Who are the two new groups eligible for one-time social insurance withdrawal from July 2025?

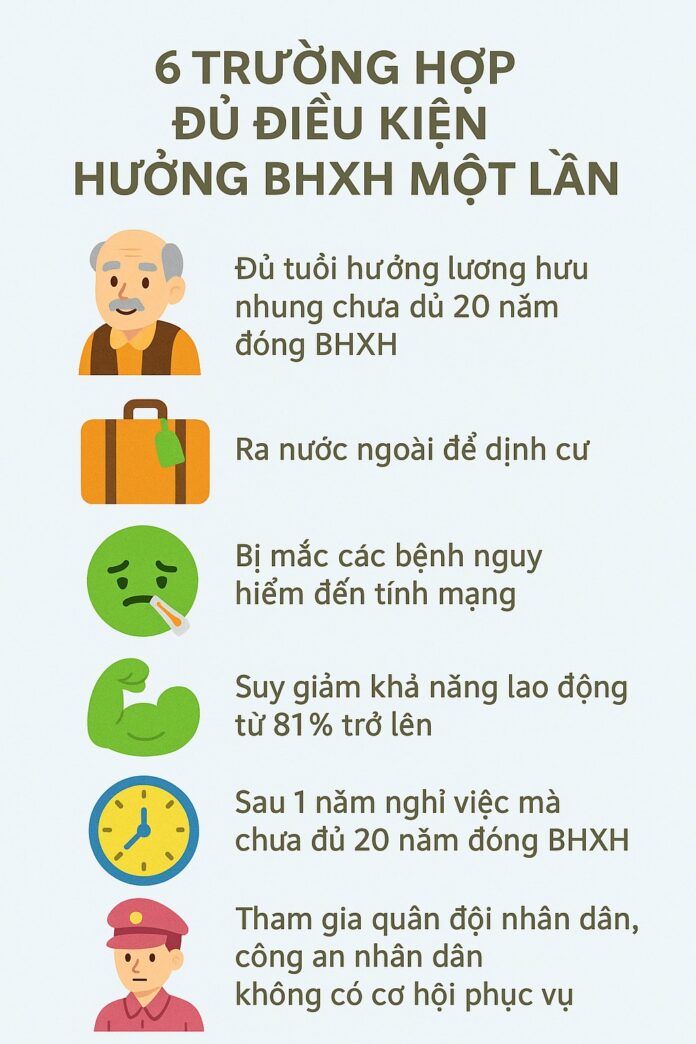

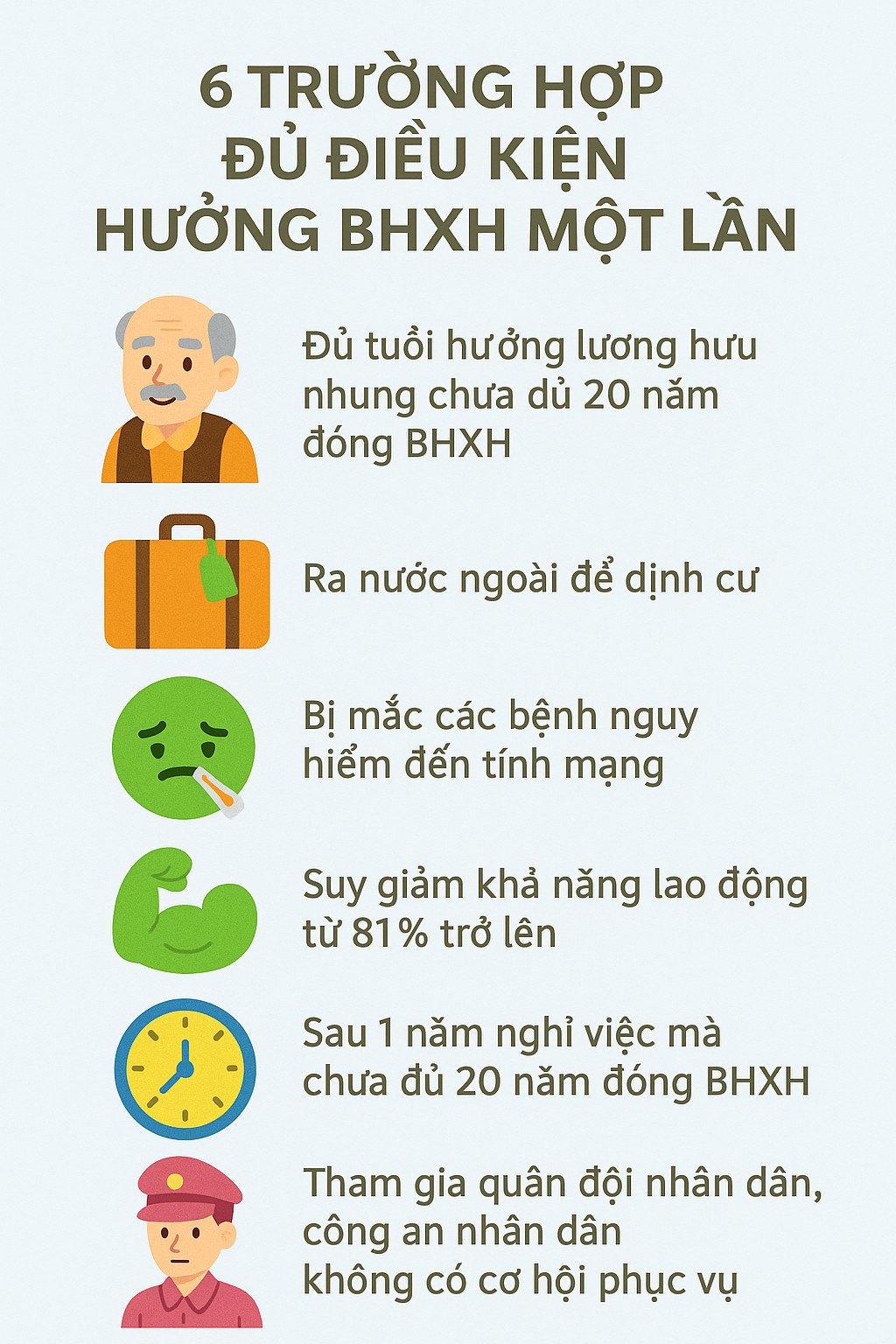

Starting July 1, 2025, the Social Insurance Law of 2024 will take effect, replacing the Social Insurance Law of 2014. According to Clause 1, Article 70 of the Social Insurance Law 2024 (effective from July 1, 2025), the subjects eligible for one-time social insurance withdrawal from July 1, 2025, include:

– Individuals who have reached retirement age but have not contributed to social insurance for at least 15 years.

– Those who emigrate to another country for permanent residence.

– Individuals with a certified loss of working capacity of 81% or more; or those with severe disabilities.

– People suffering from cancer, paralysis, decompensated cirrhosis, severe tuberculosis, or AIDS.

– Employees who have contributed to social insurance before July 1, 2025, and have not participated in social insurance for one year after leaving their job, with total contributions of less than 20 years.

– Officers, non-commissioned officers, and full-time militia members who are discharged, demobilized, or dismissed and do not fall under the category of mandatory social insurance participants, nor do they voluntarily participate in social insurance, and do not meet the conditions for retirement.

Thus, the subjects eligible for one-time social insurance withdrawal from July 1, 2025, have the following new points:

(i) The addition of two new groups eligible for one-time withdrawal: those with a certified loss of working capacity of 81% or more and individuals with severe disabilities.

(ii) Individuals with leprosy are no longer eligible for one-time social insurance withdrawal.

(iii) Employees who have reached retirement age but have contributed to social insurance for less than 15 years and choose not to continue participating will be eligible for one-time withdrawal, instead of the current requirement of less than 20 years.

(iv) Employees who start participating in social insurance from July 1, 2025, and leave their job after one year, choosing not to continue social insurance contributions, will not be eligible for a one-time withdrawal if their total contribution period is less than 20 years.

Changes to the deadline for receiving one-time social insurance payment from July 1, 2025

Based on Clause 3, Article 79 of the Social Insurance Law of 2024 (effective from July 1, 2025), and Clause 4, Article 110 of the Social Insurance Law of 2014, the regulations regarding the deadline for receiving one-time social insurance payments are as follows:

|

Before July 1, 2025 |

From July 1, 2025 |

|

Within 20 days from the date of receiving complete dossiers as prescribed for retirees or within 10 days from the date of receiving complete dossiers for one-time social insurance benefit recipients, the social insurance agency shall be responsible for settlement and payment to the employee. If not settled, a written reply with a clear reason must be provided. |

Within 20 days, excluding holidays and weekends, from the date of receiving complete dossiers as prescribed for retirees or within 7 working days from the date of receiving complete dossiers for one-time social insurance benefit recipients, the social insurance agency shall be responsible for settlement; if not settled, a written reply with a clear reason must be provided. |

Thus, before July 1, 2025, employees would receive their one-time social insurance payment within 10 days from the date the social insurance agency receives the complete dossier. From July 1, 2025, employees will receive their payment within 7 working days from the date the social insurance agency receives the complete dossier.