The rubber industry in Vietnam witnessed a strong performance in the first quarter of 2025, with a significant surge in revenue and profit margins. The primary driving force behind this growth was the sustained high prices of rubber latex, benefiting businesses engaged in rubber cultivation and raw material processing. On the flip side, manufacturers of rubber products faced challenges due to escalating input costs, squeezing their profit margins.

According to VietstockFinance, out of the 16 rubber companies that have released their financial reports for Q1 2025, the total revenue reached nearly VND 9.8 trillion, marking a 16.4% increase compared to the same period last year. The industry’s after-tax profit surpassed VND 1.6 trillion, almost doubling the figure from Q1 2024.

The average selling price of rubber latex increased by over 40%

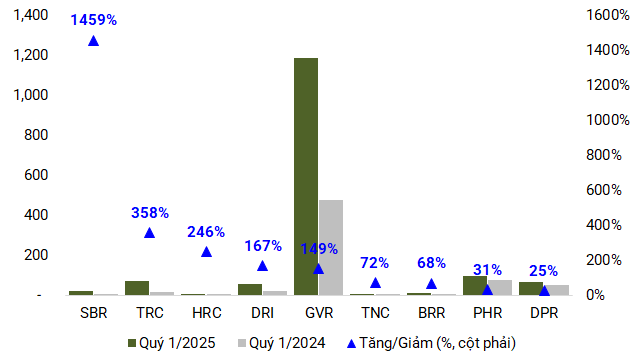

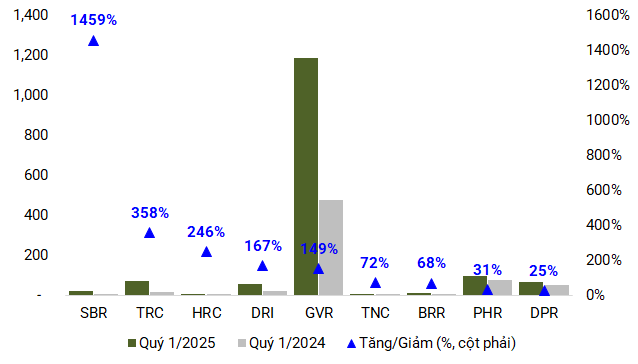

Businesses involved in rubber cultivation and extraction continued to leverage the favorable market prices. For instance, Vietnam Rubber Group (HOSE: GVR) attributed its impressive performance to higher selling prices, recording a revenue of over VND 5.6 trillion, a 24% increase, and a remarkable leap in after-tax profit to nearly VND 1.2 trillion, 2.5 times higher than the previous year.

Within the GVR system, several subsidiaries reported substantial profit increases. Tay Ninh Rubber Joint Stock Company (HOSE: TRC) achieved a 358% surge in profit, amounting to VND 70 billion, thanks to a 47% increase in the average selling price of rubber latex, reaching approximately VND 56.1 million per ton.

Dong Phu Rubber Joint Stock Company (HOSE: DPR) experienced a 25% growth in profit, exceeding VND 65 billion, despite unchanged sales volume, as they benefited from an improvement in selling prices of over 40%. Phuoc Hoa Rubber Joint Stock Company (HOSE: PHR) followed a similar trajectory, with a profit of nearly VND 96 billion, reflecting a more than 30% increase, bolstered by a one-time infrastructure lease revenue.

Other companies also demonstrated positive results. Dak Lak Rubber Investment Joint Stock Company (UPCoM: DRI) witnessed a remarkable 167% jump in profit, reaching VND 56 billion. Ba Ria Rubber Joint Stock Company (UPCoM: BRR) achieved a profit of over VND 7.7 billion, an impressive increase of nearly 70%.

Notably, Song Be Joint Stock Company (UPCoM: SBR) stood out with a nearly sevenfold increase in revenue, accompanied by a staggering fourteenfold rise in profit to VND 22.3 billion. Tong Nhat Rubber Joint Stock Company (HOSE: TNC) also experienced a significant profit growth of 72%, amounting to nearly VND 7 billion, attributed to a considerable increase in banana prices.

However, not all businesses maintained their upward trajectory. Tan Bien Rubber Joint Stock Company (UPCoM: RTB) experienced a sharp decline in both revenue and profit due to decreased sales volume, with net profit falling to VND 42.8 billion, a 61% drop. Cong Nghiep Cao Su Joint Stock Company (UPCoM: IRC) continued to incur a loss of nearly VND 2 billion, although it significantly narrowed compared to the previous year’s first quarter.

|

Rubber extraction businesses continued to thrive in Q1 2025 (in VND trillion)

Source: Author’s compilation

|

Manufacturers of rubber products faced input cost pressures

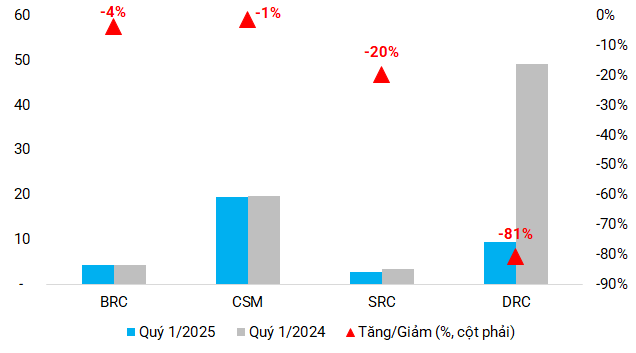

In contrast to the rubber extractors, companies engaged in manufacturing rubber products, such as tires and tubes, faced significant challenges due to soaring input costs, which squeezed their profit margins. Danang Rubber Joint Stock Company (HOSE: DRC) serves as a prime example, with an 80% plunge in after-tax profit to VND 9.5 billion, the lowest since 2017, despite a 21% increase in revenue to nearly VND 1.2 trillion. The company attributed this decline to the sudden spike in raw material prices.

A similar situation unfolded at Sao Vang Rubber Joint Stock Company (HOSE: SRC), where profit dipped by nearly 20% to VND 2.7 billion, despite a remarkable 50% surge in revenue. Casumina (HOSE: CSM), another prominent player in the industry, managed to maintain its profit at nearly VND 19.4 billion, a slight decrease compared to the previous year.

Meanwhile, Ben Thanh Rubber Joint Stock Company (HOSE: BRC), partially benefited from GVR‘s majority stake, witnessed a 4% dip in profit to over VND 4.2 billion.

According to Le Thanh Hung, CEO of GVR, rubber prices are expected to remain high this year, particularly in the Southeast region, where average selling prices have already surpassed VND 50 million per ton. Consequently, the outlook for Q2 remains favorable for rubber extractors, while input cost pressures will likely persist for manufacturers of rubber products.

|

Profit margins of rubber product manufacturers contracted (in VND trillion)

Source: Author’s compilation

|

The Pearl of Phu Quoc: Unveiling the Island’s Airport Expansion

The government has just issued Resolution No. 01 for the year 2025, dated June 1st, 2025, regarding investment in expanding Phu Quoc International Airport.

Hong Kong Conglomerate Pours Massive Investment into THACO: Holds Over $1 Billion in REE and Vinamilk Stocks; Historical Investor in Chinese Railways Over a Century Ago

Jardine Matheson, a prominent investor, has had a long-standing relationship with THACO since 2008, with a significant boost in investment in 2019, valuing the company at over $9 billion. This strategic partnership was further strengthened in late 2023, with Jardine Matheson purchasing nearly VND 9,000 billion in THACO bonds, demonstrating a strong vote of confidence in the company’s future prospects.