Gold prices surged during Monday’s trading session (June 2nd), reaching a three-week high, as a weakening US dollar and resurfacing trade war concerns fueled risk aversion. The massive SPDR Gold Trust ETF purchased nearly three tons of gold, continuing last week’s strong buying trend.

As of 8:32 am Vietnam time (3/6), gold spot prices in Asian markets dipped by 11.7 USD/oz compared to the previous US session’s close, equivalent to a 0.35% decrease, trading at 3,370.9 USD/oz according to Kitco exchange data. Converted at Vietcombank’s USD selling rate, this price equates to approximately 106.4 million VND per tael, a significant increase of 4.3 million VND from yesterday’s morning rates.

At the same time, Vietcombank quoted USD rates at 25,820 VND (buying) and 26,210 VND (selling).

In the US session overnight, gold spot prices settled at 3,381.6 USD/oz, surging by 91.3 USD/oz compared to the previous week’s close, representing a nearly 2.8% gain. This was the highest settlement price for gold spot since mid-May, and during the session, prices touched their highest level since May 8th.

On the COMEX exchange, gold futures climbed by 2.5%, ending at 3,397.2 USD/oz.

The primary catalyst for gold’s rally was the decline in the US Dollar Index, which tumbled to a six-week low. The index, which measures the greenback’s strength against a basket of six major currencies, closed at 98.71, its lowest level since late April – when it touched a three-year low.

Additionally, investors’ appetite for safe-haven assets like gold increased amid escalating trade tensions between the US and China, which appear to be heating up again.

The trade standoff between the two economic giants has shown signs of intensifying in recent days, with both sides accusing each other of violating the truce agreement reached in Geneva. Over the weekend, the US accused China of backtracking on its commitments, and on Monday, China fired back with counter-accusations. This indicates that trade negotiations between the world’s two largest economies may be deteriorating.

However, investors remain hopeful for a de-escalation following a revelation by a senior White House official to CNBC on Monday that US President Donald Trump and Chinese President Xi Jinping could hold a conversation later this week.

Tensions between the US and the European Union (EU) have also escalated after Trump announced plans to double tariffs on steel to 50%. EU officials warned that this move would “undermine” trade negotiations between the two blocs. An EU spokesperson stated, “This decision will cause further uncertainty for businesses and industry and higher costs for consumers and businesses on both sides of the Atlantic.”

“The latest tariff threats, including the doubling of steel and aluminum tariffs to 50%, along with Ukraine’s attacks on Russia over the weekend, have heightened geopolitical risks and a risk-averse sentiment,” remarked Peter Grant, a strategist at Zaner Metals, to Reuters.

Moreover, investors are also cautious about the risks associated with the US debt and budget deficit – another crucial factor favoring gold holdings, according to Fawad Razaqzada, an analyst at City Index. “As far as gold’s outlook is concerned, this fiscally uncertain and risk-averse environment couldn’t be more conducive,” stated Razaqzada.

The world’s largest gold ETF, SPDR Gold Trust, added approximately 2.9 tons of gold to its holdings during the first trading day of the week, boosting its total holdings to 933.1 tons. The fund purchased 8 tons of gold last week but offloaded 14 tons during May.

Gold Prices Surge on Monday Morning, Defying Analysts’ Cautious Forecasts

Gold prices surged during the early morning trading session on Monday, June 2nd, soaring past the $3,300 per ounce mark and reclaiming the ground lost in the previous week’s trading.

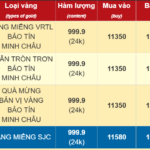

The Golden Opportunity: Unveiling the Surge in SJC Gold Prices and Ring Rates on June 2nd

The domestic gold price witnessed significant fluctuations on June 2nd, with prices seesawing throughout the day.