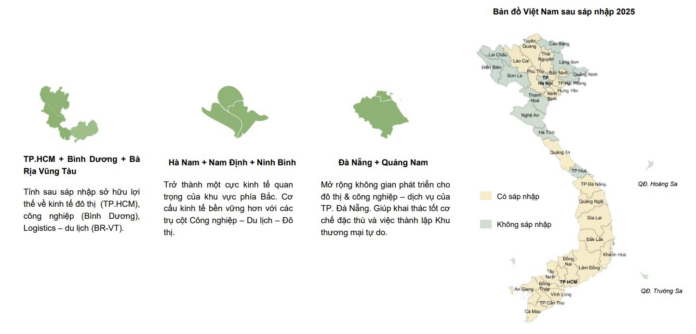

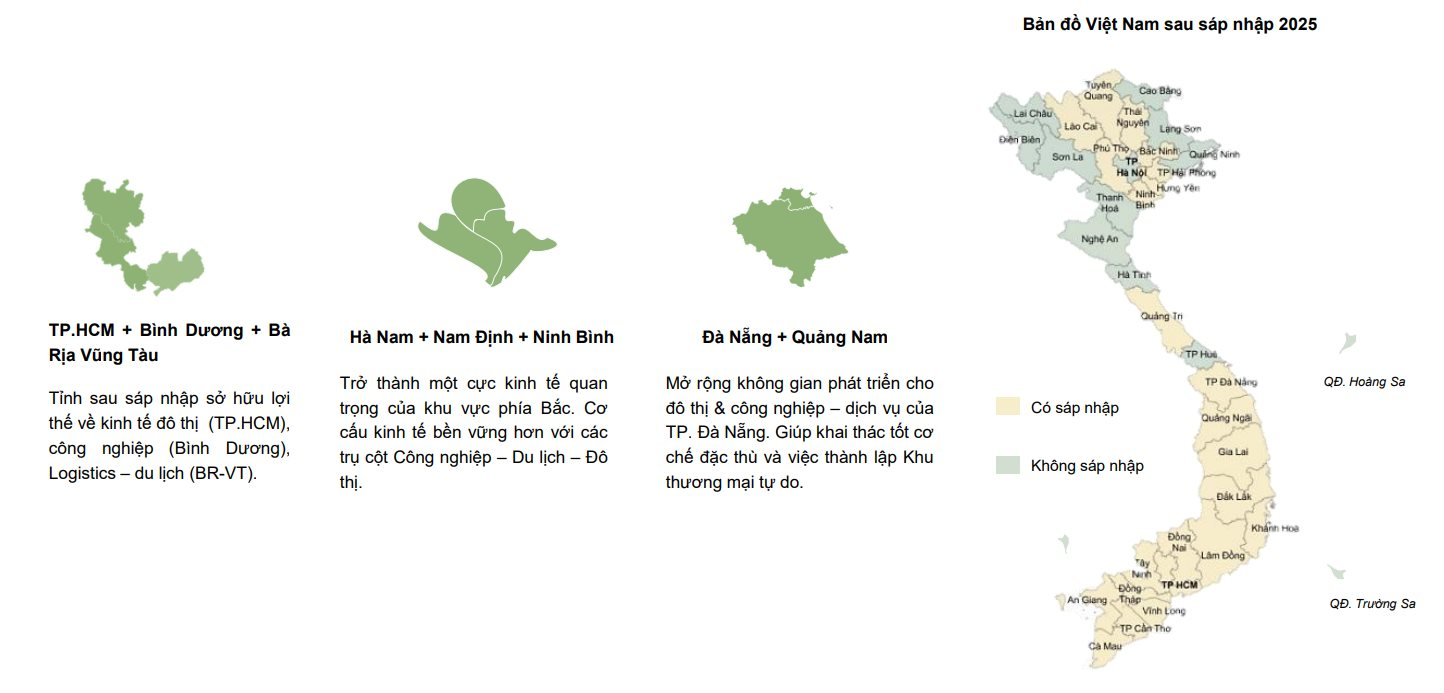

Vietcombank Securities (VCBS) anticipates positive outcomes from the proposed province-city mergers, citing expanded administrative boundaries, harmonized policies, and enhanced infrastructure connectivity.

In their recently published industry report, VCBS explains that post-merger, localities will benefit from larger scales in terms of area and population, improved budgetary resources, and diverse geographical advantages, including coastal, plain, and mountainous areas. This will enable more efficient planning and the development of key economic sectors.

According to VCBS, these changes will result in improved land resources and development opportunities for major cities and industrial projects, allowing for a focused approach to developing key economic sectors.

Looking ahead, VCBS believes that province-city mergers will positively impact the real estate market due to streamlined management, enhanced budgetary autonomy, effective geographic positioning, and strengthened infrastructure.

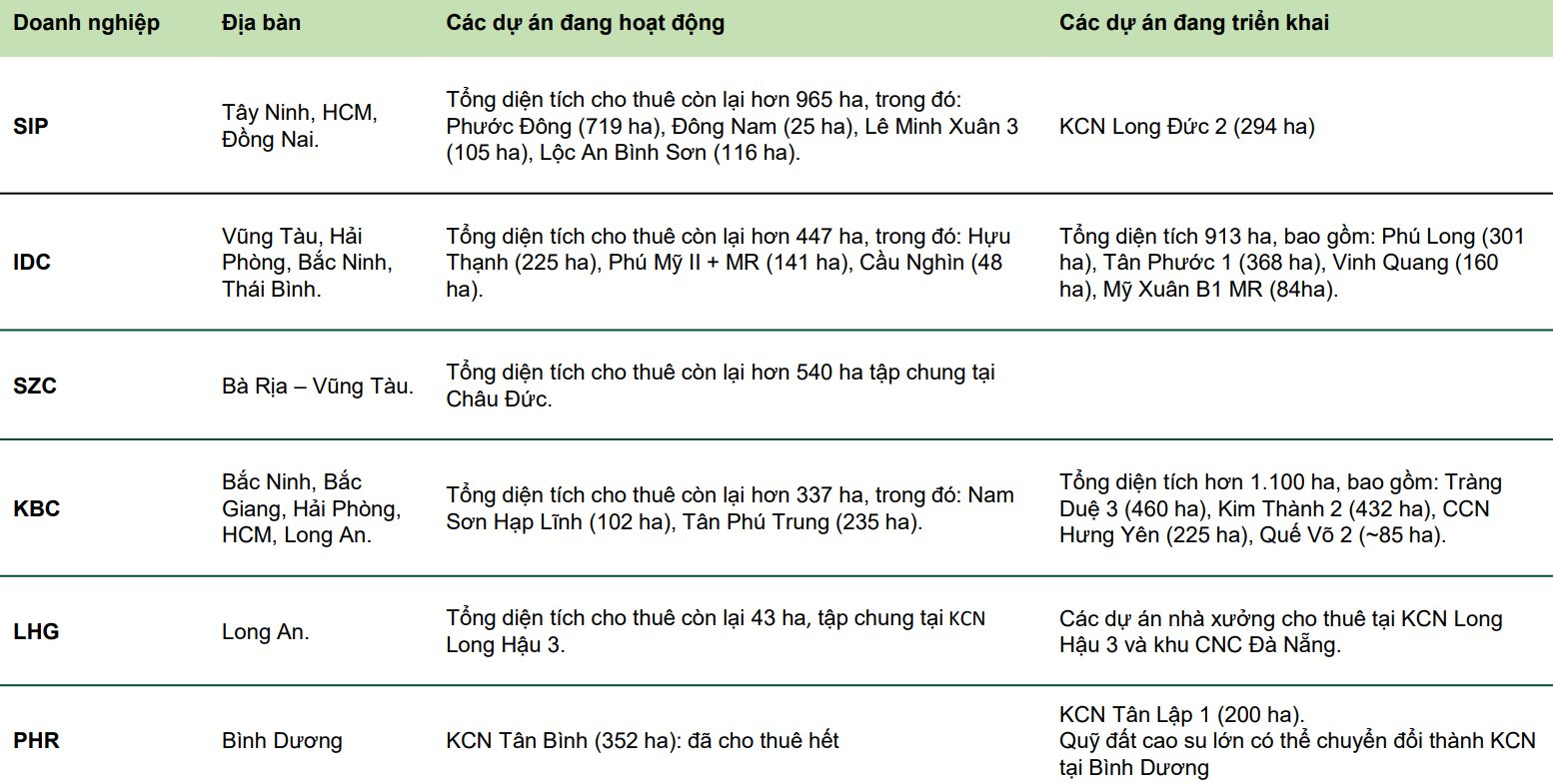

In terms of industrial real estate, VCBS expects the mergers to provide localities with increased flexibility in attracting investment, reducing procedural overlaps, and minimizing competition for FDI among different regions.

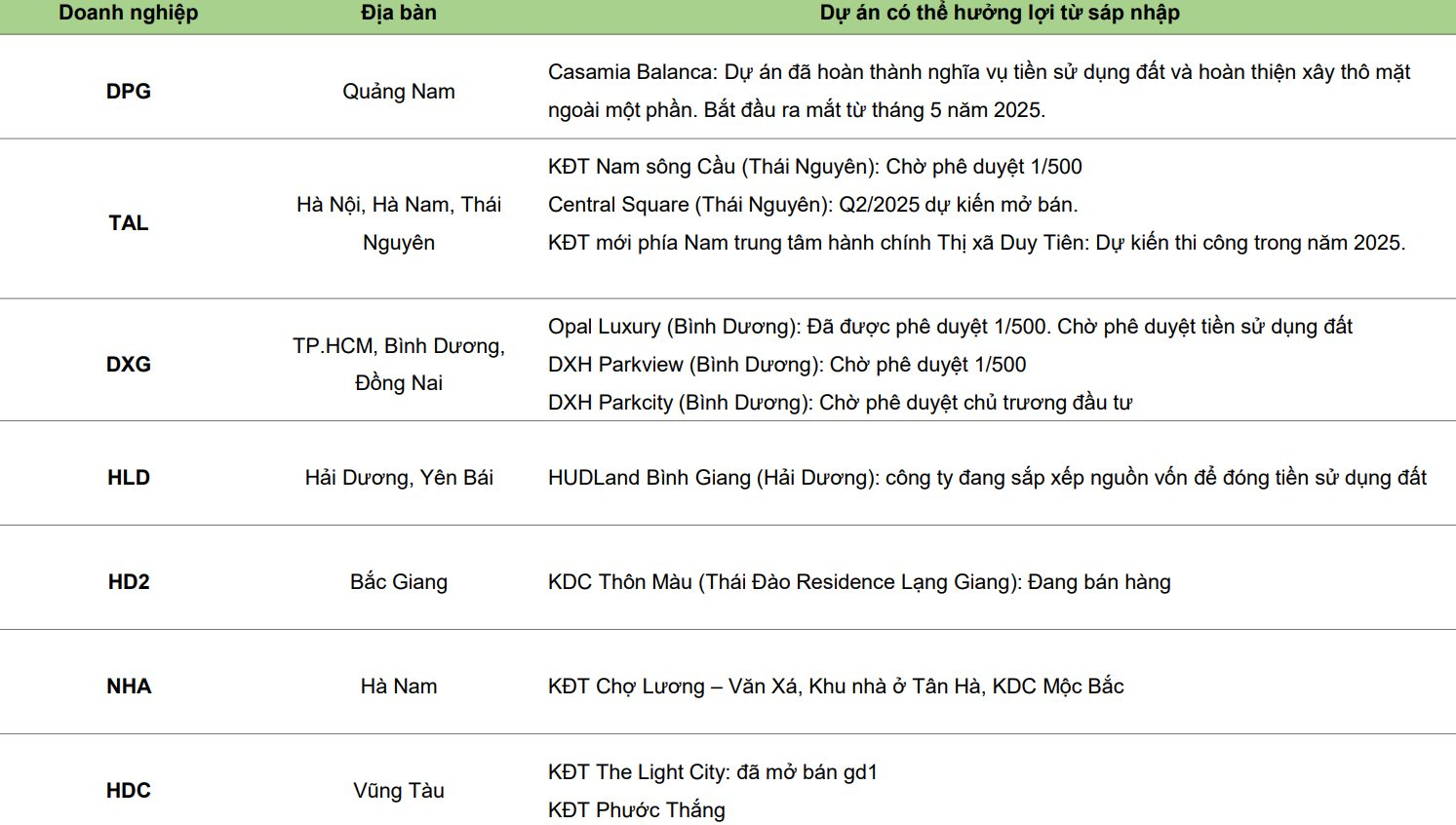

Based on these insights, VCBS identifies potential beneficiaries of the mergers, including Taseco Land (TAL), Hodeco (HDC), Kinh Bac City (KBC), Idico (IDC), Phuoc Hoa (PHR), and Saigon VRG (SIP). Notably, Dat Phuong (DPG) is the only company operating in Central Vietnam (Quang Nam), while the others are primarily focused on industrial hubs in the North and South, such as Binh Duong, Dong Nai, Bac Giang, and Vung Tau.

The Impact of Provincial Mergers on the Real Estate Market

In the first quarter of 2025, residential property and land prices in various localities experienced much more significant fluctuations compared to the previous quarter. This was mainly due to the news of provincial mergers. However, this price surge and increased trading volume carry inherent risks driven by speculative factors.

Why Are Property Prices in Hanoi Skyrocketing?

The soaring prices of apartments in Hanoi can be attributed to the high input costs of developing a commercial residential project. Land costs, which account for 25% of the total, surge to 40-50% for prime locations. Additionally, construction costs have been on a steep upward trajectory recently, contributing significantly to the overall expense.

The Housing Market Rebounds with Resilience.

The residential real estate market has witnessed a robust recovery, with a notable surge in both supply and absorption rates. This upturn is underscored by an accelerated resolution of legal issues for developers, resulting in a 51% growth in housing supply in the country’s two largest cities compared to the same period last year.

Why Are Hanoi Apartment Prices Soaring?

The soaring prices of apartments in Hanoi can be attributed to the high input costs of developing a commercial residential project. Land costs, which account for 25% of the total project cost, surge to 40-50% for prime locations. Additionally, construction costs have been on a steep upward trajectory recently, further contributing to the overall expense.

Industrial Real Estate Market Update: Slight Uptick in Warehouse Rental Rates, Supply Continues to Expand

The built-to-suit warehouse and factory segment continues to expand, underpinned by robust demand from manufacturers and logistics enterprises. Despite competitive pressures and new market entrants, rental rates in both the North and South witnessed a slight increase.