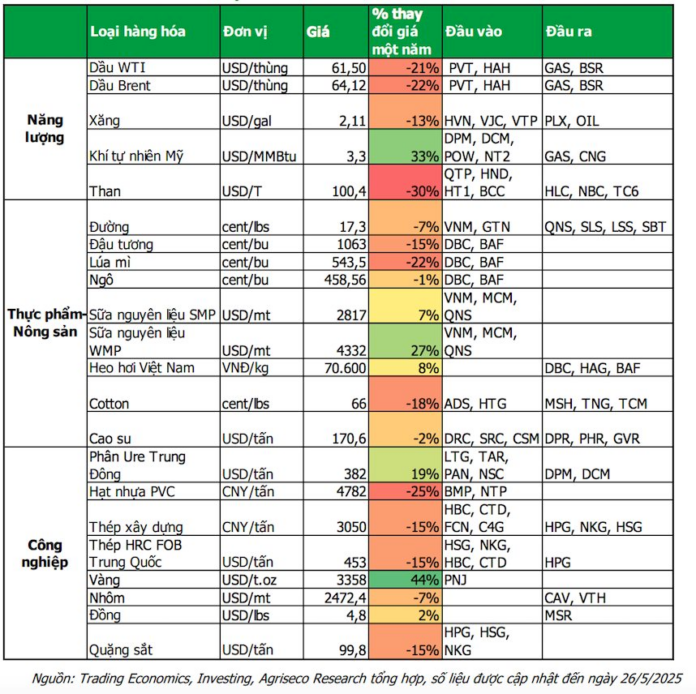

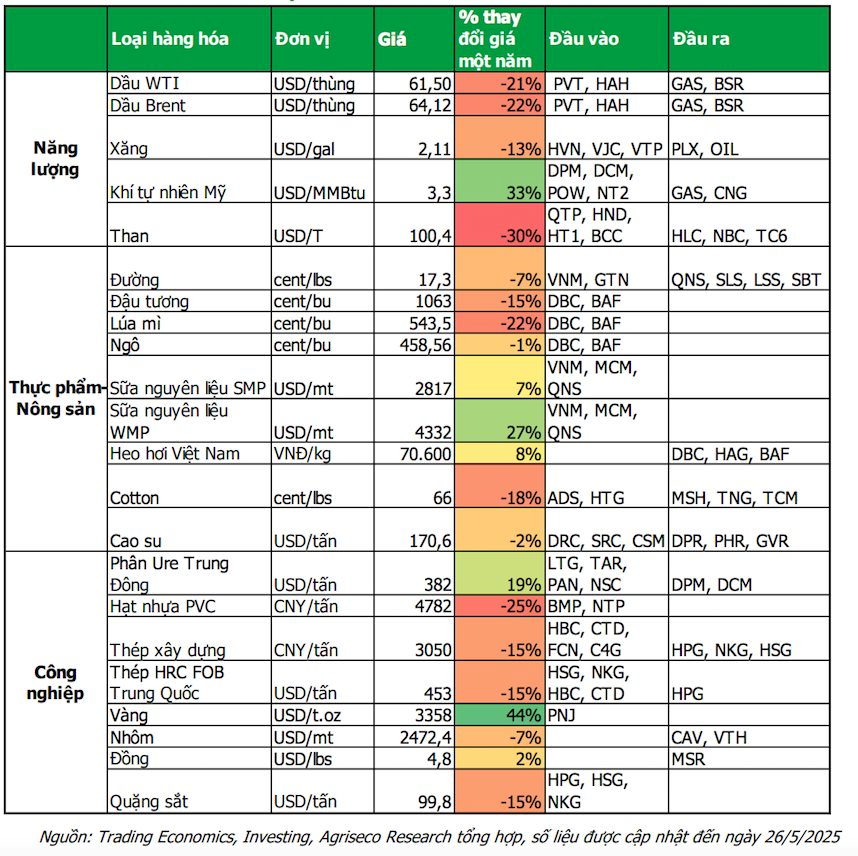

As we move into 2025, global commodity prices saw a slight increase at the beginning of the year but took a sharp downturn in April, influenced by factors such as economic slowdown and increasing supply.

With a high degree of openness in import-export activities, many domestic enterprises, especially those in sectors with a high proportion of raw material input costs, are experiencing certain impacts from this fluctuation.

In their latest update, Agriseco Research provides an assessment of stocks that are likely to benefit from changing commodity prices.

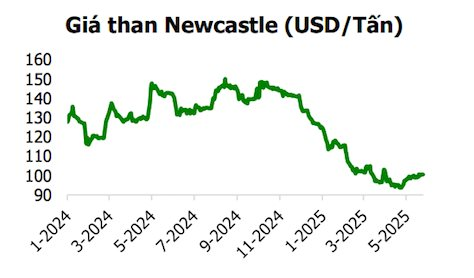

Regarding energy prices, the analytical team forecasts a decrease in crude oil, coal, and gasoline prices in 2025, while natural gas prices are expected to maintain an upward trend.

Thanks to the decline in Newcastle coal prices, Quang Ninh Thermal Power JSC (QTP) is expected to improve its gross profit margin. According to Agriseco, QTP solely relies on blended coal as its input material, and the proportion of blended coal is high due to the limited domestic coal supply.

However, the gross profit margin can be improved due to the significant drop in global coal prices, which are now over 31% lower than the same period last year and remain low. As a result, TKV can adjust the blended coal price downwards while maintaining high electricity selling prices.

Moreover, the country’s electricity demand is expected to be high, especially during the dry season, benefiting QTP. According to statistics, the electricity load has a growth rate of over 1.5 to 1.8 times the GDP growth rate (year-on-year). With the government’s target of a minimum 8% GDP growth, Agriseco estimates a load growth of about 12% in 2025, which will be even higher during the dry season. Therefore, coal-fired power plants will continue to be prioritized for dispatch.

In terms of oil prices, the World Bank forecasts that Brent crude oil prices will drop by 20% compared to the average of 2024, reaching $64 per barrel in 2025 and further decreasing to $60 per barrel in 2026.

For gas prices, currently at $3.67 per MMBtu, there has been a 33.4% increase compared to the same period last year due to higher LNG demand from Asia and Europe and supply disruptions from Russia and Algeria. According to the EIA, gas prices are expected to increase by 86% in 2025 compared to the average of 2024, reaching approximately $4.1 per MMBtu, equivalent to a 12% increase from the current price, and a further 17% rise in 2026.

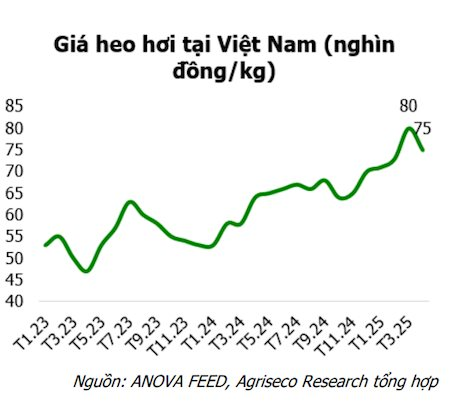

Regarding agricultural commodities, Agriseco forecasts an increase in Vietnamese hog and raw milk prices, while sugar, soybeans, wheat, and cotton prices are expected to decline.

With wheat, corn, and soybean prices continuing their downward trend, the analytical team predicts an improvement in Dabaco’s (DBC) gross profit margin. The potential for growth also comes from the expectation that hog prices will remain high and are unlikely to drop in the near future due to increasing demand as the tourism and services industry recovers in 2025, along with the complex disease situation.

On the other hand, Agriseco mentions that global sugar prices are in a long-term downward trend due to expectations of increasing supply from favorable weather and expanded sugarcane planting areas in Brazil and Thailand, along with India’s relaxed restrictions on sugar exports. For domestic sugar prices, a slight decrease is expected due to a 20% rise in sugar production this year compared to the previous year, and high sugar inventories resulting from competition with smuggled sugar and weak consumption.

Similarly, cotton prices are forecasted to continue declining in the coming period due to a projected global cotton production surplus for the 2024/25 crop year, outpacing demand, and the impact of new US tariffs. Meanwhile, the World Bank predicts rubber prices will reach 200 cents/kg in 2025, a 14% increase from the previous year. However, this projection faces significant risks from trade measures that could affect the growth of global automobile production.

Additionally, the analytical team predicts that hog prices will remain high and are unlikely to drop significantly due to the re-emergence of African Swine Fever (ASF) and foot-and-mouth disease in some areas across the country.

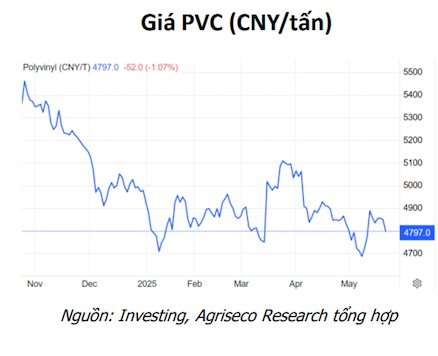

Regarding industrial commodities, firstly, the analytical team observes that global PVC resin prices dropped sharply in mid-April in both Asia and the US due to trade tensions and falling oil prices. However, prices recovered by over 2% in May amid low inventory levels and the temporary tariff agreement between the US and China on May 12, 2025.

In the short term, Agriseco forecasts that PVC prices may continue to face downward pressure due to weak demand from the real estate and automotive sectors in an uncertain environment, coupled with increased supply from Shin-Etsu Chemical, which restarted its plant in the Netherlands on May 21, 2025, after completing maintenance with an annual capacity of 450,000 tons of PVC.

Consequently, an expansion in Binh Minh Plastic JSC’s (BMP) gross profit margin is anticipated in the coming quarters. Additionally, BMP benefits from the recovery of the domestic real estate market. The demand for construction materials, especially plastic pipes, has significantly increased due to the rising number of commercial housing projects under development compared to the same period last year and the acceleration of key public investment projects. With a market share of over 25% and a nationwide distribution system, BMP expects to achieve a 10% growth in revenue in 2025.

For yellow phosphorus, the analytical team predicts that prices will remain stable in the coming period as global yellow phosphorus consumption in 2025 is expected to grow only slightly by about 2–3% compared to 2024, driven by the LFP battery industry for electric vehicles.

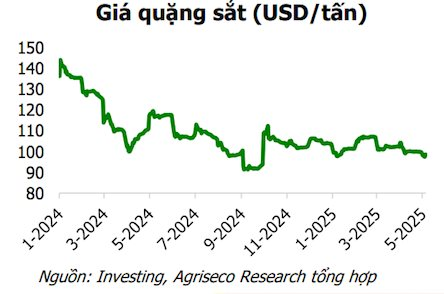

Regarding Chinese rebar prices, they have dropped by 14.5% year-on-year and 6% since the beginning of the year due to the sluggish real estate market. Rebar prices in China are expected to continue declining due to policy changes in home purchases, which threaten construction prospects, and weak demand.

In Vietnam, steel prices have decreased by nearly 3% year-on-year, a slight increase from the previous month, thanks to robust domestic demand and Vietnam’s anti-dumping measures on HRC and coated steel from China. The analytical team expects domestic steel prices to rise in the latter part of the year due to accelerated public investment and a recovering real estate market.

Agriseco assesses that Hoa Phat Group (HPG) will continue to improve its gross profit margin thanks to the decrease in raw material input costs. Iron ore and coke prices are expected to remain low and decline in 2025 due to stable supply and weak demand. Meanwhile, domestic steel prices are projected to increase in the second half of 2025 due to real estate market demand and anti-dumping duties on Chinese steel, improving profit margins for businesses.

The Sizzling Heat Continues: Northern Vietnam’s Power Consumption Soars to New Heights

The scorching heat in the North and Central regions of the country has caused a surge in electricity consumption, with the national and northern regions reaching a new record high. The peak power demand hit an unprecedented 51,290 MW, showcasing the immense strain on the power grid due to the intense weather conditions.

The Rising Cost of Electricity: A Necessary Evil?

The Vietnam Electricity Group (EVN) has announced an increase in the average retail electricity price to 2,204 VND/kWh (excluding value-added tax or VAT) starting tomorrow, May 10.