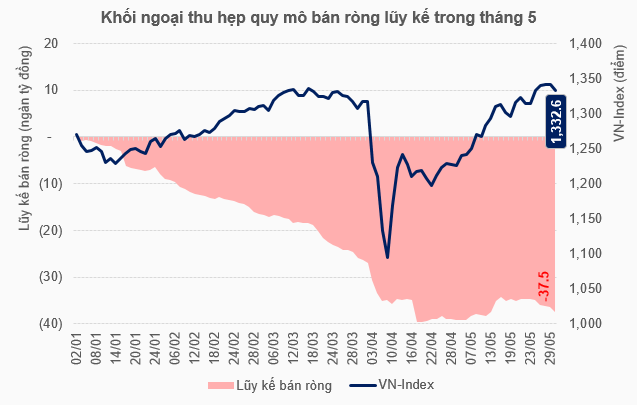

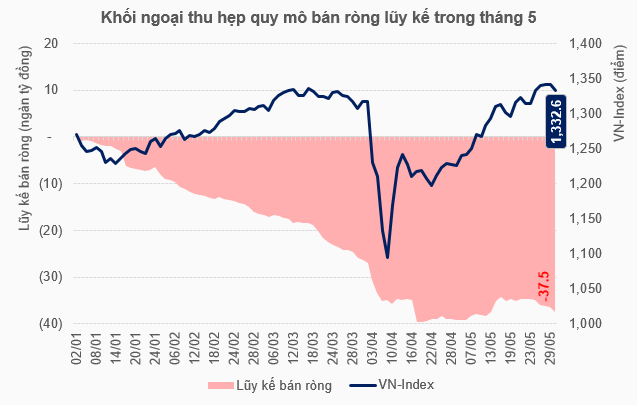

VN-Index’s strong recovery in May, ending the month at 1,332.6 points, was an unexpected turn of events, rebounding from the low of 1,073.61 points amidst the tariff shock. The foreign block’s return to net buying provided a significant boost.

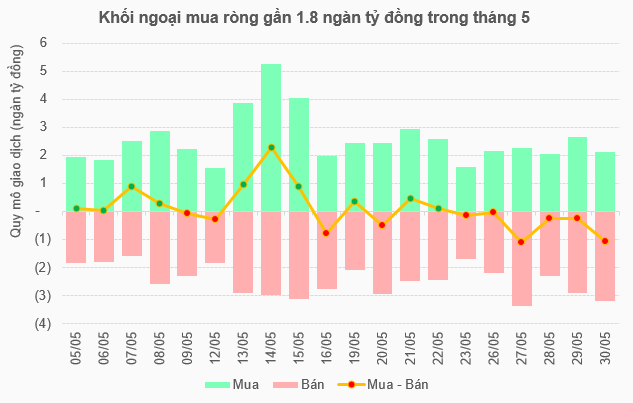

On the HOSE, foreign investors net bought nearly VND 1.8 trillion in May, reducing the net selling scale since the beginning of the year to about VND 37.5 trillion. This also marked the first month of net buying since they last did so in January 2024.

Foreigners net bought in 10 out of 20 trading sessions in May, with the most notable session on May 14, with a net buying value of nearly VND 2.3 trillion, focusing on FPT, VPB, and MWG stocks.

Source: VietstockFinance

|

Source: VietstockFinance

|

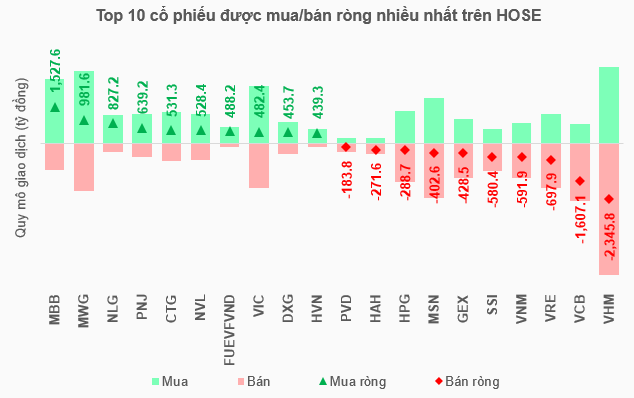

In May, MBB was the most net bought stock with a value of over VND 1.5 trillion, followed by MWG with nearly VND 982 billion, NLG with over VND 827 billion, and PNJ with over VND 639 billion. On the selling side, the market recorded two stocks with net selling values of over VND thousand billion, including VHM with over VND 2.3 trillion and VCB with over VND 1.6 trillion.

Source: VietstockFinance

|

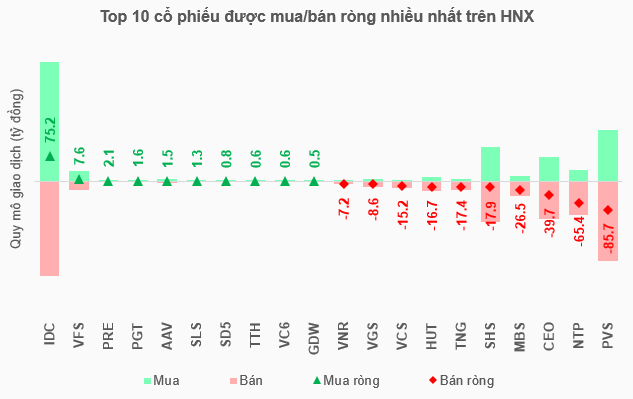

On the HNX, although foreigners still net sold nearly VND 256 billion, the scale was significantly narrowed compared to the previous two months, which were over VND 508 billion in March and over VND 439 billion in April. With this result, the accumulated net selling value in the first five months of the year exceeded VND 1.2 trillion.

IDC led the net buying in May with over VND 75 billion, far surpassing the runners-up. In terms of net selling, PVS topped the list with nearly VND 86 billion, followed by NTP with over VND 65 billion and CEO with nearly VND 40 billion.

Source: VietstockFinance

|

Was the net buying a fleeting or long-term trend?

Since President Donald Trump announced the postponement of imposing high retaliatory tariffs on trading partners, the Vietnamese stock market has rebounded strongly, with foreign investors resuming net buying.

According to Mr. Nguyen The Minh, Director of Research and Development at Yuanta Vietnam Securities Company, in the first few weeks of May, foreign capital net bought strongly in the Vietnamese market. However, the rising US bond yields will hinder this trend.

Currently, US bond yields are relatively high for long-term maturities, with 10-year and 30-year yields ranging from 4.5-5%. This reflects the sell-off causing pressure on public debt and capital costs for the US economy. This will undoubtedly impact macroeconomic trends in the short term, especially exchange rate pressure.

If the yield trend continues to rise, even surpassing the 5% threshold for 30-year bonds, then exchange rate risks for Vietnam will increase significantly, affecting foreign capital inflows.

On this topic, Mr. Luu Chi Khang, Head of Self-Business at Kien Thiet Vietnam Securities Company (CSI), opined that the net buying trend is more long-term than short-term.

According to Mr. Khang, capital is flowing out of the US as investors believe that President Donald Trump’s tariff plans could have a significant impact, affecting the USD. Actual results also show that since Trump’s tough statements on tariffs in early April, the USD has continuously weakened.

While the VND is still depreciating against the USD, the weakening of the USD will inevitably lead to a trend of net buying in emerging markets, including Vietnam, against the backdrop of a positive economic outlook and a foreign ownership ratio of only about 16% as of May, following a period of strong net selling.

– 07:57 03/06/2025

The Cash Flow Conundrum: Unlocking the Billion-Dollar Foreign Investment Boom

The excitement escalated significantly in the afternoon session as the liquidity of the two exchanges soared to an 8-session high, surging 23% from the morning session. Although the VN-Index didn’t surge significantly, the overall price level was lifted, particularly with foreign capital pouring in, resulting in a remarkable net buying session of over VND 900 billion on the HoSE.