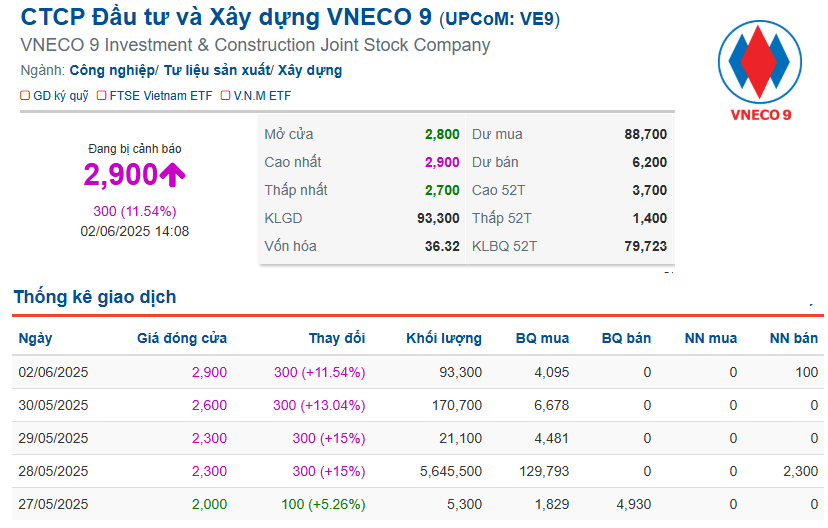

Shares of VNECO Investment and Construction JSC (UPCoM: VE9) caught the market’s attention as they surged to the ceiling price for four consecutive sessions, closing at VND2,900 per share on June 2, 2025, a remarkable 53% increase within just one week. This price is more than double the early-April low of VND1,400 and nearly matches the price from early October 2024. VE9 is now only 22% away from its three-year peak of over VND3,700, established in late September 2024.

VE9’s consecutive gains last week – Source: VietstockFinance

|

|

VE9 was previously listed on the HNX from January 2008 and experienced a sharp increase in the second quarter of 2010, peaking at nearly VND15,000 per share—a sevenfold increase in less than three months. However, the stock has since been on a downward spiral, becoming one of the “penny stocks” on the exchange. VE9 was forcibly delisted in November 2020 and moved to UPCoM, where its market price has remained below par value ever since. |

Along with the scorching surge, VE9‘s liquidity saw a significant breakthrough. In the past week, the average trading volume of this stock reached nearly 1.2 million shares per day, compared to the yearly average of around 80,000 shares per day. Notably, on May 28, 2025, VE9 set a liquidity record with more than 5.5 million shares traded—the first session marking the start of its consecutive ceiling price sessions.

The extraordinary liquidity on May 28 was associated with transactions made by two major shareholders. Mrs. Do Ngoc Anh reported that she had divested her entire stake of 722,400 VE9 shares (6.01%) and was no longer a shareholder. Conversely, Mrs. Vu Thi Thu Trang became a new major shareholder by acquiring nearly 1.55 million shares, increasing her ownership from 0.73% to 13.59%, equivalent to over 1.63 million shares.

According to the disclosures, neither individual is related to insiders or affiliated entities at VE9. It is estimated that Mrs. Trang invested over VND3 billion to purchase the shares, while Mrs. Ngoc Anh earned approximately VND1.4 billion from the sale.

VE9’s price movement since resuming trading on UPCoM after delisting from HNX – Source: VietstockFinance

|

VE9 was formerly known as Construction Electricity 3.9 JSC, which was privatized from a state-owned enterprise in 2004. With its current charter capital of over VND125.2 billion, the company has expanded its capital thirtyfold since its initial business registration. Headquartered in Nha Trang, Khanh Hoa Province, VE9 specializes in constructing electricity grids and substations up to 500kV, as well as power plants. Notably, as of the end of 2024, VE9 had only four employees, a significant decrease from 286 employees in 2006.

VE9 has experienced stagnant business operations for many years, incurring losses for six consecutive years since 2019. In 2024, the net loss narrowed to VND73 million, but the company continued to record an additional loss of VND239 million in the first quarter of 2025, bringing the cumulative loss to nearly VND121 billion as of March 31, 2025. Owners’ equity as of the same date stood at a meager VND9 billion.

Notably, in the first quarter of 2025, VE9 generated zero revenue. In recent years, the company’s revenue has been extremely low, reaching only a few billion dong if any. The company attributed this to economic hardships that prevented revenue generation, while management expenses continued to incur losses. The weak financial situation led VE9 to suspend dividend payments since 2018. The last time the company paid dividends was in the first quarter of 2017, with a remarkable 60% payout ratio in cash.

| VE9’s dismal business results over the past decade |

– 15:32 02/06/2025

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.

The Vietnamese Stock Market Soars: A 29% Surge and a Whopping 11x Dividend Payout

The 2024 dividend yield marks a significant milestone as it represents the highest cash dividend that the company’s shareholders have ever received.

A Local Beer Brand Lists on UPCoM, Offering 6 Million Shares After Two Decades of Brewing Excellence

” Hanoi Beer Trading Joint Stock Company – Hung Yen 89, with a capacity of 35 million liters per year and an extensive distribution network in the North, will be trading on UPCoM under the ticker BHH. Despite a loss in the first quarter of 2025, the company aims for a 13% growth in net profit for the full year, coupled with a commitment to continue paying cash dividends.”