Gold prices surged at the start of this week amid news of potential trade agreement breakdowns between the US and China.

According to market reports from Phu Quy Gold and Gems Group, notable events this week could impact gold prices. Specifically, after the opening of the first session of the week, prices surged following news related to the potential collapse of US-China trade agreements.

Additionally, Russia and Ukraine are expected to hold negotiations today (June 2nd). If these negotiations yield positive results, along with favorable economic data for the US dollar, gold prices may come under pressure and drop below the $3,200 mark. Conversely, if global tensions persist, economic data weakens, and there is an increased likelihood of Fed rate cuts, gold prices could surge.

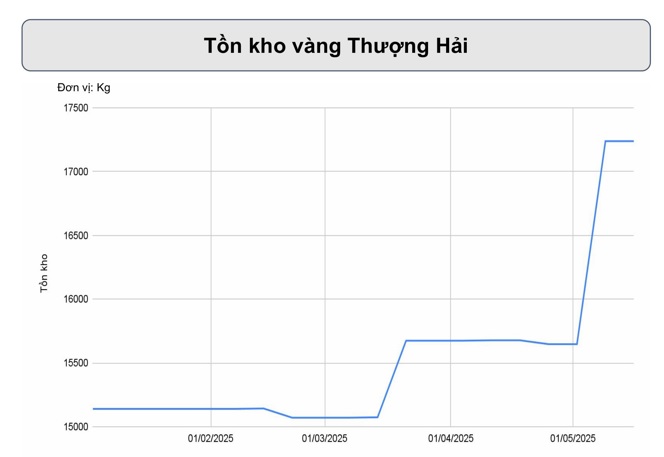

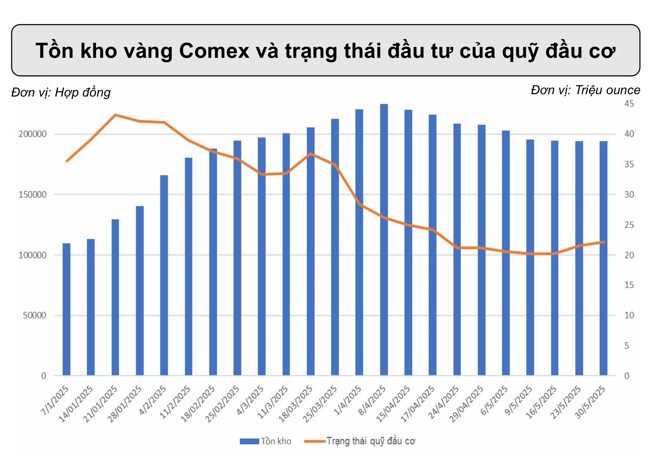

Market data shows that gold inventories in Shanghai remain stable at over 17 tons. COMEX gold inventories are similar, hovering around 38 million ounces. The buying status of speculative funds increased slightly due to the upward trend in gold prices last week.

Gold inventories remained stable last week.

With gold prices sustaining levels above $3,200 per ounce and speculative funds significantly increasing their buying status, new price peaks could be established in the future. However, stable inventories and slightly slower buying activity indicate a cautious market sentiment during this period of sideways gold prices, awaiting factors that could drive a new trend.

According to Phu Quy’s analysis, gold prices are likely to continue their long-term upward trend. However, technically, a triple-top pattern is forming, suggesting a potential short-term decline.

A Kitco News survey found that industry experts and gold traders hold balanced views on gold’s potential this week.

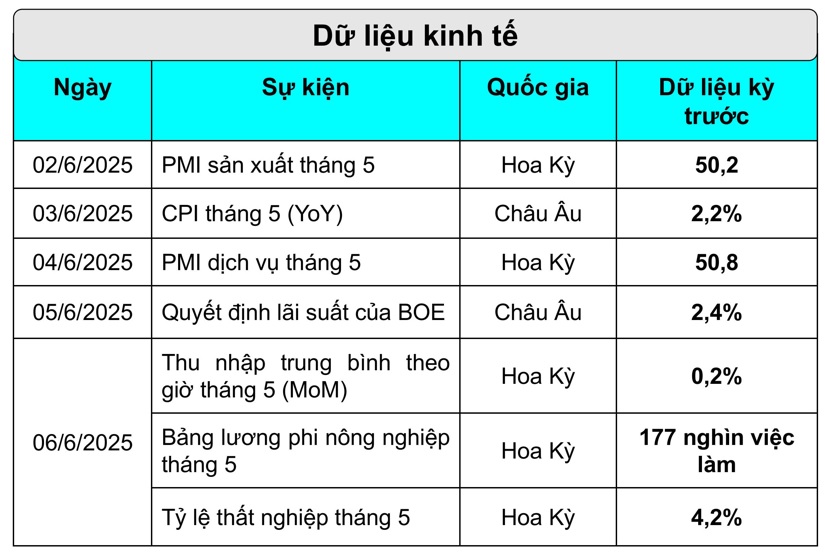

This week’s economic events could influence gold prices.

Adrian Day, President of Adrian Day Asset Management, shares the view that gold prices could fluctuate significantly this week but doubts any substantial decline. He believes that while the market is focused on Trump administration actions, the real drivers of gold demand predate them and remain intact.

“Central banks clearly want to diversify their holdings away from the dollar,” he said. He believes that positive economic signals could lead to a slight decrease in gold prices, but “nothing suggests a sharp decline” in the near term.

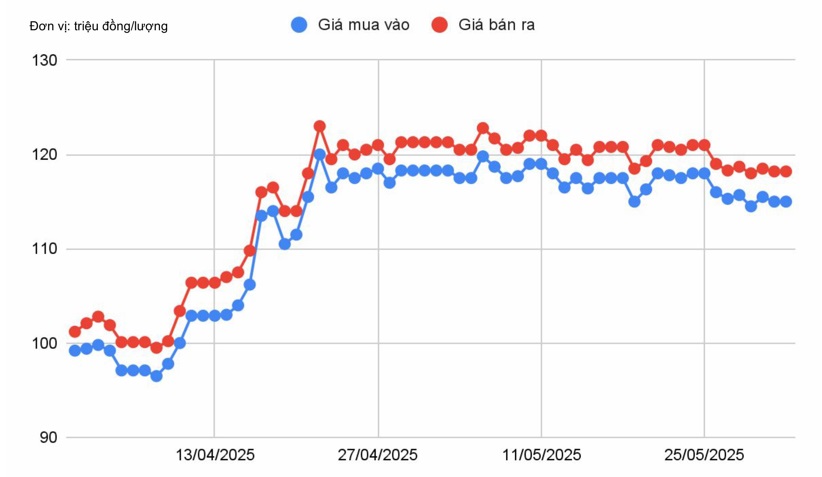

Domestic SJC gold price movements.

In a Kitco News survey of 14 analysts, 6 (43%) predicted rising gold prices, 4 (29%) forecast a decline, and the remaining 4 (29%) expected stability. Among retail traders, 56% anticipated higher prices, 24% predicted a decrease, and 20% expected stability.

What’s the Deal with SJC’s Monopoly on Gold Bars Over the Past Decade?

In 2024, the volatile gold prices resulted in a significant revenue shift for SJC. The company raked in 32,193 billion VND, marking a notable surge of nearly 4,000 billion VND compared to 2023. This performance is especially noteworthy considering SJC’s previous monopoly on gold bullion, during which it boasted revenues surpassing 72,000 billion VND.