Inadequate Regulations for Businesses

On May 26, 2025, the Ministry of Finance announced a call for comments on the draft decree amending and supplementing a number of articles of Decree No. 103/2024/ND-CP dated July 30, 2024, of the Government regulating land use fees, land rental, and Decree No. 104/2024/ND-CP dated July 31, 2024, of the Government on the Land Development Fund.

The most controversial aspect of the draft is that it retains the regulation that in cases where decisions have been made on land allocation, land lease, permission for land use purpose conversion, conversion from the form of annual land rent payment to one-time payment, detailed planning adjustment, etc., before the Law on Land 2024 took effect (August 1, 2024), but the land price has not been determined, a supplementary payment of 5.4%/year on the amount payable for the period of unpaid land use fee or land rent must be made.

Commenting on the supplementary land use fee regulation, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, opined that the regulation on supplementary land use fee payment is not truly reasonable for enterprises, especially in cases where enterprises “agree to receive land use rights” to implement investment projects. The reason is that real estate project investors, commercial housing developers, are not at fault for the state agency’s failure to issue a decision on land prices or submit a land price scheme to the competent authority.

Recently, a real estate investor in Thu Duc was stunned to receive a notice of land use fee for their project amounting to over VND 300 billion. Previously, the price was estimated at just over VND 50 billion by the unit price appraisal. As they needed business capital, the investor sold some products to customers at a price based on the provisional land price.

Currently, this land use fee expense has increased to more than five times the original estimate. This puts the investor in a difficult position, as continuing to sell at the old price would result in significant losses, while adjusting the price upwards to ensure profits would make the selling price very high and unsuitable for the market demand.

Risk of Driving Up Real Estate Prices

Discussing the regulation on supplementary land use fee payments, the Vietnam Real Estate Brokers Association (VARS) stated that many enterprises with projects cannot proceed due to the “bottleneck” in calculating land use fees. Several completed projects cannot be sold because they are awaiting the fulfillment of financial obligations. The risks associated with high land use fees are likely to occur.

“Not only that, but a project that lasts for many years, even decades, before the land use fee is calculated, will not only cause stagnation but also increase the cost for businesses. During the waiting period, enterprises must still bear the cost of interest and opportunity cost,” VARS affirmed.

Especially for projects that were temporarily calculated for land use fees in the past, enterprises continue to face a significant challenge with the additional payment being much higher than initially expected, leading to the risk of losses. In the past, many enterprises have been unable to fulfill their financial obligations due to unforeseen increases in land use fees.

According to Mr. Nguyen Van Dinh, Chairman of VARS, the inadequacies related to land use fees not only waste land resources and cause economic losses for both enterprises and customers but also negatively affect the real estate market and the economy as a whole.

Currently, land use fees account for a large proportion of real estate prices. When costs arise, investors will have to consider adjusting real estate prices upwards. Meanwhile, in recent times, real estate prices in some major cities, especially in Hanoi, have continuously set new highs. “If housing prices continue to rise, it will be difficult for the majority of people to access housing. This will lead to many social welfare issues,” said Mr. Dinh.

Sharing the same view as Mr. Dinh, experts also believe that in the context of increasing land use costs for enterprises, real estate prices will not decrease, affecting the sustainable development of the market and contradicting the Government’s directions on reducing housing prices to meet the housing needs of the people.

Notably, the requirement to pay a significant amount of supplementary land use fees is also beyond the calculations of enterprises. This will cause many investors to lack the financial capacity to make supplementary payments, leading to the inability to implement projects, and the continued scarcity of supply. Unless this issue is resolved, housing prices will not decrease.

Based on the above analysis, legal experts propose amending Point d, Clause 2, Article 257 in the direction of not calculating the supplementary amount for the period of undetermined land price, as this causes enterprises to incur enormous costs, affecting input costs and increasing real estate prices. Meanwhile, the delay in determining land prices is not the fault of the enterprises.

In case of ensuring compliance with the regulations at Point d, Clause 2, Article 257, on calculating the supplementary amount for the period of undetermined land price, the State should only apply this for the period from August 1, 2024 (the effective date of the 2024 Land Law) until the date of the decision approving the land price is issued, excluding the period of 180 days, which is the deadline for determining the land price according to Clause 4, Article 155 of the 2024 Land Law.

A Reputable Social Housing Developer: Streamlining Processes with a Green Channel for Faster Approvals and a Shift to Post-Checks.

“This was the opinion shared by Mr. Pham Doan Tien, Director of the Investment Project Management Board of the 319 Corporation, Ministry of Defense, at the seminar ‘Making the Dream of Social Housing a Reality’.”

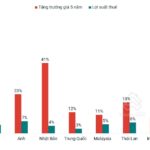

Vice-Premier: Vietnam’s Real Estate Price Growth Among the Highest in the World… A Troubling Reality

The soaring property prices in Vietnam paint a concerning picture. Various studies indicate that the country’s real estate price growth is among the highest globally, while home affordability for locals is declining. This discrepancy warrants attention and highlights a pressing issue.