Oil prices rose nearly 3% despite OPEC+’s decision to stick to its plan of increasing output. Wildfires in Canada’s oil-producing province and Trump’s new tariff threats pressured the US dollar, contributing to the rise.

Oil prices rose nearly 3%

despite the OPEC+ group of oil-producing countries’ decision to maintain their plan to increase output. Wildfires in Canada’s oil-producing province of Alberta and new tariff threats by US President Donald Trump pressured the US dollar, contributing to the rise in oil prices.

On June 2nd, Brent crude oil futures settled at $64.63 per barrel, up $1.85, or 2.95%, while WTI crude oil futures rose by $1.73, or 2.85%, to $62.52. The wildfires in Alberta, which accounts for about 7% of Canada’s total crude oil production, have impacted the market.

Additionally, a weaker US dollar supported higher oil prices as Trump’s new tariff threats could affect economic growth and inflation. Commodities priced in dollars, such as oil, become more affordable to buyers holding other currencies when the greenback weakens.

OPEC and its allies, known as OPEC+, decided to increase output by 411,000 barrels per day (bpd) in July 2025, marking the third consecutive monthly increase. This decision aims to regain market share and penalize members who exceeded their production quotas.

Analysts at Goldman Sachs expect OPEC+ to implement the final production increase of 410,000 bpd in August 2025. Morgan Stanley also forecasts a return to total production growth of 411,000 bpd by October 2025.

US natural gas prices hit a three-week high

US natural gas prices rose 7% to a three-week high due to reduced production, warmer weather forecasts, and higher-than-expected demand for the week. The increase in natural gas prices was also supported by a near 3% rise in US oil futures after OPEC+ maintained its output increase plan.

The July 2025 natural gas futures on the New York Mercantile Exchange rose 24.7 US cents, or 7.2%, to $3.694 per million British thermal units (mmBTU) – the highest since May 9th, 2025.

Gold prices hit a three-week high, silver its highest in over seven months

Gold prices climbed over 2% to their highest level in more than three weeks, driven by a weaker US dollar, geopolitical risks, and economic uncertainties. These factors boosted the appeal of gold as a safe-haven asset.

Spot gold on the LBMA rose 2.5% to $3,372.13 an ounce after hitting its highest since May 8th, 2025, earlier in the session. Gold futures for August 2025 on the New York Mercantile Exchange rose 2.5% to $3,397.20 an ounce.

The US dollar weakened by 0.5% against a basket of major currencies, making gold cheaper for buyers holding other currencies. Silver also benefited from the weaker dollar, with spot silver rising 4.7% to $34.54 an ounce, its highest since October 23rd, 2024.

Copper prices rose

Copper prices increased amid speculation about potential new import tariffs after US President Donald Trump declared he would double tariffs on aluminum and steel imports to 50%.

Three-month copper on the London Metal Exchange rose 1.2% to $9,607 a ton. Copper futures on the Comex rose 4% to $4.8625 per pound and touched $4.9495, the highest since April 3rd, 2025, during the session.

The decline in copper inventories in London, which fell 45% to 148,450 tons, the lowest in nearly a year, also supported higher copper prices. A weaker US dollar made metals priced in the greenback more attractive to buyers holding other currencies. The dollar weakened after US manufacturing data showed a decline for the third consecutive month in May 2025.

Rubber prices in Japan hit a one-month low

Rubber prices in Japan fell for the fourth straight session to a one-month low as the new harvest season raised expectations of increased supply.

The November 2025 rubber contract on the Osaka Stock Exchange (OSE) fell 4.1 Japanese yen, or 1.39%, to 290.9 yen (2.03 US dollars) per kg. Earlier in the session, rubber prices dipped to 290.2 yen per kg, the lowest since April 30th, 2025.

According to the Japan Exchange Group, global rubber prices fell sharply in the previous week due to the resumption of rubber production in the Northern Hemisphere after the end of winter. The June 2025 rubber contract on the Singapore Exchange fell 2.2% to 157.1 US cents per kg.

Chinese financial markets were closed for a public holiday.

Robusta coffee prices hit a seven-month low

Robusta coffee prices on the London market touched a seven-month low due to concerns about increasing supply from major producing countries.

Robusta coffee for July delivery on the ICE Futures Europe exchange fell $58, or 1.3%, to $4,405 a ton, the lowest since early November 2024 ($4,350). In May 2025, coffee prices fell a total of 17%.

Meanwhile, arabica coffee for July delivery on the ICE rose 0.6% to $3.4445 per pound. Coffee prices fell 17% in May 2025.

Sugar prices fell

Raw sugar for July delivery on ICE fell 0.17 US cent, or 1%, to 16.88 US cents per lb. Sugar prices fell 2.3% in May and hit a near four-year low (16.81 US cents per lb) the previous week.

White sugar for August delivery on the London market fell 1.1% to $470.90 a ton.

Soybean prices hit a seven-week low, corn fell, and wheat rose

Soybean and soybean oil prices on the Chicago Board of Trade fell to a seven-week low due to concerns about reduced demand for US oilseeds and favorable weather conditions boosting crop yields in the country.

July soybean futures on the Chicago Board of Trade fell 8-1/4 US cents to $10.33-1/2 per bushel after falling to $10.32-1/2, the lowest since April 11th, 2025. July corn futures fell 3-1/2 US cents to $4.4-1/2 a bushel, while July wheat futures rose 6-1/2 US cents to $5.4-1/2 a bushel.

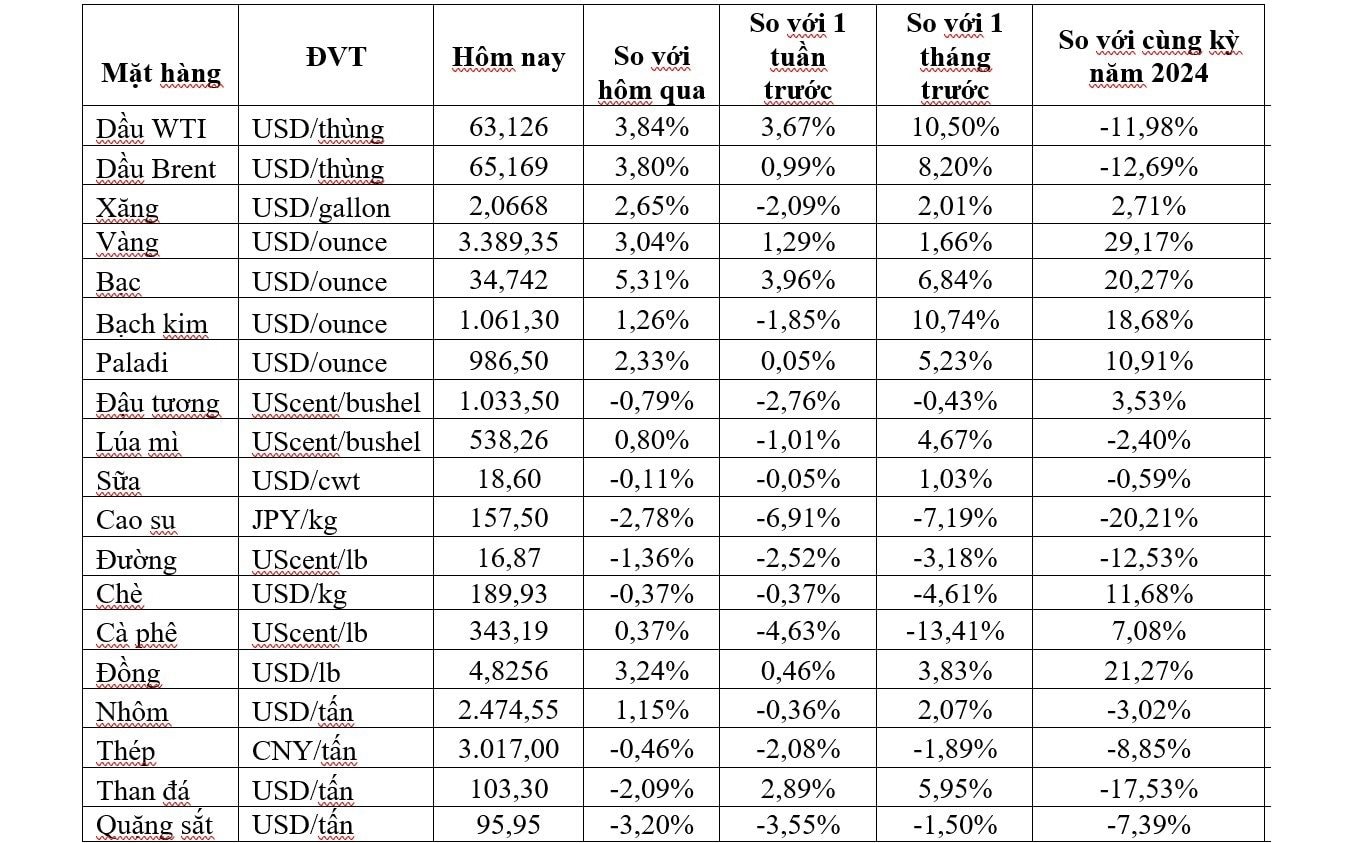

Prices of some key commodities on the morning of June 3

Source: Internet

The Price of Gold Soars to a 3-Week High as the US Dollar Plunges and SPDR Gold Trust Maintains its Buying Spree.

The primary catalyst for this rally in gold prices is the weakening of the US dollar, which has plummeted to a six-week low.

The Hottest Commodities: Unraveling the Price Volatility of Crude Oil, Steel, Coal, and Pork in the Latter Half of the Year.

“Agriseco Research offers insightful evaluations on stocks poised to benefit from the shifting tides of commodity prices. Our expert analysts provide in-depth insights, helping investors navigate the complex world of commodity-linked equities. With a keen eye on market trends and a finger on the pulse of the industry, we empower investors to make informed decisions and seize opportunities.”