According to the General Statistics Office, the country’s gross domestic product (GDP) in Q1 2025 is estimated to have increased by 6.93% compared to the same period last year, reaching the highest growth rate compared to Q1 in the years between 2020 and 2025. Against this backdrop, the non-life insurance business has yielded positive results, with insurance premium revenue estimated at VND 22,014 billion, up 10.6% year-on-year.

Stable growth in insurance premium revenue continues.

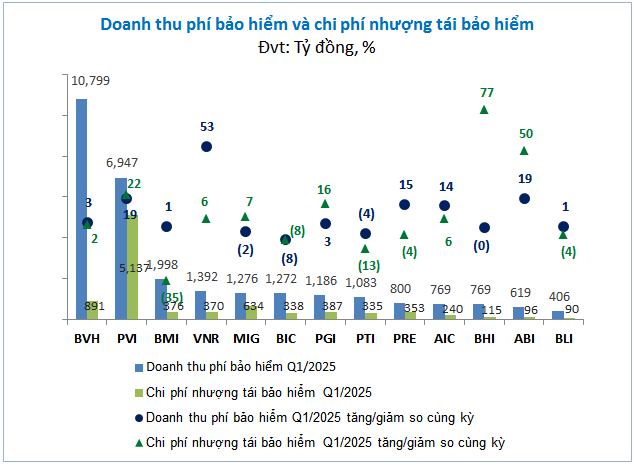

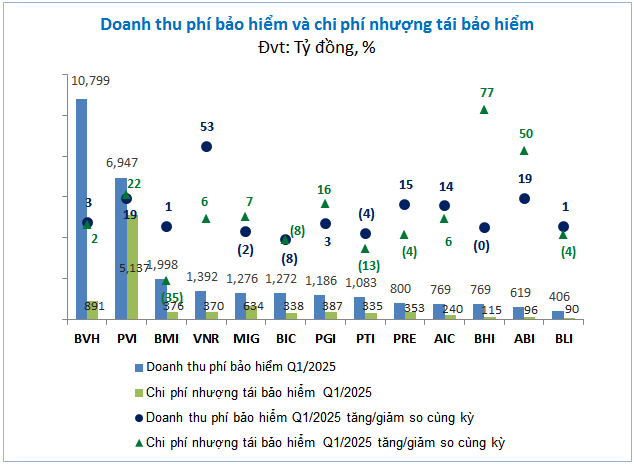

Economic growth leads to improved income and spending of the people, boosting insurance demand. VietstockFinance data shows that in Q1 2025, insurance premium revenue (original and reinsurance accepted) of 13 non-life insurance companies reached VND 29,316 billion, up 8% over the same period last year.

Source: VietstockFinance

|

However, reinsurance cession expenses increased by 10%, causing net insurance revenue to increase by only 6%, reaching VND 20,759 billion.

Source: VietstockFinance

|

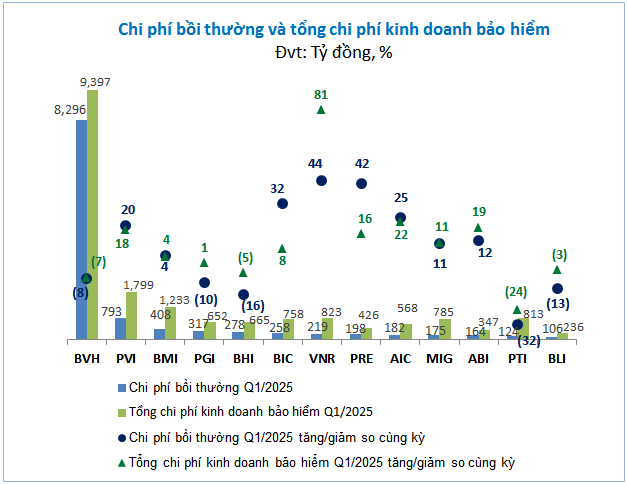

The pressure of compensation costs decreased by 4%, to VND 11,518 billion, helping to maintain the total insurance business expenses at VND 18,502 billion, almost unchanged from the previous year.

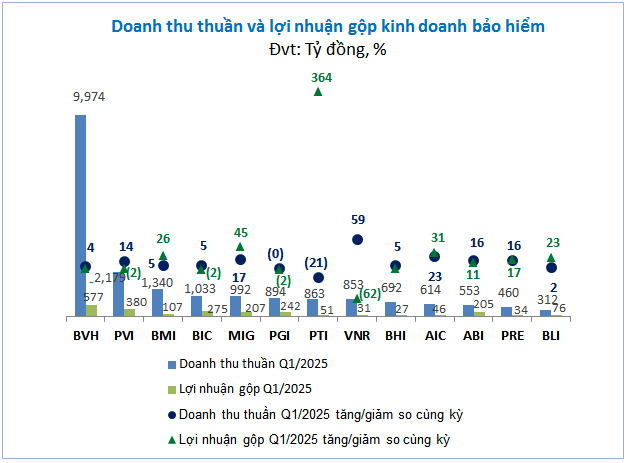

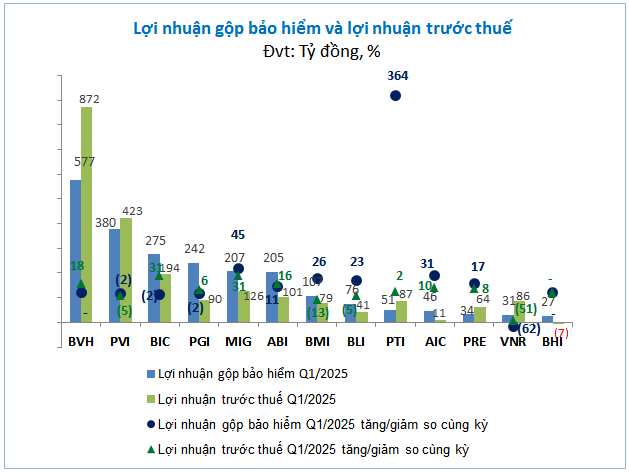

Thanks to the increase in revenue while keeping costs stable, the gross profit from the insurance business of the 13 enterprises reached VND 2,258 billion, doubling that of Q1/2024.

Source: VietstockFinance

|

Of which, BVH led with a gross profit of VND 577 billion, followed by PVI (VND 380 billion). Enterprises with profits of over VND 200 billion included BIC (VND 275 billion), PGI (VND 242 billion), MIG (VND 207 billion), and ABI (VND 205 billion).

In terms of growth rate, PTI took the lead with a gross profit of VND 51 billion, 4.6 times higher than the low base of VND 11 billion in the same period last year. MIG ranked second with a 45% increase, reaching VND 207 billion.

On the contrary, despite recording a 53% surge in reinsurance accepted premium revenue to VND 1,392 billion, VNR’s gross profit from insurance business plummeted by 62% to VND 31 billion. The main reason was a 44% rise in compensation costs to VND 219 billion, causing total insurance business expenses to soar by 81% to VND 823 billion.

Financial operations faced setbacks due to unattractive deposit channels.

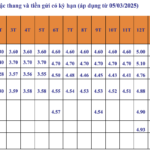

With the target of credit growth in 2025 of over 16% and economic growth of 8%, maintaining low lending rates is an important goal that the State Bank of Vietnam (SBV) aims for. Therefore, since the beginning of this year, commercial banks have been requested to control deposit interest rates to limit transmission to lending rates.

According to a report from the SBV, by the end of Q1/2025, the average lending interest rate decreased by 0.4% compared to the beginning of the year, while the deposit interest rate edged up slightly by 0.08%. The increase in deposit interest rates compared to the beginning of the year was mainly from small-scale commercial banks, but most banks have reduced interest rates since the issuance of Dispatch No. 19/CD-TTg dated February 24, 2025 (the Prime Minister requested the SBV to immediately inspect commercial banks that adjusted deposit interest rates upward).

About 60% of the investment portfolio of listed non-life insurance companies are short-term deposits (3-12 months), and the decline in interest rates has reduced interest income from deposits, which account for a large proportion of financial profits.

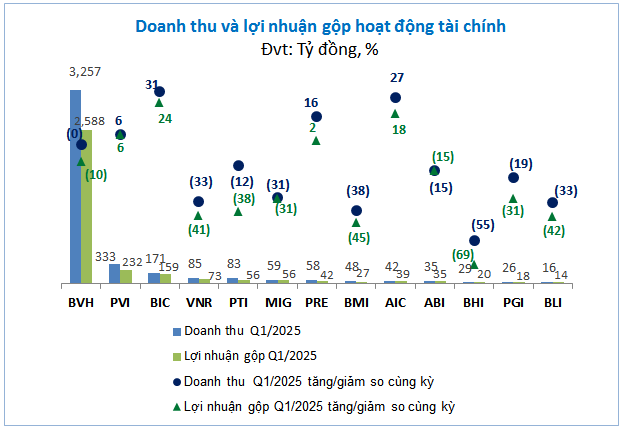

In Q1, 13 non-life insurance companies recorded a 2% year-on-year decrease in total financial revenue to VND 4,242 billion. Meanwhile, financial expenses surged by 61% to VND 883 billion, causing the financial profit of the group to drop by 11% to VND 3,359 billion.

Except for a few enterprises with positive results thanks to exchange rate differences or profits from securities such as AIC (up 18%), BIC (up 24%), PVI (up 6%), and PRE (up 2%), most of the remaining companies experienced a decline in financial profit due to weakened income from bank deposits.

Some notable decreases include BMI (-45%), BLI (-42%), VNR (-41%), PTI (-38%), MIG, and PGI (both down 31%)…

Source: VietstockFinance

|

In the context of declining interest rates, Mr. Pham Van Hiep, Director of Investment Department of Baominh Insurance Corporation, said at the 2025 Annual General Meeting of Shareholders that the company would significantly adjust its investment portfolio structure this year.

Specifically, Baominh plans to reduce the proportion of bank deposits from 84% in 2024 to 59% in 2025. At the same time, the company will increase the proportion of investment in stocks to 15% (compared to 3.5% in 2024), invest 13% in bonds (up from 5.2%), and for the first time include entrusted investment in the portfolio with a ratio of 5%.

However, Mr. Hiep emphasized that Baominh would also be cautious in allocating investment funds gradually into stocks based on the stock market’s positive developments, while preparing plans to manage risks when shifting from fixed-income investment forms to higher-yielding but riskier channels.

Also, at the Annual General Meeting of Shareholders, Mr. Dinh Viet Tung, Chairman of the Board of Directors of Baominh Insurance Corporation, stated that in the insurance business model, the main source of profit is not from the original insurance business but from investing idle cash flows.

According to Mr. Tung, Baominh’s investment activities in recent years have not been truly outstanding compared to some enterprises in the same industry, but there have been positive changes. The company’s management has also worked with professional investment funds to research and deploy entrusted investment activities to improve the efficiency of stock and fixed-income product investments.

“In the context of a volatile market, we limit direct investment in stocks because this field requires high professionalism and capital risk. When the market is favorable, Baominh has invested in bank bonds to improve profits. In the future, if the market continues to develop positively, we will consider expanding our investment in corporate bonds, giving priority to banks or enterprises with a stable foundation. Stock investment activities will also be implemented through entrustment to professional investment funds. On the contrary, if the market is unfavorable, Baominh will continue to prioritize the deposit channel to ensure capital safety and profits for shareholders and customers,” said Mr. Tung.

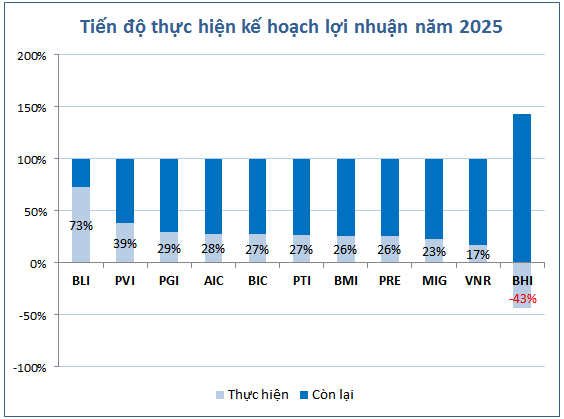

The first enterprise to reach 73% of the annual profit target.

Source: VietstockFinance

|

Despite the strong growth in core business profits, the pre-tax profit of the group of non-life insurance companies in Q1 increased slightly due to a decline in financial profit and a 21% increase in management expenses to VND 3,008 billion. As a result, the pre-tax profit of the industry reached VND 2,167 billion, up 6% over the same period last year.

BVH continued to lead with the highest pre-tax profit in the industry and an 18% growth rate compared to the same period. PVI ranked second in profit value but recorded a slight decrease of 2%.

In terms of growth rate, BIC and MIG were the two outstanding names, with pre-tax profits increasing by 31%, the highest growth rate in the group, reaching VND 194 billion and VND 126 billion, respectively.

On the contrary, BHI was the only enterprise in the industry to report a loss in Q1, with a loss of VND 7 billion, as the gross profit from both insurance and financial activities was insufficient to offset management expenses.

VNR also recorded unfavorable results, with a sharp decline in pre-tax profit due to the negative impact of both insurance and financial activities.

Source: VietstockFinance

|

The enterprise that caused the biggest surprise was Baolong Insurance Corporation (BLI). Although its pre-tax profit in Q1 decreased by 5% over the same period to VND 41 billion, thanks to setting a lower profit plan for 2025 than the previous year (down 32%), BLI achieved 73% of its annual profit target after just the first quarter, the highest in the industry.

What are the prospects for insurance revenue and financial profit growth?

According to KBSV Securities Company, commercial banks may face liquidity pressure in the context of promoting disbursement to meet high credit growth targets. However, with a flexible exchange rate policy, the SBV still has room to support the liquidity of the banking system. Thanks to this, the deposit interest rate is generally maintained stable at a low level, reducing capital competition pressure, which is in line with the monetary policy orientation to support economic growth.

However, in the long run, KBSV noted that the risk of trade policy fluctuations could put pressure on macroeconomic management. In the scenario of exchange rates and inflation rising above 4%, maintaining low-interest rates will become challenging. According to the forecast scenario, the deposit interest rate may increase by 1-2 percentage points, while the lending rate will increase slightly and more slowly than the deposit interest rate, about 0.5-1 percentage points.

For non-life insurance companies, which have a large investment portfolio in deposits, the increase in deposit interest rates will positively affect financial income, especially income from deposit interest.

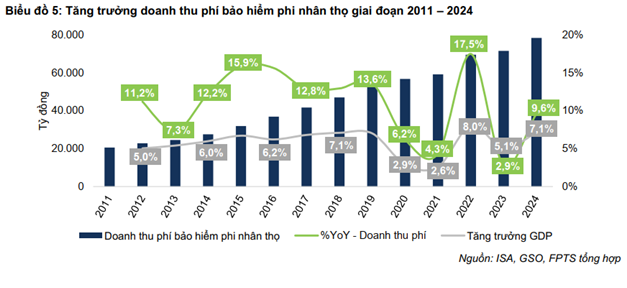

Regarding the prospects for insurance revenue growth, FPTS Securities Company assessed that the growth potential of the non-life insurance market remains significant, especially in health insurance and motor vehicle insurance segments.

Data from FPTS shows that non-life insurance premium revenue in Vietnam grew at a compound annual growth rate (CAGR) of 10%/year in the 2011-2024 period, in line with GDP growth trends. In 2023 alone, the total market revenue reached VND 71,439 billion, up 3% – a slower increase than GDP (5%) due to the impact of the crisis of trust after irregularities in the bancassurance distribution channel.

In the 2025-2029F period, FPTS forecasts an average growth rate of 11.3%/year for non-life insurance revenue, with a CAGR of 9.1%. The driving force comes from the expected stable GDP growth of 6.1-6.6%/year and improved per capita income.

Notably, the non-life insurance penetration rate in Vietnam is currently only about 0.7% of GDP, lower than that of many countries in the region. This is a significant room for market expansion in the medium and long term.

Khang Di

– 12:00 01/06/2025

Unveiling the Mastermind Behind the Success of Chu Lai Open Economic Zone

“Chu Lai Industrial Infrastructure Development Company Limited (Cizidco) has recently released its 2024 audited financial statements, offering a glimpse into the company’s financial performance and strategic direction.”

The Insiders’ Rush to Scoop up TDM Shares Amidst High Prices

“In a show of strong confidence, key stakeholders and insiders associated with the TDM leadership collectively snapped up over 2 million shares in May and June. This move comes amidst a backdrop of a remarkable recovery for the stock, which has more than doubled in value since hitting rock bottom in late 2022.”

“Bank Interest Rates on May 28: Unveiling the Top-Tier Institutions with the Highest Yields”

With a substantial deposit to invest, ranging from hundreds of billions to trillions of VND, customers can now take advantage of an attractive interest rate of 7.5%-9.65%. This opportunity is presented by four prominent banks: ABBank, PVcomBank, HDBank, and Vikki Bank. It’s time to make your money work harder for you!

Latest SHB Bank Interest Rates for May 2025: Which Term Deposit Offers the Best Rates?

“In May 2025, SHB offered its highest interest rates to individual customers who deposited their money online for 36 months or more.”