Huawei’s Strategic Investments in Over 60 Chinese Chip-Related Firms since 2019

Since being subjected to US sanctions in 2019, Huawei Technologies has strategically invested in over 60 Chinese companies related to chip technology, as recently uncovered by Nikkei. The company has made remarkable efforts to counter the restrictions on accessing Western technology by fostering a domestic supply chain.

Specifically, Huawei has expanded its investments in domestic companies through Hubble, a wholly-owned investment firm established in 2019 when Washington began imposing limitations on the largest Chinese telecom company’s access to technology and markets.

According to data from the Chinese research firm Itjuzi, Hubble has invested in more than 60 companies, spanning chip design and materials to manufacturing and testing. Nikkei also confirmed through Tianyancha, a Chinese business information website, that Hubble is a shareholder in over 50 companies, with the lowest investment resulting in a stake of approximately less than 10%.

Huawei’s clear objective is to have these companies develop technologies and manufacture products that align with its goals. Tan Jin, a senior researcher at Japan’s Mizuho Bank, commented, “The company’s top priority is to create a controllable supply chain.”

Numerous Chinese companies possess the necessary technology for next-generation chips. For instance, last year, Huawei invested in Suzhou Carbon Semiconductor Technology, a company that develops and manufactures semiconductor wafers using carbon nano tubes. These wafers outperform those made from traditional silicon.

Huahai Chengke New Material, a company that Huawei invested in since 2021, produces advanced packaging materials essential for the production of high-bandwidth memory used in AI development.

In addition to investments made through Hubble, Huawei also has close ties with SiCarrier, a Shenzhen-based chip equipment manufacturer. This company develops and manufactures equipment vital for the process of creating intricate circuits on semiconductor wafers.

SiCarrier is believed to have been a division of Huawei that later spun off as an independent company following the imposition of US sanctions. Although there is currently no equity relationship between the two, they are thought to maintain a close collaboration. A sign outside one of SiCarrier’s facilities still bears Huawei’s name, indicating a past association.

SiCarrier is rapidly establishing multiple large-scale facilities in Shenzhen, as reported by Reuters, with plans to raise $2.8 billion. The company is on a trajectory to become a significant player in the chip equipment industry.

Previous US sanctions have prevented Huawei from working with TSMC, the world’s largest contract chip manufacturer and holder of the most advanced chip-making technologies. Similarly, SMIC, China’s biggest chipmaker, is unable to procure the necessary advanced production equipment due to sanctions.

With limited options, Huawei has quietly established a chip supply chain within China and strived to enhance its technology. They have developed their own 7-nanometer chips, utilized in smartphones and other devices. Their upcoming laptop, slated for release on June 6, may feature even more advanced 5-nanometer chips.

All these cutting-edge chips are believed to be manufactured in China, designed by HiSilicon, and produced by SMIC and other companies. A source from Japan commented, “SMIC provides 7-nanometer chips using older technology. Thus, Huawei’s 5-nanometer chips could be produced as an upgrade of the same technology.”

However, there are still challenges in mass-producing advanced chips. The same source from Japan asserted, “They may be inferior in accuracy and production efficiency” when compared to competitors with access to advanced equipment.

The Challenges and Investments of Domestic Production

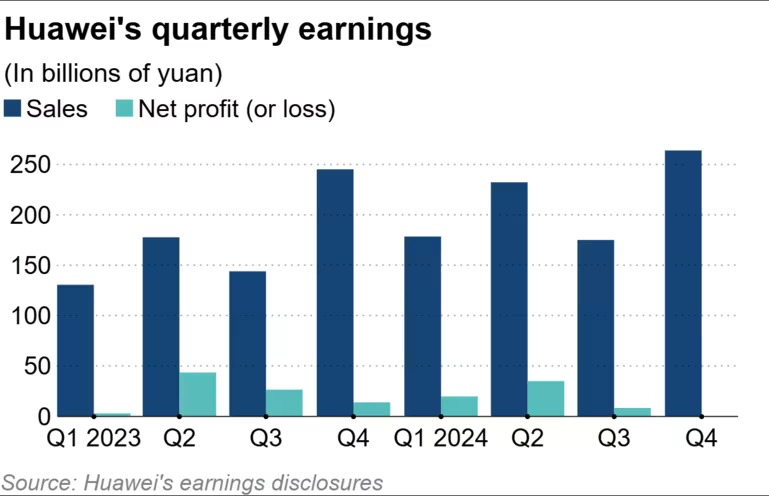

Domestic production also demands substantial investments. Huawei reported a net loss of approximately $56 million in the last quarter of 2024, as per its 2024 financial report. The increased costs associated with semiconductor development and production could have contributed to this loss.

Last week, Xiaomi announced it was developing smartphones and tablets using 3-nanometer chips of their own design. However, it is believed that they rely on TSMC for manufacturing, indicating their continued dependence on external sources.

The Real Deal: Investing in Prime Real Estate in Livable City Centers

In a dynamic real estate market, savvy investors are prioritizing value-driven opportunities in livable cities. These sought-after locations offer not just a high standard of living but also guarantee sustainable profitability.

The Captivating “Kiều by KITA”: A Smart Investor’s Top “Candidate”

“As the real estate market shifts its focus towards long-term tangible value, investors are seeking premium apartments with a central location, solid legal foundations, comprehensive amenities, and excellent connectivity. Kieu by KITA, located at 927 Tran Hung Dao, emerges as a top priority choice to fulfill these demands.”

The Pearl of Phu Quoc: Unveiling the Island’s Airport Expansion

The government has just issued Resolution No. 01 for the year 2025, dated June 1st, 2025, regarding investment in expanding Phu Quoc International Airport.