However, to achieve this goal, delegates suggested that the bill needs to be further reviewed and supplemented to ensure: (i) respect for the legitimate ownership rights of the secured party; (ii) a clear framework for administrative enforcement and the responsibility of local authorities to coordinate; (iii) a flexible mechanism for the transfer of secured assets, especially real estate; (iv) a unified current legal system; (v) minimizing legal risks for related parties.

ADDITIONAL PROVISIONS ON ENFORCEMENT OF SECURED ASSETS

Delegate Huynh Thi Phuc from Ba Ria-Vung Tau province’s National Assembly delegation stated that the bill has fully inherited the spirit of Resolution 42 by legalizing the right to seize secured assets in Article 198a. However, currently, Clause 5 of Article 198a of the draft only stipulates the obligation to maintain security and order by local authorities without a clear legal basis for enforcement in case the secured party deliberately refuses to cooperate in handling secured assets of non-performing loans. “I propose to add a clause stipulating a clear mechanism for administrative enforcement in case the secured party deliberately opposes and does not cooperate,” said Delegate Huynh Thi Phuc.

Delegate Nguyen Huu Thong particularly noted the provisions of Article 198c related to the return of exhibits and evidence that are secured assets in criminal cases. He considered this regulation necessary but needed to be consistent with the Law on Handling Administrative Violations and the Criminal Procedure Code: “It is necessary to supplement provisions on the time limit for returning to avoid delay causing damage to credit institutions.”

Similarly, Delegate Tran Anh Tuan from Ho Chi Minh City’s National Assembly delegation, said: “It is necessary to stipulate more clearly about coordination with local authorities from the beginning in case the credit institution informs that the asset holder does not cooperate”. The delegate proposed allowing credit institutions to proactively coordinate with the People’s Committee and the commune-ward police when proceeding with the seizure to ensure security and order.

Many delegates also expressed caution about the regulation on seizure of secured assets in Article 198a. Delegate Nguyen Huu Thong from Binh Thuan province’s National Assembly delegation worried: “Allowing credit institutions to seize without a court decision may affect the legitimate ownership rights of citizens according to the Constitution and the Civil Code”. Delegate Nguyen Huu Thong said that the bill needs to clarify the mechanism to protect the interests of the secured party when disputes or complaints arise. The participation and signing of the minutes of seizure of secured assets by the People’s Committee of the commune level in the bill is not appropriate.

“The People’s Committee at the commune level does not have the authority to enforce civil judgments. It is suggested that seizure be allowed only with clear agreement, uncontested assets, and there must be specific provisions on supervision and complaint,” said Delegate Nguyen Huu Thong.

“Legalizing Resolution 42 is very necessary. When the secured assets are disposed of, credit institutions can recover capital, recapitalize customers, and reduce pressure on bad debt and interest rates. To protect the interests of borrowers, the bill has clearly defined conditions, procedures, and transparent asset disposal procedures, requiring credit institutions to issue internal regulations to ensure legality and transparency in handling secured assets.”

The issue of priority when selling secured assets also received attention from the National Assembly deputies. Delegate Tran Anh Tuan affirmed that it is necessary to stipulate the highest priority for credit institutions – the direct recipient of secured assets according to the contract. Delegate Tran Anh Tuan proposed that this should be concretized in Clause 2, Article 198a to avoid problems in implementation.

Sharing the same view, Delegate Tran Van Tien from Vinh Phuc province’s National Assembly delegation proposed designing a mechanism to distinguish between two situations to harmonize the interests of the parties. If the asset has been agreed upon with the asset holder before the credit institution accepts the mortgage, the credit institution must have a three-party agreement before seizing. If the agreement is made after the credit contract is signed, the credit institution has the right to seize as prescribed by law.

Delegate Nguyen Huu Thong also suggested that the drafting agency clarify the principle of determining the validity of the secured contract, as well as the coordination mechanism between the enforcement agency and the credit institution to avoid legal conflicts and ensure effective handling.

DIFFICULTIES IN TRANSFERRING SECURED ASSETS

One of the outstanding issues raised by many National Assembly deputies in the discussion about the bill to amend and supplement a number of articles of the Law on Credit Institutions is the difficulties in transferring secured assets, especially real estate projects. Although the reality of credit activities in recent years shows that the handling of secured assets is one of the key solutions to debt recovery and bad debt reduction; However, many credit institutions still face countless difficulties when transferring these assets. The reason lies in the legal gap, the lack of synchronization between specialized laws, and the overlapping inter-sectoral coordination mechanism, causing congestion in handling.

Delegate Huynh Thi Phuc pointed out the bottleneck in the current regulations, as Article 200 of the Law on Credit Institutions has not made any adjustments in the new draft to remove difficulties for the transfer of secured assets, which are real estate projects.

The delegate analyzed: “The transfer of real estate projects as secured assets is facing great difficulties due to the lack of guiding documents and overlapping inter-sectoral coordination”. This reality makes the debt handling process take a lot of time, while the secured assets are gradually degrading and losing value, leading to damage not only to the bank but also to the economy.

To solve this problem, Delegate Huynh Thi Phuc proposed adding a new regulation in the law towards increasing the initiative and legal validity of the transfer of secured assets. Specifically, Delegate Huynh Thi Phuc proposed: “The transfer takes effect immediately when the credit institution completes the transfer procedures according to the contract, without depending on guidance from other specialized legal documents”

According to the delegates, this is a breakthrough proposal to ensure continuity and effectiveness in handling assets and reduce the stagnation that is common today.

In fact, in many cases, although credit institutions have reached an agreement on the transfer, they still encounter difficulties in obtaining permits and approvals from construction management, land, and environmental agencies, or from local authorities, prolonging the process for many months or even years. This not only causes direct damage to the bank but also erodes the trust of investors, negatively affecting the real estate market.

Many other delegates also expressed their agreement on the need to amend the law to create a clear and unified legal corridor for the transfer of secured assets. Some opinions suggested that there should be a “one-door inter-agency” mechanism or assign one focal point responsible for coordinating the handling of secured asset transfer dossiers among parties: tax agencies, natural resources and environmental agencies, local authorities, and credit institutions. Only then can the handling process be shortened, while protecting the legitimate interests of the buyer, the seller, and the borrower.

From the above reality, it can be seen that completing legal regulations related to the transfer of secured assets, especially real estate, is an urgent requirement to handle bad debts thoroughly and promote the flow of credit capital in the economy. Delegates noted that supplementing regulations in the bill to amend and supplement a number of articles of the Law on Credit Institutions must be accompanied by legal uniformity among specialized laws such as the Land Law, the Law on Real Estate Business, the Law on Investment,… at the same time, there must be a clear coordination mechanism between state administrative agencies, avoiding each sector having its own regulations that cause difficulties for businesses and credit institutions.

According to experts, if the above-mentioned legal bottlenecks are not thoroughly and promptly resolved in this law amendment, the goal of quickly reducing bad debts and creating a healthy credit environment will be difficult to achieve in reality…

The full content of the article is published in Vietnam Economic Review Magazine No. 22-2025 issued on 02/06/2025. Please find it here: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

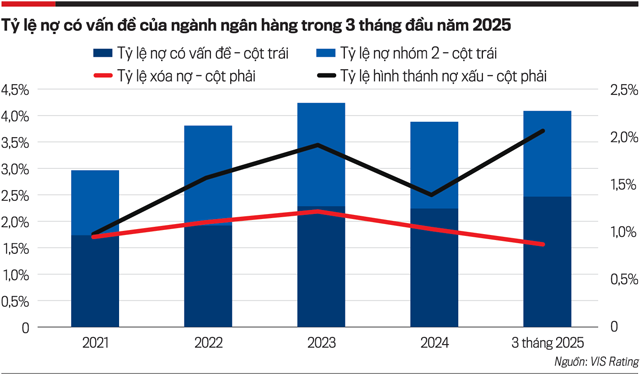

Anticipating a Significant Drop in Bank’s Non-Performing Loans Post-Legislative Resolution 42

The government has presented to the National Assembly the Draft Law amending and supplementing a number of articles of the Law on Credit Institutions, aiming to legalize some important policies from Resolution No. 42. Legalizing Resolution 42 will not only enable banks to handle secured assets of non-performing loans but also unblock previously clogged capital flows, thereby facilitating reduced lending rates to the benefit of both banks and borrowers.

“Prime Residential Development Site Up for Grabs in Hanoi”

We are pleased to announce the sale of a significant debt portfolio, totaling over VND 41.5 billion, belonging to the Electrical and Water Installation and Construction Joint Stock Company. One of the key assets backing this debt offering is the development rights to the Cowa Tower project, located at 199 Ho Tung Mau, Nam Tu Liem District, Hanoi. This prime real estate opportunity presents a unique investment prospect for prospective buyers.