Recent Acquisition by Thien Long Group Sparks Interest in the Bookstore Industry

Thien Long Group’s recent acquisition of a controlling stake in Phuong Nam Bookstore Chain has sparked interest in the industry. Thien Long is renowned for its dominance in the stationery sector, with annual profits surpassing those of many real estate businesses.

Phuong Nam is also one of the top two players in the bookstore industry, alongside Fahasa. This merger is predicted to create a new dynamic in the bookstore market.

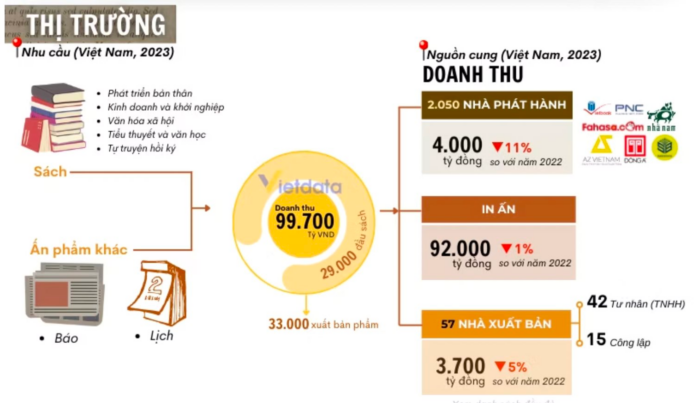

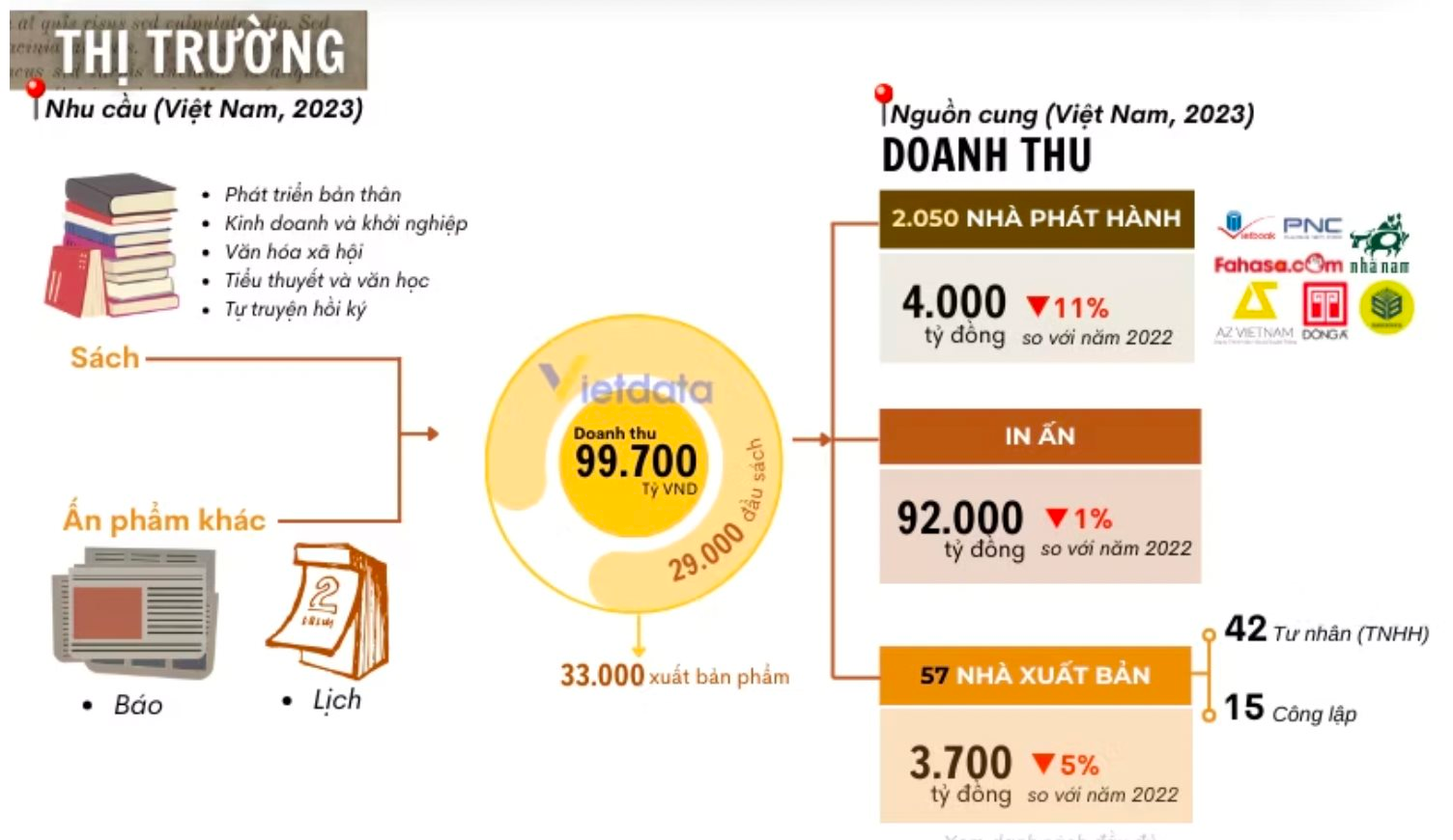

Stable but Largely Untapped USD Billion Market

The publishing, distribution, and printing of books constitute a stable market with a total value of approximately USD 4 billion. According to Vietdata, the total market revenue in 2023 amounted to VND 99.7 trillion (nearly USD 4 billion). Publishers like Fahasa, Phuong Nam, and Nha Nam generated VND 4 trillion in revenue, while printing accounted for the lion’s share with VND 92 trillion, and publishing contributed the remaining VND 3.7 trillion.

In recent years, the market has faced a dual challenge: the explosion of information technology and the rampant issue of pirated books. Online books (Ebooks) have become a popular alternative to printed books, and pirated books are often sold at significantly lower prices, sometimes up to 70% less than the original.

From an insider’s perspective, a representative from Fahasa affirmed the market’s untapped potential, particularly in the online segment, which primarily caters to the 18-25 age group and specific product categories.

Fahasa is investing in restructuring its existing stores and expanding its presence in provinces.

Fahasa, the current market leader, is actively restructuring its existing stores and expanding its footprint by opening new bookstores in provinces. Since the beginning of 2025, Fahasa has inaugurated bookstores in Phu Nhuan and Go Vap districts in Ho Chi Minh City, with upcoming branches in bustling commercial centers in Dong Nai and Ba Ria-Vung Tau on May 29.

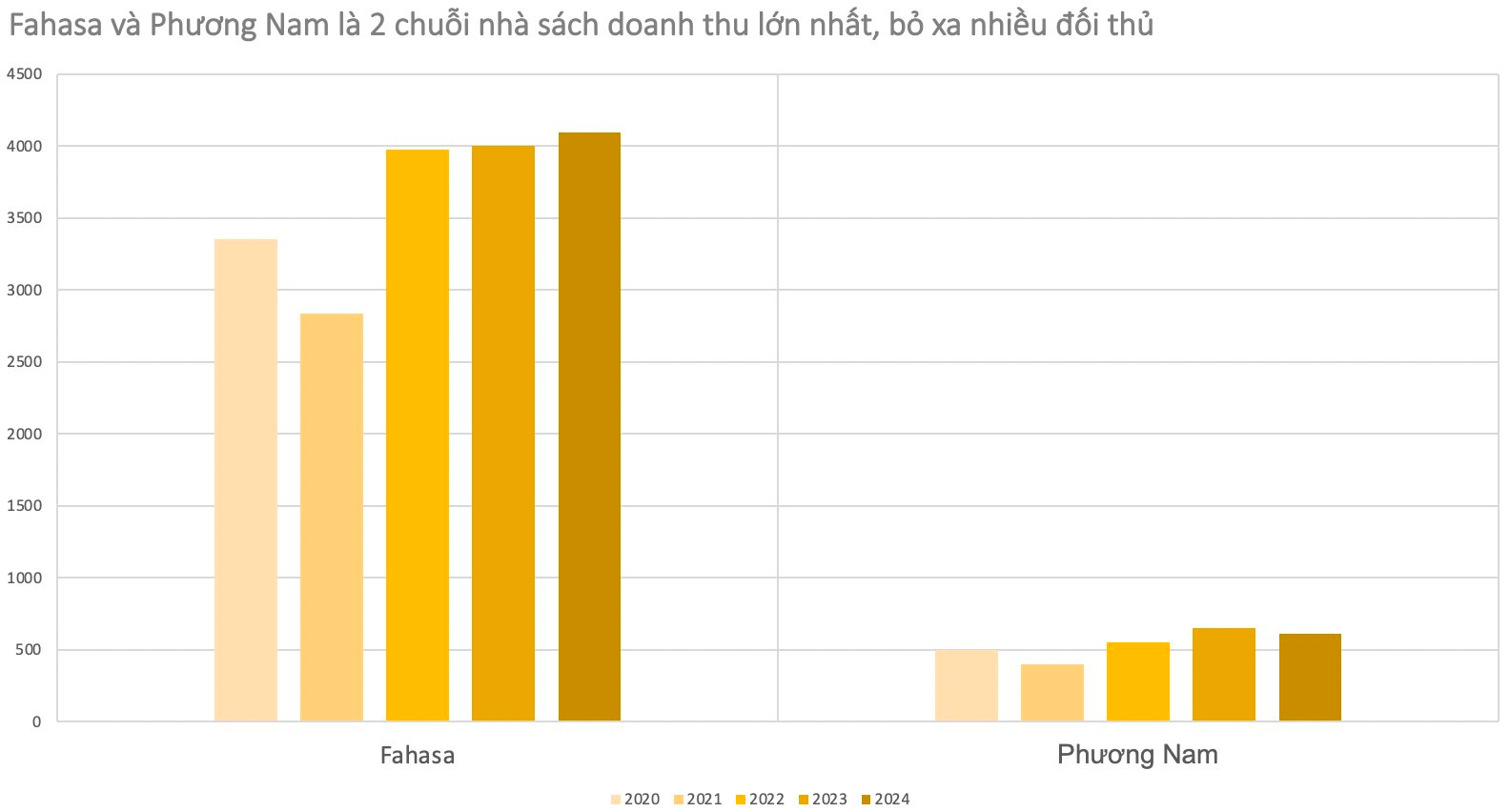

With over 130 bookstores nationwide, Fahasa leads the market in both bookstore chains and revenue, generating VND 4 trillion in annual revenue, far surpassing its competitors. Phuong Nam follows with annual revenue close to VND 1 trillion.

Vietdata’s data up to 2022 reveals that Fahasa attained a revenue of nearly VND 4 trillion, followed by Phuong Nam with VND 900 billion. Other chains, such as Nha Nam, Tien Phong, and AlphaBooks, lag behind with revenues below VND 200 billion.

Thien Long’s entry into the market by acquiring Phuong Nam may alter the dynamics between Fahasa and its partners. When asked about concerns regarding this new competitor, Fahasa asserted that they focus on improving and enhancing their customers’ experience rather than fixating on rivals.

Thien Long’s strategic move to acquire Phuong Nam Bookstore Chain.

Thien Long’s Strategic Calculations in Acquiring Phuong Nam

Phuong Nam, with its 50 bookstores mainly located in Ho Chi Minh City, recorded a pure revenue of VND 614 billion in 2024, a 6% decrease from the previous year. Their profit also declined to VND 10 billion.

By acquiring Phuong Nam, Thien Long immediately gains access to a distribution network of approximately 50 bookstores. Thien Long has also been developing its Clever Box and Peektoy chains, but after nearly three years, they have only managed to open 12 stores.

Mr. Nguyen Dinh Thu, Thien Long’s Director of Strategy and Investment, stated that M&A has been a long-term strategy for the company. The deal with Phuong Nam is their first publicly announced controlling acquisition after thorough evaluations and a cautious investment approach.

In the medium term, investing in Phuong Nam allows Thien Long to vertically expand its value chain and gain insights into consumer trends and demands through this distribution channel.

This acquisition also enables Thien Long to swiftly expand its Clever World stores, which offer toys and lifestyle products, in a cost-effective manner, aligning with their long-term strategy.

In the long run, Phuong Nam is a suitable partner for Thien Long as both companies share an ecosystem of products that cater to learning, creativity, and intellectual development.

Notably, both Fahasa and Thien Long are involved in the printing sector, which accounts for the largest share of the industry’s total revenue, amounting to billions of USD.

“OCB and OCBS Securities Sign Comprehensive Strategic Partnership”

On May 28, 2025, Orient Commercial Joint Stock Bank (OCB) and OCBS Securities Joint Stock Company (OCBS) solidified their partnership by signing a comprehensive strategic cooperation agreement. This momentous occasion marked a significant step forward in both entities’ journey to enhance customer benefits and experiences.

The Big Players in Textile Industry Navigate a 90-Day Tariff Reprieve from the US

Amidst the pressures of price-sharing, order competition, and tariff risks, prominent textile and garment enterprises such as Vinatex, Hoa Tho, Huegatex, and M10 are in a 90-day sprint before the tariff exemption ends. With the volatile American market, the garment industry is compelled to pivot, diversify risks, and pinpoint strategies for the third quarter of 2025.

Unveiling the Five-Star Property Experience: A Grand Office Opening and Brand Launch

On May 21, 2025, Five Star Property, a leading real estate company, inaugurated its head office at Home City, 177 Trung Kinh, Cau Giay, Hanoi. This momentous occasion marked the official launch of the Five Star brand and the beginning of its journey to becoming a trusted real estate development and project distribution consultant.

The Green Revolution: 2024 Sees a Stellar Rise in Agricultural Exports

2024 was a landmark year for Vietnam’s agricultural, forestry, and seafood exports, with a record turnover of 62.5 billion USD, an impressive 18.7% increase from 2023. This remarkable growth, the highest in two decades, was driven by strong performance across key agricultural products, including rice, coffee, fruits and vegetables, timber, cashew nuts, and seafood, all of which experienced significant increases.