Inauguration of the DACOVET Vaccine Factory

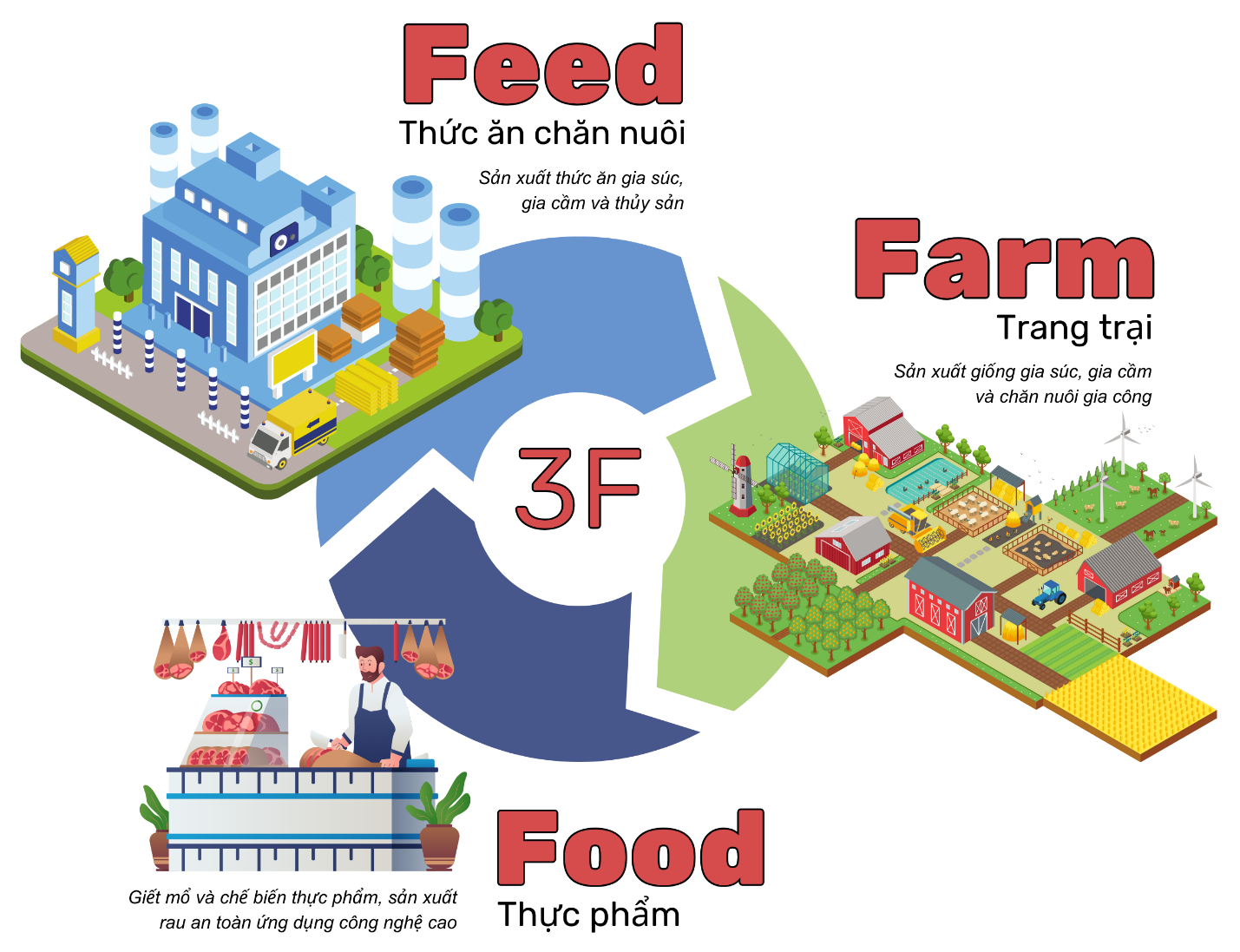

In March 2025, Dabaco inaugurated the DACOVET vaccine factory and announced the commercialization of the African Swine Fever vaccine, DACOVAC-ASF2. This marks a significant turning point, solidifying DBC’s pioneering position in safeguarding national food security and advancing Vietnam’s livestock industry. With over 60,000 basic sows and an annual pork production of 1.5 million, DBC has consistently prioritized disease control. Since the emergence of ASF in Vietnam in 2019, DBC has collaborated with the USDA to successfully develop a vaccine with an impressive 80-100% protection rate. The DACOVET factory, with an investment of over 300 billion VND and an annual capacity of 200 million doses, employs advanced technology from the US, Germany, and Japan. It received WHO-GMP certification in August 2024.

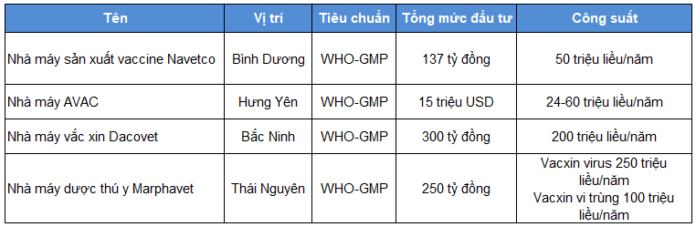

List of veterinary vaccine manufacturers in Vietnam

Source: Company websites

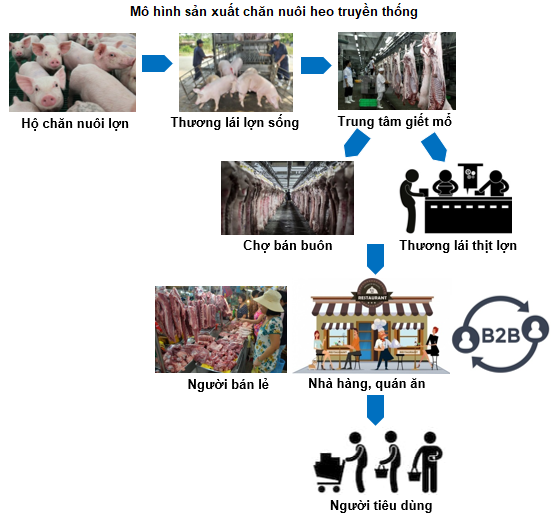

Promoting the 3F Model

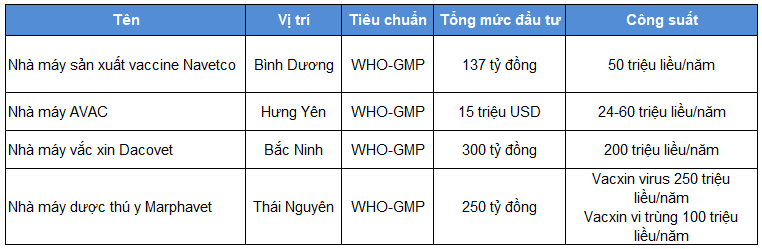

By concentrating resources on research and the application of solutions for the development of core agriculture and food industries under the closed-loop 3F (Feed – Farm – Food) value chain, DBC can reduce intermediary costs compared to the traditional value chain. This elimination of middlemen for live pigs and pork allows them to provide consumers with reasonably priced products.

Source: Vietnam Livestock Association

Additionally, this model ensures better quality control in pork production, addressing the issue of banned substance use in livestock farming. It offers consumers high-quality, nutritious food products that meet food safety standards.

The 3F Model (Feed – Farm – Food)

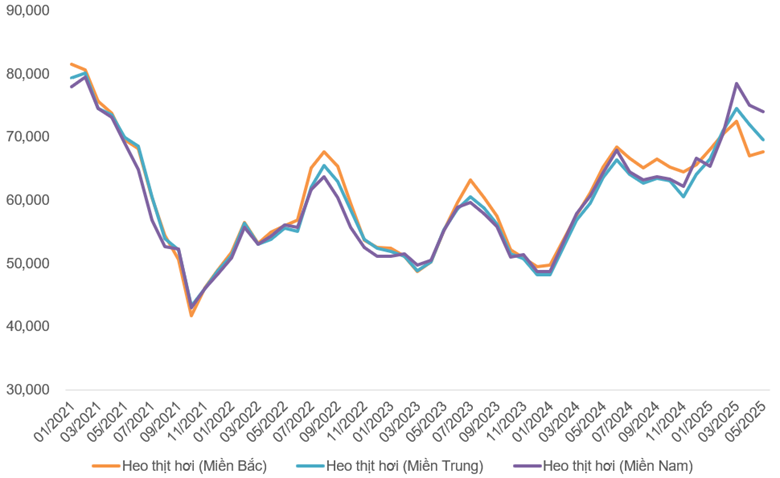

Pork Prices Continue to Rise in 2025

Following the severe outbreak of African Swine Fever (ASF) in 2024, pork supply plummeted, causing pork prices to soar and maintain this upward trend. As of March 2025, pork prices in Vietnam had risen significantly, at times nearing the peak levels of January 2021. While the upward trend showed signs of slowing and adjusting in April and May 2025, prices remain higher than in 2024.

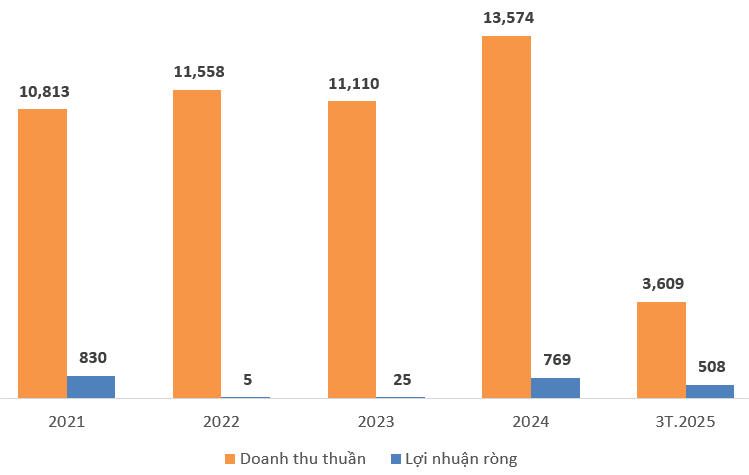

With prices remaining high and domestic consumption continuing to grow, DBC is well-positioned to further expand its profit margins. This upward momentum has resulted in impressive first-quarter results for 2025, with net profits reaching 508.26 billion VND, surpassing 50% of the 2025 plan and nearly equaling the full-year profit of 2024.

Domestic Pork Prices from 2021 to May 2025

(Unit: VND/kg)

Source: Vietnam Livestock

DBC’s Business Results from 2021 to Q3 2025

(Unit: Billion VND)

Source: VietstockFinance

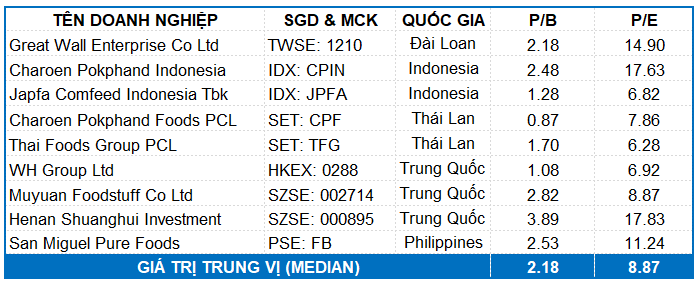

Stock Valuation

DBC is currently a leading company in Vietnam’s livestock farming, slaughtering, and meat processing industry. For a fair valuation of DBC’s stock, a comparison can be made with publicly traded companies in the same industry, specifically those from Asian countries (China, Thailand, Indonesia, Taiwan, etc.) with similar or larger market capitalizations.

Source: Investing.com and VietstockFinance

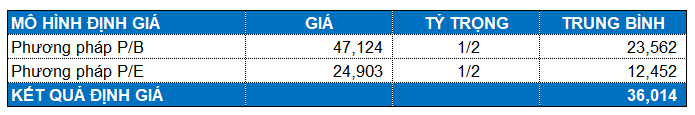

Using the Market Multiple Models (P/E, P/B) with equal weights, the predicted fair value for DBC stock is 36,014 VND. Therefore, the current market price presents an attractive opportunity for long-term investment.

Enterprise Analysis Department, Vietstock Consulting

– 13:02 06/04/2025

The Giant Pig of China: Farmer Raises 500kg Pig, the Size of a Polar Bear, in Hope for Profit Windfall.

The practice of fattening pigs to over 500 kg is raising concerns among experts about the potential spread of diseases.

“DCM – Anticipating Steady Growth (Part 2)”

Petro Vietnam Ca Mau Fertilizer JSC (HOSE: DCM) boasts a robust financial structure and a consistent track record of cash dividend policies. As such, DCM stands out as a notable stock for long-term investors seeking steady returns and a reliable investment prospect.