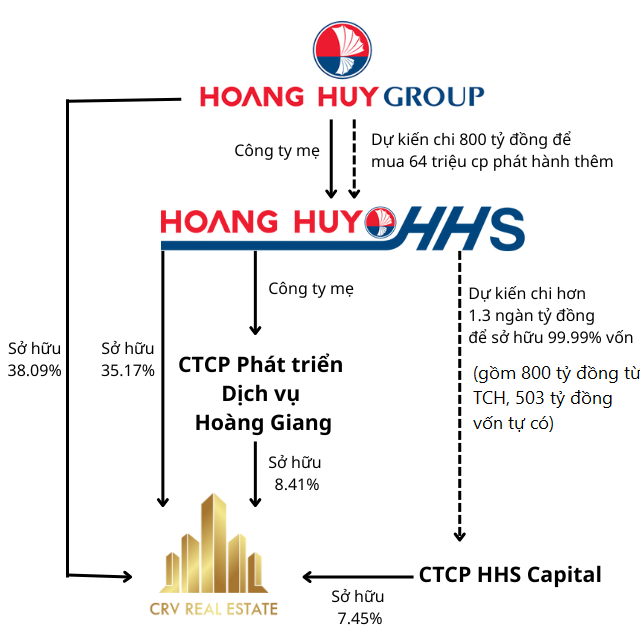

With an offering price of VND 12,500/share, TCH needs to spend VND 800 billion on the deal to purchase 64 million HHS shares. After the transaction, TCH‘s ownership in HHS will increase from 51.06% to 58.31%, equivalent to nearly 252 million shares.

The fact that TCH was the sole investor in HHS‘s private placement of 64 million shares was approved by the HHS Annual General Meeting of Shareholders in April 2025.

HHS will use the proceeds to purchase shares of HHS Capital from existing shareholders. Specifically, HHS plans to spend more than VND 1,300 billion to acquire nearly 50.1 million HHS Capital shares (equivalent to 99.99% of capital), of which nearly VND 503 billion will come from HHS‘s own capital, and the remaining VND 800 billion from the above-mentioned share offering.

The goal of acquiring HHS Capital is for HHS to directly and indirectly own 51.03% of the shares of CRV Real Estate Group Joint Stock Company – currently a subsidiary of TCH and an associate of HHS.

The plan to increase ownership in CRV was also approved by the HHS Annual General Meeting of Shareholders in April 2025, aiming to increase HHS‘s interest in CRV, as it is expected to yield positive financial results in the coming period due to its initiation of investments in large and potential projects.

Currently, 81.67% of CRV‘s capital is owned by a group of shareholders, including TCH (38.09%), HHS (35.17%), and HHS‘s subsidiary, Hoang Giang Service Development Joint Stock Company (8.41%).

|

Ownership structure between Hoang Huy Group and CRV

Compiled by the author

|

What does CRV have to offer?

According to the additional issuance prospectus in 2022, CRV was formerly known as Hung Viet Trading Joint Stock Company, established in 2006 with a charter capital of VND 5 billion, which increased to nearly VND 6,600 billion in 2020. The current legal representative and General Director is Ms. Pham Thi Thu Huyen, who served as Chief Accountant of CRV from 2016 to 2020. Prior to that, she was Deputy Chief of Finance and Accounting at the Waterway Transport Corporation (under the Ministry of Transport) and Chief Accountant of Hanoi Port from 2014 to 2016.

TCH joined and became the parent company of CRV in 2007 when CRV needed additional capital to invest in real estate projects. Today, CRV is a developer and distributor in numerous real estate projects. Mr. Do Huu Ha, Chairman of TCH, also serves as Chairman (non-executive) of CRV.

At the time of the prospectus, CRV had one subsidiary, Dai Thinh Vuong Construction Joint Stock Company (99% ownership) – the investor of the Hoang Huy – So Dau project in Hai Phong city.

According to HHS, from 2020 to the present, CRV has developed several real estate projects in Hai Phong city, such as Hoang Huy – So Dau with a total investment of nearly VND 1,500 billion, Hoang Huy Commerce (H1 tower) with a total investment of over VND 3,700 billion, and Hoang Huy New City II with a total investment of nearly VND 15,100 billion.

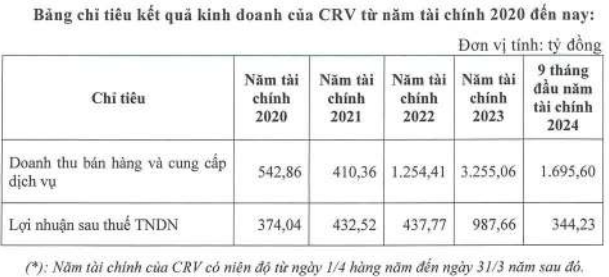

As of December 31, 2024, CRV had a chartered capital of over VND 6,700 billion. Total assets were nearly VND 9,200 billion, with payables of over VND 1,300 billion. The company’s fiscal year runs from April 1 to March 31 of the following year. Accordingly, in the 2023 fiscal year (April 1, 2023, to March 31, 2024), CRV recorded a consolidated after-tax profit of nearly VND 988 billion, the highest since 2020 and double the previous year. In the first nine months of the 2024 fiscal year (April 1, 2024, to December 31, 2024), the company posted a consolidated after-tax profit of over VND 344 billion.

Source: HHS

|

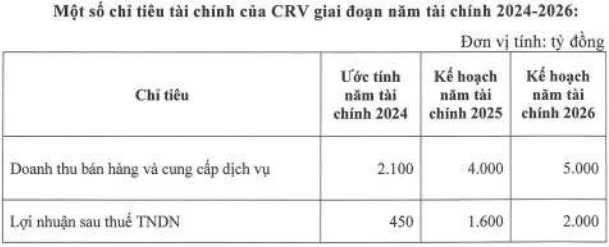

HHS expects CRV to continue to be profitable in the 2025-2026 fiscal year as its key project, Hoang Huy New City, starts recognizing revenue and profits.

Source: HHS

|

Notably, the Ho Chi Minh City Stock Exchange (HOSE) announced that it had received the listing registration dossier of CRV in June 2024. However, the company withdrew its listing registration with the reason of needing time to update, review, and finalize the listing registration dossier. Up to now, CRV has not provided any new information regarding its listing plan.

Did HHS Capital shareholders make a 160% profit in just over two months?

According to HHS, HHS Capital owns 7.45% of CRV‘s shares. If HHS acquires this company, its ownership in CRV will increase from 43.58% to 51.03%.

HHS Capital is introduced as a company specializing in real estate consulting, brokerage, and auction, as well as land-use rights auction. Its headquarter is located in Le Chan district, Hai Phong city. As of March 31, 2025, the company’s charter capital was VND 501 billion, and it had no payables.

HHS Capital was recently established on March 31, 2025. The founding shareholders include 10 individuals: Mr. Mai Tuan Anh (4.638%), Mr. Nguyen Thanh Nam (9.162%), Mrs. Nguyen Thi My Hanh (8.662%), Mr. Tran Kim Chung (10.926%), Mr. Truong Van Son (10.399%), Mr. Dao Ngoc Long (11.106%), Mrs. Du Thi Huyen Trang (11.176%), Mr. Nguyen Van Hai (9.261%), Mrs. Dao Ngoc Phuong (13.389%), and Mrs. Nguyen Thu Hang (11.281%). The legal representative and General Director is Mr. Do Tien Dung.

If calculated based on the par value (VND 10,000/share), 7.45% of CRV‘s shares, equivalent to nearly 50.1 million shares, are worth approximately VND 501 billion. Thus, the entire charter capital of HHS Capital (par value) is equivalent to 50.1 million shares of CRV.

On the other hand, according to the plan, HHS will spend more than VND 1,300 billion to acquire nearly 50.1 million shares of HHS Capital, equivalent to a purchase price of VND 26,000/share, VND 16,000 higher than the par value of VND 10,000/share.

– 20:18 03/06/2025

“TCH Finalizes Plans to Issue Over 200 Million Shares, Focusing on Two Major Projects in Haiphong”

The Hoang Huy Finance Investment Joint Stock Company (HOSE: TCH) convened an extraordinary general meeting for the 2025 financial year to approve a plan to increase its charter capital to nearly VND 8,700 billion. This move aims to bolster the company’s resources for two key real estate projects in Hai Phong.