Vietnam’s liquefied petroleum gas (LPG) imports in April reached over 375,000 tons, with a value of more than $245 million, according to preliminary statistics from the General Department of Customs. This marks a significant increase of 34.5% in volume and 34.2% in value compared to the same period last year.

Cumulative imports in the first four months of the year stood at over 978,000 tons, valued at more than $649 million, a slight decrease of 0.5% in volume but an increase of 0.7% in value compared to the same period in 2024.

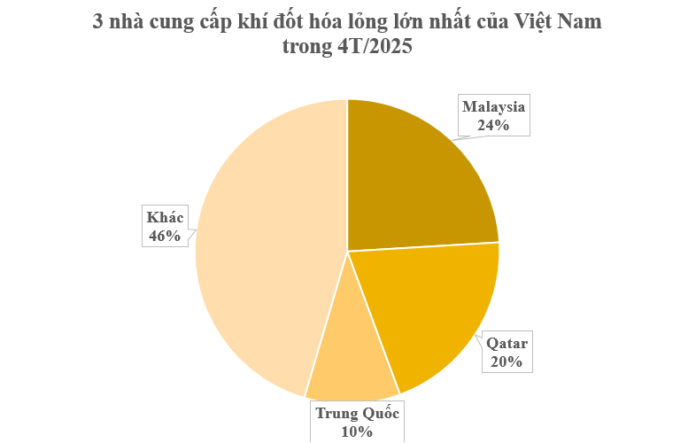

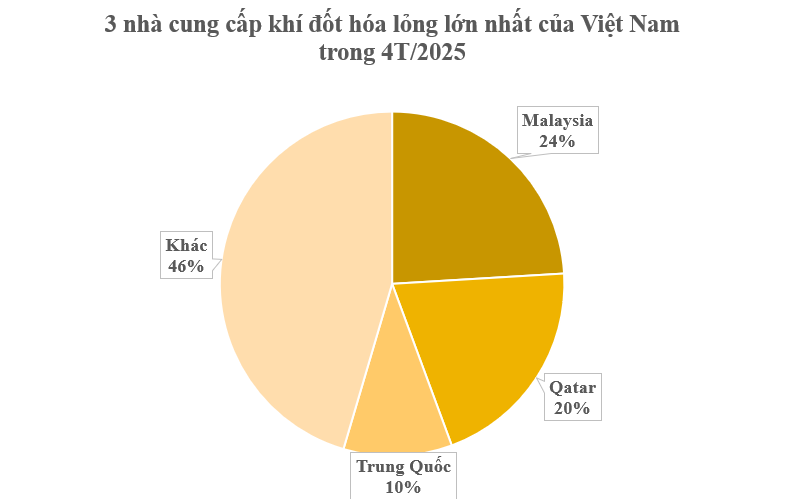

Malaysia was the largest supplier of liquefied natural gas to Vietnam from the beginning of the year, providing over 235,000 tons valued at more than $162 million. This represents a 13% increase in volume and a 20% surge in value compared to the same period in 2024. The average price reached $692 per ton, a 6% increase from the previous year.

Qatar maintained its second position, supplying over 198,000 tons worth over $127 million, despite a 15% volume decrease and an 8% value drop compared to 2024. Prices increased by 10% year-on-year, reaching $641 per ton.

China, the third-largest supplier, contributed over 99,000 tons valued at more than $71 million, reflecting a 14% volume increase and an 8% value rise. Their prices dipped by 5% to over $716 per ton compared to the previous year.

In 2024, Vietnam imported over 3.11 million tons of LPG, valued at over $2.04 billion, with an average import price of $656.6 per ton. This signified a substantial increase of 6.12% in volume, 31.55% in value, and 6.12% in import price compared to 2023.

Vietnam primarily sourced its LPG imports from three markets: Qatar, Saudi Arabia, and the U.A.E., with a total value of nearly $890 million. Malaysia’s rapid ascent to become the top supplier surpasses the dominance previously held by these three Middle Eastern giants.

Vietnam’s LPG market emerged in 1991 with an initial production of approximately 400 tons. Currently, domestic LPG production is supplied by the Dinh Co and Dung Quat refineries, with an annual output of about 750,000 tons.

LPG in Vietnam is predominantly used for domestic purposes, such as heating, cooking, industrial processes, automotive fuel, and refrigeration. However, its utilization in petrochemical technology and other applications remains relatively low.

As domestic supply meets only about 60% of the consumption demand, retail LPG prices in Vietnam are influenced by global price fluctuations. With a growing appetite for LPG and insufficient local production, imports will remain a crucial solution to bridge the gap in the coming years.

Global experts predict a rise in natural gas prices across major global markets in 2025, followed by a decrease in 2026-2027, but prices are still expected to be double the average of the previous decade. According to the IEA report, natural gas production in the Middle East is anticipated to increase by over 20 billion cubic meters in 2023-2025, translating to a 3.3% growth rate. The region is increasingly adopting natural gas for electricity generation and gradually replacing oil and oil-based products in various sectors.

Over 50 Vietnamese Businesses Head to the US to Boost Trade: Vietnam Expected to Sign MOUs Worth Over $2 Billion for US Goods

The Ministry of Agriculture and Environment has announced that the Minister will lead a delegation of nearly 50 agricultural agencies, businesses, and associations on a visit to the United States from June 1st to 7th. The purpose of this trip is to explore trade promotion opportunities and to learn about the import procedures for US agricultural, forestry, and aquatic products.

The Billionaire’s Stand: Why Tran Dinh Long Opted Out of the High-Speed Rail Race and Stuck to His Strengths

“In the past, Mr. Tran Dinh Long, Chairman of Hoa Phat Group, has repeatedly emphasized his focus on the core business domain where the company excels – steel. With a steadfast commitment to this core competency, Mr. Long has steered the group towards unparalleled success and established a formidable reputation in the industry.”