On June 6, FTSE will announce the constituent stocks of the FTSE Vietnam Index. On June 13, 2025, MarketVector will announce the MarketVector Vietnam Local Index. June 20, 2025, is expected to be the completion day of the restructuring of the portfolios of ETFs referencing these indices.

Regarding the FTSE Vietnam Index, SSI Research estimates that HCM could be added due to meeting all the conditions, and no stocks are expected to be removed.

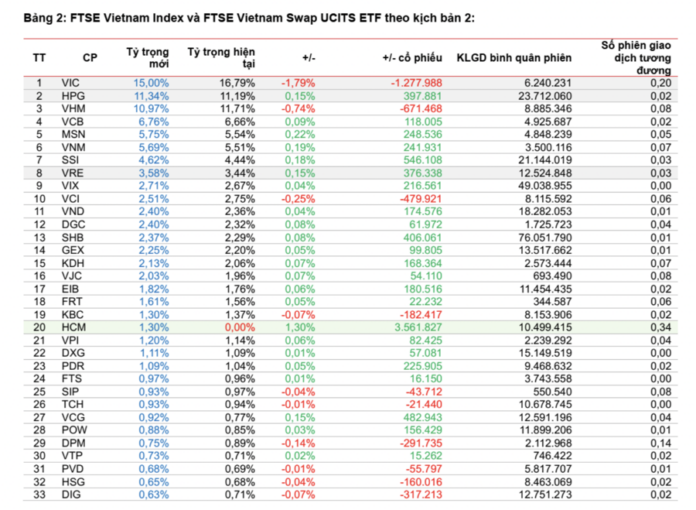

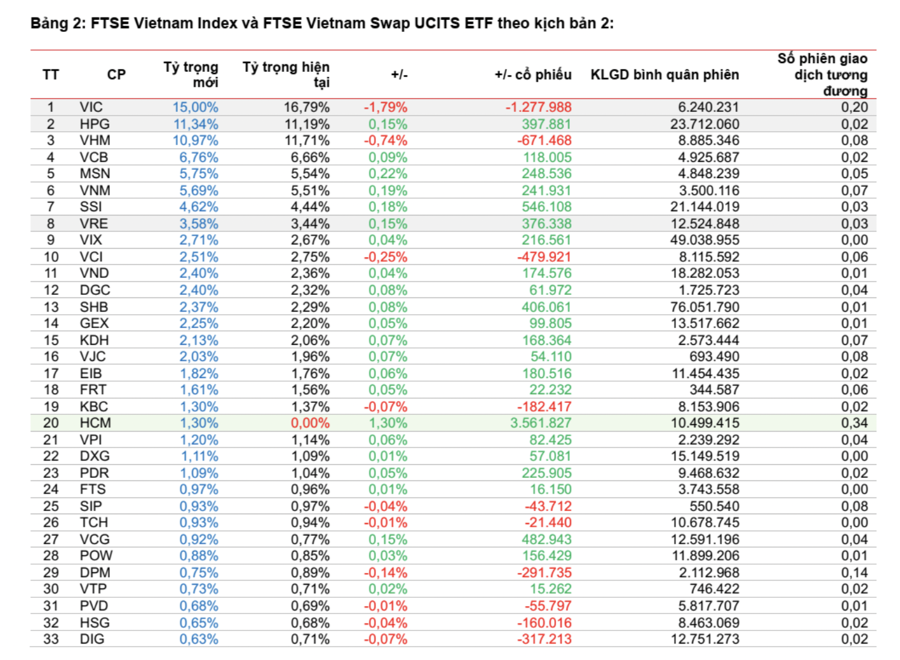

Assuming these changes, the index portfolio will include 33 stocks. It is important to note that the foreign ownership limit of HCM as of May 30, 2025, was 10.21%, close to the minimum threshold of 10% set by FTSE Vietnam. Therefore, SSI Research presents two scenarios.

Although it does not meet the conditions this time, NVL may return to the index in the future. Currently, NVL meets all the criteria except for the fact that the Ho Chi Minh City Stock Exchange put the stock on alert on September 23, 2024, and removed it from the alert list on April 3, 2025.

In the past, NVL had been removed from the index during the Q2/2023 review due to being put on alert on April 25, 2023, but was added back to the index in Q4/2023, right after being removed from the alert list on November 3, 2023.

According to the regulations of the FTSE Vietnam Index, stocks can only be considered for inclusion in the index after 12 months from the date of removal from the alert list. Therefore, as NVL has only recently been removed from the alert list within two months, it does not meet the conditions for inclusion in the index this period.

VIC may reduce its weight in the index after a recent strong price increase. Since March 24, 2025 (the effective date of the index in the Q1/2025 review), VIC’s stock price has increased by 73.5%, causing a 79.5% increase in its free-float capitalization. With this recent surge, VIC’s weight in the index has risen to 16.79% as of May 30, 2025. At the time of the review, the weight limit for constituent stocks was set at 15%. Therefore, if VIC’s weight is reduced in the index, the weights of the remaining stocks may increase accordingly.

Recently, with the listing of VPL, SSI Research has considered the possibility of including this stock in the index. VPL officially listed on HOSE on May 13, 2025, and currently meets the criteria for market capitalization, free-float, and the limit of foreign ownership, but does not yet meet the listing time (3 months) and liquidity criteria.

Specifically, the average trading value of VPL is currently at 58 billion VND, lower than the required 40% of the average trading value of the FTSE Vietnam index basket over the last three months.

The FTSE Vietnam Swap UCITS ETF is a swap fund that tracks the FTSE Vietnam Index. As of May 30, 2025, the fund’s total net asset value (total fund asset) was approximately 7,040 billion VND (equivalent to 270 million USD). Since the beginning of 2025, the fund’s total net asset value has increased by 6.5%, however, the number of fund certificates has decreased by 7.4% to 9.5 million units, resulting in a 15.3% increase in NAV/fund unit.

The decline in the number of fund certificates partly reflects a net capital outflow from the fund, amounting to 511 billion VND (equivalent to 19.8 million USD) since the beginning of the year.

The estimated index portfolio and fund transactions are as follows: Scenario 1, no changes in stocks in the index basket. It is estimated that the FTSE Vietnam Swap UCITS ETF will sell 1.27 million VIC shares and 517,000 VHM shares. On the buying side, the fund is expected to purchase 518,000 VRE shares. Additionally, the fund may significantly buy HPG, SSI, SHB, and sell VCI and DIG.

Scenario 2: HCM may be added to the FTSE Vietnam Index basket. It is estimated that the FTSE Vietnam Swap UCITS ETF will buy about 3.5 million HCM shares (a weight of 1.3%). On the buying side, the fund will also purchase SSI (+540,000 shares), VCG (+480,000 shares), SHB (+406,000 shares), and HPG (+397,000 shares). Conversely, on the selling side, the fund may trade a large volume of VIC (-1.27 million shares) and VHM (-671,000 shares)

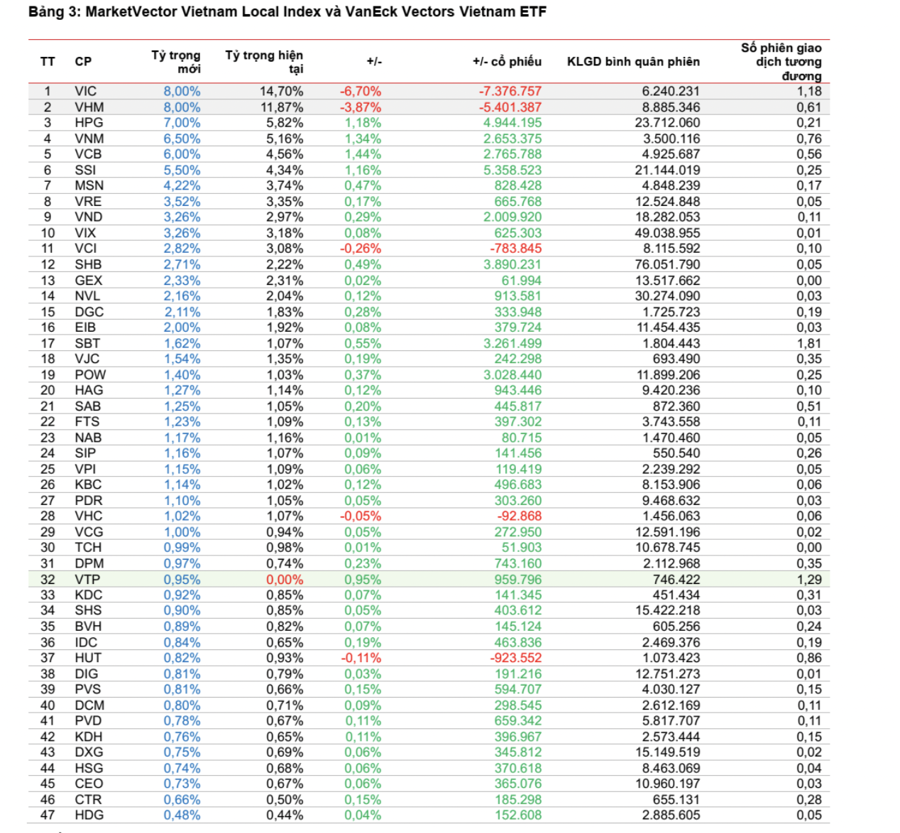

For the MarketVector Vietnam Local Index, based on updated data as of May 30, 2025, SSI Research predicts that the MarketVector Vietnam Local Index may add VTP to the basket as it is in the top 85% of the accumulated free-float market capitalization among eligible stocks. No stocks are expected to be removed.

Assuming these changes, the index portfolio will include 47 stocks. Similar to the FTSE Vietnam Index, the weights of VIC (14.7%) and VHM (11.8%) have increased significantly due to recent price surges. Both stocks have a weight limit of 8%. Therefore, in this review period, the fund will sell these two stocks to reduce their weights. Regarding the possibility of VPL being added to the index, the stock currently meets the criteria for market capitalization and free-float but has not met the listing time criterion (a minimum of 9 months)

It is estimated that the VanEck Vectors Vietnam ETF will adjust its stock portfolio as follows: On the buying side, the fund will purchase 959,000 VTP shares (a weight of 0.95%). On the selling side, the fund will offload 7.3 million VIC shares and 5.4 million VHM shares. Additionally, the fund may buy SSI, HPG, SHB, SBT, and POW, while selling HUT and VCI.

The VanEck Vectors Vietnam ETF, which tracks this index, has a total net asset value of 10.8 thousand billion VND (416 million USD). Since the beginning of the year, the fund’s total net asset value has decreased by -0.25%, while the number of fund certificates has dropped by -14.6% to 30.6 million units, resulting in a 16.8% increase in NAV/unit. The net capital outflow from the fund since the beginning of the year is high at 1.5 thousand billion VND (60 million USD)