In the previous period, personal credit growth typically outperformed with a rate of 18-22% per year, while corporate credit remained at around 10-12%. However, from 2023 to 2024, the trend shifted significantly: personal credit increased by 11-15%, while corporate credit growth exceeded 18%. This development reflects a clear shift in the entire industry – from retail growth to the corporate sector. This trend aligns with Vietnam’s economic context, aiming for high GDP growth (7-8% per year), encouraging businesses in production, trade, and services to increase investment and expand their operations. As a result, the capital demand from enterprises has increased significantly, naturally driving banks with a focus on corporate lending strategies.

However, corporate lending is a challenging segment, requiring strong assessment capabilities, industry-specific knowledge, and specialized credit risk management skills. This dynamic creates a distinct performance differentiation among banks in this group, impacting credit growth rates, asset quality, and interest margins. Therefore, the investment outlook for banks focusing on corporate lending depends not only on the expansion capabilities of enterprises but also on competitive advantages, target customer quality, and the flexibility of each bank’s strategy. Analyzing these factors will provide a clearer picture of the prospects for banks in this group in a volatile economic context.

Outlook for Banks Specializing in Corporate Lending

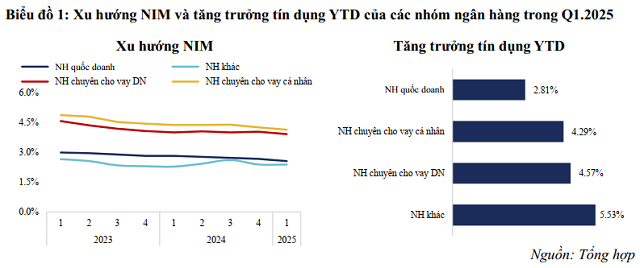

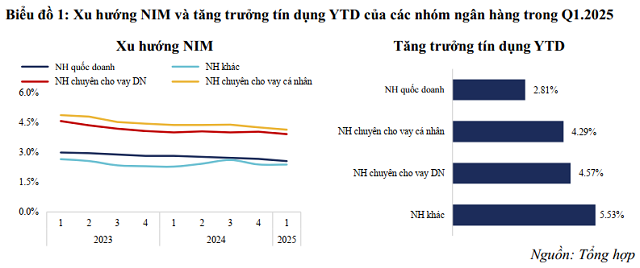

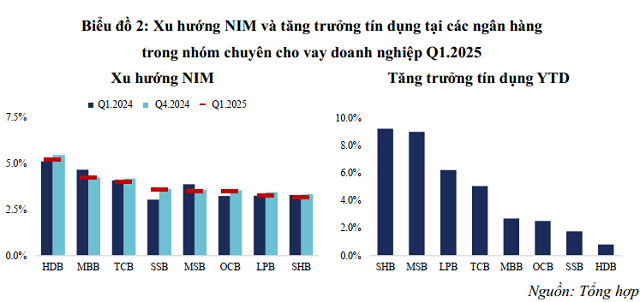

In the first quarter of 2025, banks specializing in corporate lending maintained a strong credit growth rate, with a credit growth rate of nearly 4.6%, significantly outpacing the industry average. Not only did they sustain debt expansion, but they also demonstrated the ability to maintain a stable net interest margin (NIM), comparable to retail banks. This is a positive sign given the pressure to reduce lending rates. It indicates that profitability from the corporate client segment is being optimized due to sustained strong investment and production capital demands.

In this context, innovation and strategic flexibility become crucial factors in determining competitive advantages, not only among corporate banks and the rest of the industry but also among members within this group. Given their focus on serving enterprises, many banks in this group have continued to strengthen their ecosystem of supply chain financing – from suppliers to distributors and end customers. This foundation enables them not only to expand their credit scale but also to develop cross-selling opportunities for financial services such as guarantees, trade finance, cash management, and specialized financial advisory services. Therefore, the customer ecosystem has become an essential factor in assessing the potential and outlook of banks in this group.

Individual Bank Prospects

Although Techcombank and MBBank belong to the group of banks specializing in corporate lending, each has its own development strategy and strengths, resulting in distinct performance and growth potential. This complexity makes assessing investment prospects in this group challenging and requires a multidimensional perspective, considering customer orientation, product strategy, and target market.

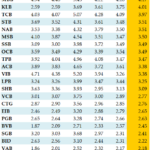

Techcombank and MBBank are two prominent representatives with strategies focused on ecosystem-based corporate financing. Techcombank stands out due to its real estate ecosystem, while MBBank has built an extensive ecosystem encompassing infrastructure (industrial parks, seaports), construction, telecommunications, and commerce. Thanks to their clear positioning and the ability to develop accompanying services such as cash management, guarantees, and financial advisory, these two banks maintain the industry-leading CASA ratio, an essential foundation for sustaining net interest margins (NIM) in a low-interest-rate environment. In the first quarter of 2025, Techcombank’s credit growth slowed to 5.1% from 7.8% in the same period last year, indicating a cautious approach to growth. In contrast, MBBank achieved a lower growth rate of 2.7%, despite targeting a 24% credit growth for the year, as it recently obtained a higher bank rating and was prioritized for higher credit growth. This cautious approach demonstrates the bank’s priority on risk management and maintaining a safe NPL level. Techcombank is focused on improving its CASA ratio to enhance its NIM. Additionally, the need to significantly reduce lending rates to support enterprises in its ecosystem has put pressure on the bank’s NIM.

HDBank also possesses a corporate customer ecosystem but with a stronger focus on supporting its extensive retail customer base, leveraging the strengths of its parent company, Sovico, and the vast customer network of VietJet Air, HD Saison, and other retail partners. This combination unlocks the potential to develop specialized financial solutions for supply chains in the tourism, aviation, and consumer industries. HDBank currently leads the group in NIM, benefiting from its retail products and SME customers.

LPBank has chosen a different path, focusing on customers in rural areas and secondary cities, where there is still significant growth potential. By understanding the niche market dynamics and having diverse access to traders, small businesses, and enterprises, LPBank recorded an impressive credit growth rate of 6.2% in the first quarter of 2025, close to half of its annual target. However, improving NIM will be an essential factor in enhancing the bank’s growth potential in the coming periods.

On the other hand, SHB and MSB are bright spots in credit expansion, both achieving growth rates above 9% in the first quarter of 2025, outpacing the industry average. However, their development orientations differ: MSB focuses on serving industrial enterprises, while SHB provides credit packages for real estate and construction companies. Despite impressive loan growth, both banks need to improve their NIM to enhance profit quality and resilience in a low-interest-rate environment. SeABank and OCB also have a significant portion of their portfolios dedicated to corporate customers (around 70-80%), but they cater to a more diverse range of industries. This diversity makes their credit growth less stable and challenging to break through. In Q1/2025, SeABank and OCB achieved credit growth rates of 1.8% and 2.5%, respectively. Repositioning their strategies and focusing on more specialized segments will be key to better exploiting their potential in corporate lending.

Banks specializing in corporate lending are assessed to have significant growth potential in an economy oriented towards expansion and increasing capital demands from enterprises. However, the potential of individual banks within this group is differentiating, depending on their strategies, customer ecosystems, and low-cost capital mobilization capabilities. The first quarter of 2025 clearly demonstrated this trend: banks with strong CASA foundations maintained stable NIMs, while some banks with average credit growth in the previous year entered a cycle of acceleration. This situation presents opportunities but also demands a high level of flexibility and strategic differentiation among banks.

Lê Hoài Ân, CFA – Nguyễn Thị Ngọc An, HUB

– 12:00 03/06/2025

A Brokerage Firm Lowers Profit Forecast for Banking Sector in 2025, Now Projected at 14% Growth

The securities firm has downgraded its profit growth forecast for the banks under its coverage, lowering its projection from the previous range of 15-17% to below 14% as adverse factors continue to mount.

“NIM Bank Under Pressure: Can It Weather the Storm?”

The net interest margin (NIM) story for Q1 2025 is a concerning tale, with over half of the banking system witnessing a decline. This is more than just a trend; it reflects a worrying shift in the industry’s profit landscape, monetary policy movements, asset-liability structure, and credit consumption behavior.

The Fed is in a Bind: Walking the Tightrope of Interest Rates

From the beginning of the year to mid-April 2025, the average lending interest rates for new transactions of commercial banks decreased by 0.6 percentage points compared to the end of 2024. This move has provided a much-needed respite for businesses by alleviating the pressure of capital costs in production and trading activities, thereby fostering economic growth.

The Evolution of China’s Banking Strategy and Lessons for Vietnam

The Chinese banking system has undergone a strategic transformation over the past decade. Moving away from a model reliant on large-scale credit growth, fueled by real estate lending and state-owned enterprise loans, the industry has embraced a new paradigm. This paradigm shift involves a comprehensive approach to finance, diversifying revenue streams, and embracing digital transformation. This evolution reflects a conscious effort to adapt to the demands of risk management, improved operational efficiency, and sustained growth.