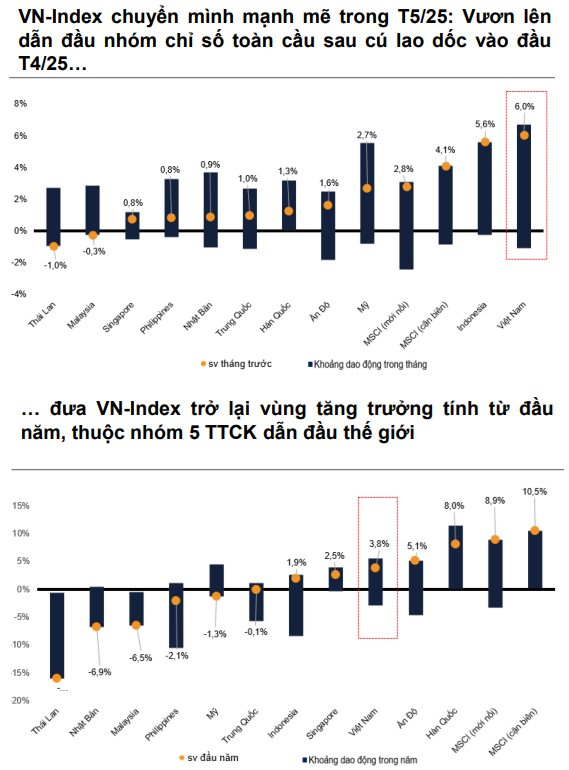

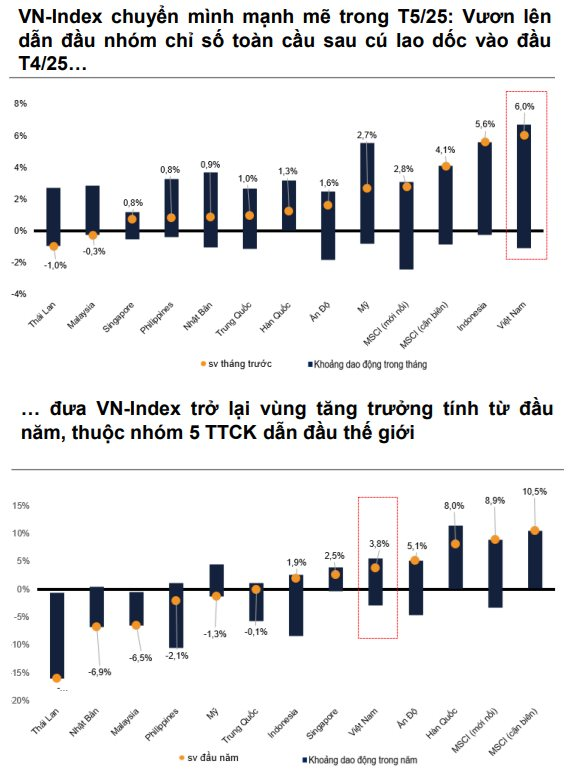

In VNDirect’s newly published strategic report, the securities firm assessed that the VN-Index surpassing the 1,300-point mark in May was not only due to positive signals from global trade agreements but also solid internal momentum. Signs of easing tensions became apparent as the UK and China successfully concluded agreements with the US. Simultaneously, Vietnam completed the first two rounds of negotiations.

Domestically, the release of two pivotal resolutions, Resolution 68-NQ/TW and Resolution 198/2025/QH15, provided a boost to encourage the expansion of the private sector. However, the market still faced pressure as Vietnam’s PMI fell to 45.6 in April, indicating declines in output, new orders, employment, and purchasing activities.

Notably, the impressive 6% gain was mainly driven by the Vingroup family of stocks amid a stream of positive news about these companies. This momentum helped the VN-Index regain its footing, achieving a year-to-date gain of 3.8%.

VN-Index targets 1,400 points in the base case scenario, with potential to surpass 1,500 points in an optimistic outlook

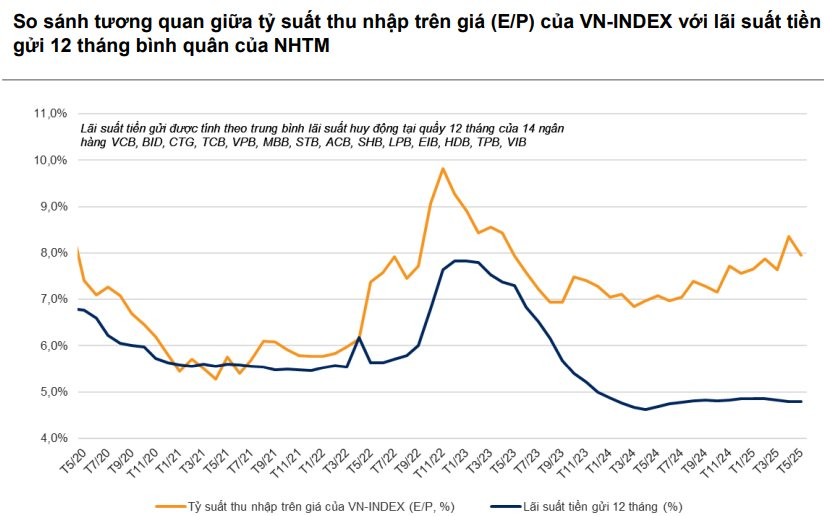

Looking at the market context for June, VNDirect observed healthy growth in credit and deposits, accompanied by low-interest rates. While deposit interest rates have generally remained stable, localized pressure has started to emerge in some smaller banks. VNDirect anticipates a downward trend in the DXY index and expects Vietnam to be upgraded by FTSE in September, which would positively influence the stock market in 2025.

These factors could improve investor sentiment and attract new capital inflows, leading to a revaluation of the stock market at higher levels. As a result, the stock market’s yield would remain attractive compared to deposit interest rates.

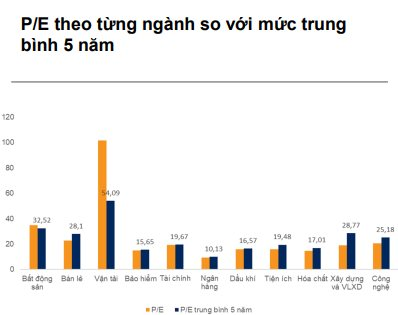

The robust recovery brought the market’s P/E ratio back to around 12.9 times, similar to the beginning of the year. However, VNDirect considers this valuation attractive as it discounts approximately 16% from the 10-year average. Despite the challenges posed by the US’ tax policy, analysts expect listed companies on HOSE to achieve EPS growth of 12-17% in 2025, depending on tariff scenarios.

VNDirect maintains three scenarios for the market in 2025, with a target of 1,400 points for the VN-Index in the base case. In an optimistic scenario, the VN-Index could surpass 1,500 points and close at 1,520 points if Vietnam successfully negotiates with the US to reduce the countervailing tax rate below 20% or drastically cuts interest rates to boost economic growth.

Short-term corrections provide opportunities for profit-taking and increasing allocations in stocks with supportive narratives

Nonetheless, in the short term, VNDirect believes that market consolidation is necessary to absorb cheap supply and establish a new price base, gathering sufficient supportive factors and momentum for a breakthrough above this critical resistance level. This strategic moment offers investors an opportunity to restructure their portfolios and take profits from stocks that have surged while shifting focus to sectors that remain attractively valued and have not fully recovered to pre-April 2nd levels.

VNDirect highlights notable opportunities in the securities, steel, and select export-oriented businesses in the textile and seafood industries, as supportive factors are likely to emerge in the coming period.

The analytical report also projects that FTSE may officially upgrade Vietnam to an emerging market in September 2025. Looking further ahead, VNDirect anticipates that the remaining MSCI upgrade criteria will be met by 2026. The market will officially be upgraded to emerging market status by MSCI in the June 2027 review.

The Stock Market in June: What to Expect After a Brilliant May

The VN-Index ended May with the strongest gain since the beginning of the year, but it now faces profit-taking pressure at the old peak. Analysts remain cautious, suggesting that the market will continue its accumulation trend to absorb profit-taking selling pressure while awaiting new supportive information.

A Surprising Turn: The Sudden Sell-Off of a Stock by Brokerage Firms’ Proprietary Trading

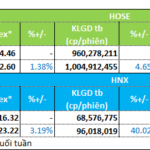

The proprietary trading arms of securities companies offloaded a net sell value of VND1.42 trillion on the Ho Chi Minh Stock Exchange (HoSE).

Shipping Stocks, Seafood, and Textiles: A Trio of Lucrative Investment Opportunities

The HNX exchange witnessed a significant improvement in liquidity during the final trading week of May. Marine transportation, textiles, and seafood were the top-performing sectors, attracting the most capital inflows over the week.