NCT’s Annual General Meeting in 2025

On June 20, NCT, the leading cargo service provider at Noi Bai International Airport, will hold its 2025 Annual General Meeting in Hanoi.

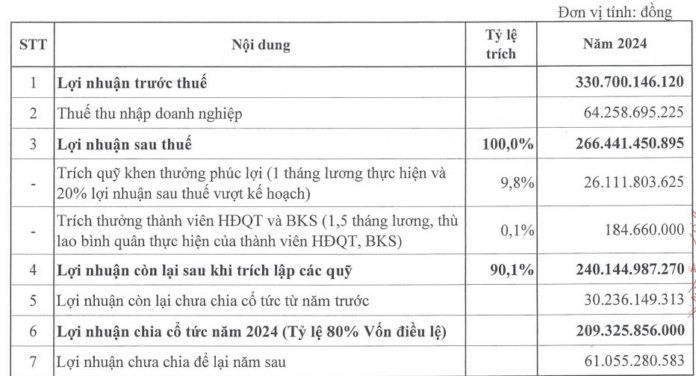

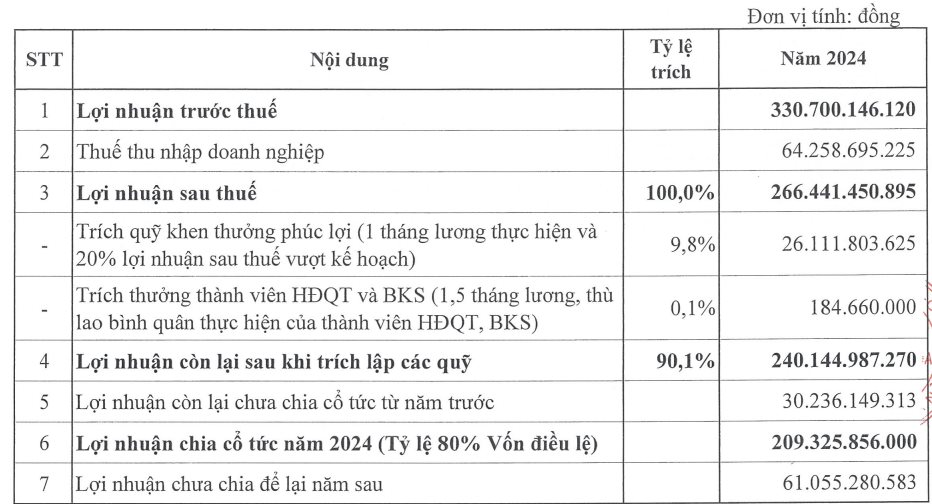

According to the released agenda, the company’s management will propose a cash dividend payout of 80% for 2024, amounting to over VND 209 billion. Additionally, the meeting will involve the election of five members to the Board of Directors and three members to the Supervisory Board for the 2025-2030 term.

Looking ahead, NCT’s management anticipates challenges in the business environment and the air cargo industry due to various factors. While the company has not disclosed its business plan for 2025, its performance in 2024 was impressive, with revenue and profit exceeding targets by significant margins.

In 2024, NCT recorded nearly VND 950 billion in revenue and VND 266 billion in after-tax profit, surpassing the plan by 20% and 22%, respectively. The total cargo volume handled was 370,179 tons, a 14% increase compared to the planned figure.

The domestic cargo volume reached 103,000 tons, exceeding the annual plan by 17% due to the post-pandemic economic recovery and the boom in e-commerce, which fueled the demand for small-scale and rapid cargo transportation through air freight services.

In the international market, cargo volume exceeded the plan by 13%, totaling over 267,000 tons. NCT attributed this to the ongoing tensions in the Red Sea, which led to a container shortage and subsequently, an increase in sea freight rates. This situation prompted a shift in cargo transportation from the Suez Canal to air freight, benefiting NCT’s international cargo volume.

In the first quarter of 2025, NCT continued its strong performance, with a 30% year-on-year growth in revenue and a 29% increase in after-tax profit. The company attributed this growth to the robust expansion in import and export activities and the positive performance of the airlines it serves.

Established in 2005, NCT specializes in providing cargo handling services at Noi Bai International Airport. Over the years, the company has diversified its offerings to include warehousing, customs declaration, cargo security inspection, and domestic and international transportation services.

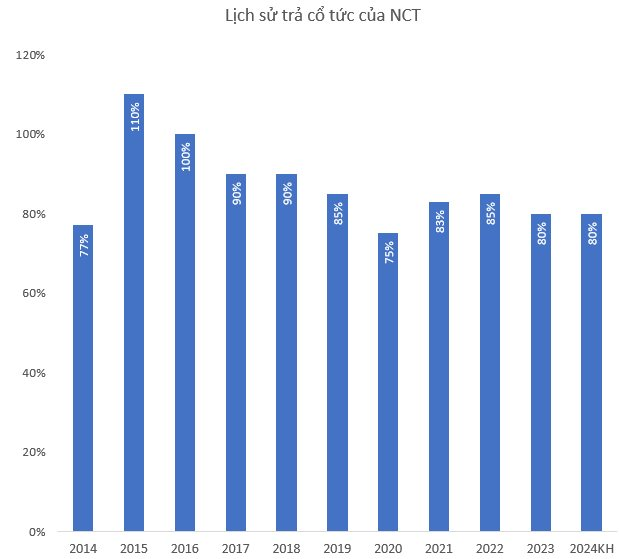

NCT has a history of paying high dividends, with a peak of 110% in 2015. In recent years, the company has maintained a generous dividend policy, with payout ratios of 83% in 2021, 85% in 2022, and 80% in 2023.

In terms of ownership structure, Vietnam Airlines, NCT’s parent company, holds 55.13% of the shares. Other significant shareholders include America LLC with 10.7% and Noi Bai Airport Ground Services JSC with 6.98%.

On the stock market, NCT’s share price surged by nearly 3% on June 3, closing at VND 106,800 per share.

Aseansc Aims for Over $13 Billion in Profits in 2025, Elects Two New Board Members

The annual general meeting (AGM) of Asean Securities Joint Stock Company (Aseansc) unveiled ambitious plans for the year 2025. The Board of Directors proposes to achieve a revenue of VND 323 billion and a pre-tax profit of VND 131 billion, marking a significant 27% and 5% increase, respectively, from the previous year’s performance. To ensure a complete board, the assembly will also elect two new members to the Board of Directors, filling vacancies from expiring terms.

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.